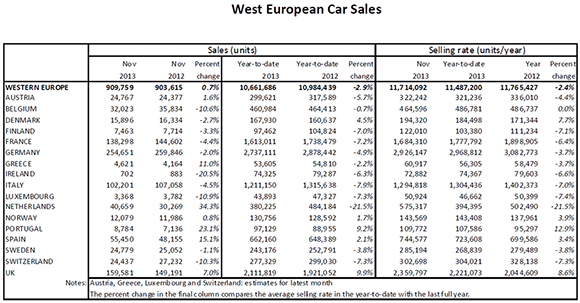

Car sales in Western Europe grew by 0.7% in November, according to data released by LMC Automotive.

After a couple of stronger months, the Seasonally Adjusted Annualised Rate (SAAR) of sales eased a little in November to 11.7m units a year, but LMC said that continues to reflect an improvement from earlier in the year.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

With the overall West European car market down over 20% down on pre-financial crisis levels and with economic growth in Europe not expected to pick up quickly in the near future, LMC warned that the car market recovery in Europe “looks set to be patchy”. LMC forecasts that the West European car market will expand by 2.6% to 11.79m units in 2014 – a level on a par with 2012’s market.

LMC also said that a more detailed analysis of November’s sales results revealed contrasting results among key markets.

The UK, easily the strongest growing among the major markets of the region this year, continued to make solid progress last month, up 7% year-on-year. As has been the theme throughout 2013, the private retail side of the market continued to lead the way. Year-to-date, private registrations were up 15.4%.

Car sales in Germany were down by 2% – the year-to-date market was down by 4.9%. At 2.93m units a year, the November selling rate is “a little disappointing”, LMC said. However, LMC noted that the German economy is in good shape and “some modest growth in 2014 remains our core assumption”.

In France and Italy, selling rates slipped back last month after stronger results for September and October. The Spanish market’s selling rate of 740,000 units a year “reflected ongoing scrappage support”.