Strong January car markets in Germany and the UK helped to push the West European car market to 5.1% year-on-year growth in January, reinforcing hopes for further market recovery in 2014.

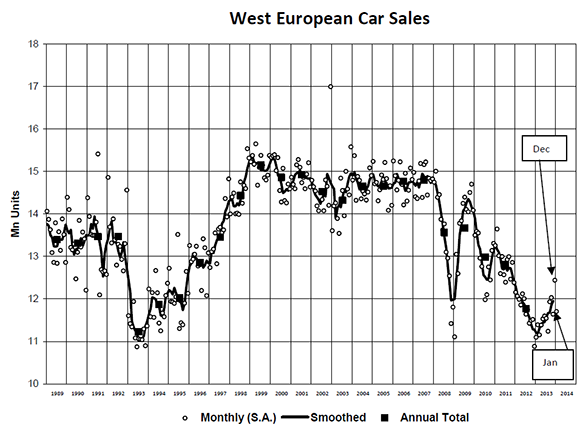

Data from LMC Automotive showed that the Seasonally Adjusted Annualised Rate (SAAR) of sales for Western Europe stood at 11.7m units a year last month. LMC said that it forecasts the West European car market to pick up by around 3% in 2014 as Europe’s economy continues its ‘tentative recovery’.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

LMC analyst Jonathon Poskitt said January’s growth was encouraging, but needs to be seen in perspective. “We saw the European car market stabilise in the second half of last year and now there is indeed growth and that’s welcome, of course,” he said. “But let’s not lose sight of the fact that we’re seeing a slow expansion off a very low market base. The market projection for this year leaves it at around 2012’s level and with some way to go to get back up to pre-crisis levels. Europe’s economy is still going to be pretty weak in 2014.

“The hope has to be that confidence across Europe will continue to return over time, leading to stronger momentum for economic growth. Along with the continued absence of any major financial crisis, we should see faster car market expansion further out as consumers opt to replace their ageing cars.”

The German car market started this year somewhat stronger than it did in 2013. The January result, a 7.2% gain, along with a solid pick up in the economy and consumer confidence, should see the German car market climb back above 3m units in 2014, LMC said.

The UK car market also continued to grow last month and LMC noted that many of the factors reinforcing market growth in the UK remain in place, including low interest rates, improved consumer confidence, and growing economic activity.

The other major car markets in Western Europe also started 2014 on a positive note. The Spanish market remains at levels of less than half of those seen pre-financial crisis, though it is moving slowly in the right direction thanks to ongoing government support in the form of the PIVE scheme. Until unemployment rates begin to fall from the lofty levels currently seen in Spain, any serious improvement in the car market will likely be postponed, though there is the potential for rapid market improvement once economic conditions allow, LMC says.

The French car market improved last month, though the weak economic backdrop remains a concern and the selling rate suggests tough months ahead. Italy also saw an improvement in year-on-year terms, but a selling rate that reflected the difficult economic conditions that continue to be endured.