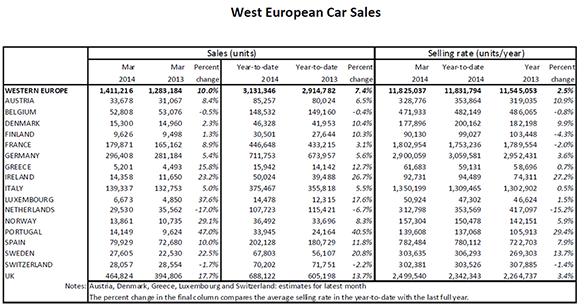

Car sales in Western Europe were up by 10% in March, a positive development that is boosting hopes that a sustainable recovery to the depressed market is gathering momentum.

Data released by LMC Automotive shows that the West European car market was up 7.4% for the first quarter of the year. The Seasonally Adjusted Annualised Rate (SAAR) of sales for March was 11.8m units a year (in February it was estimated at 11.9m units).

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

“It’s a positive development, of course,” said LMC analyst Jonathon Poskitt.

“But this recovery is coming off a very low base and the market is still at a historically very low level.”

Poskitt is cautious on the outlook. However, he notes that Europe’s economy is now growing again.

“The return to growth in the eurozone is obviously welcome,” he said. “And some national car markets have been running at such low levels that replacement demand can come on stream fairly quickly, in concert with scrappage incentives in the case of Spain, to show markets considerably up on year-ago levels.

“However, significant economic problems remain. Unemployment rates, for example, are running at very high levels in some countries and there are concerns over the underlying strength of consumer demand. This will act as a constraint to the region’s economic performance and to the recovery of demand in the region’s car market.”

LMC forecasts that the West European car market in 2014 will rise by around 3.5% to almost 12m units, still way under the 14m-plus markets of pre-recessionary times.

The March figures by country show year-on-year growth in most markets across the region. Of the big markets, the UK stood out again. In a key month for the UK market, due to the registration plate change, sales grew 17.7%. The selling rate climbed to 2.5m units a year, helped by the ongoing rapid growth in private sales (UK private sales were up 20.8% in March).

In Germany car sales were up by 5.4% – the year-to-date market was up by 5.6%. While the German market appears, on the face of it, to be picking up well, incentives continue to play a key role, LMC noted.

France, Italy and Spain were all up, year-on-year. Consumer confidence has been picking up a little though the weight of high unemployment continues to act as a drag. LMC said. The Spanish market continues to benefit from the government’s PIVE scheme, which LMC expects to remain until key economic factors begin to really support sales.

In Italy, the selling rate climbed a little in March (to 1.35m units a year) while France’s monthly SAAR stood at 1.8m units a year.

Hear LMC analyst Jonathon Poskitt discuss prospects for Europe’s car market with just-auto editor Dave Leggett in an exclusive webinar on Friday, April 11 (more details and free registration).