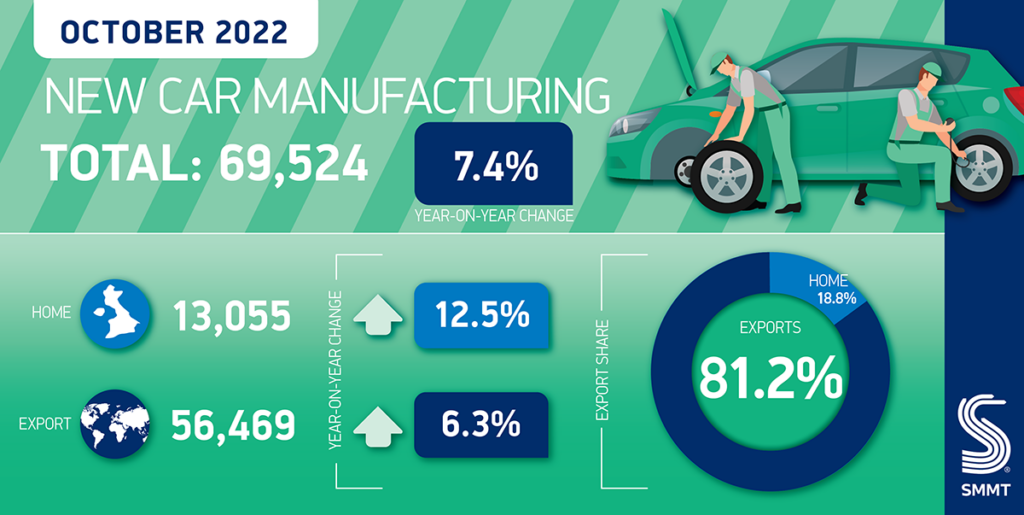

UK car production returned to growth in October, rising 7.4% to 69,524 units, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT). The rise followed September’s fall, which came after four consecutive months of growth, illustrating how supply chain turbulence, in particular global chip shortages, continues to affect UK car manufacturers.

Although positive, with production for both home and overseas markets up 12.5% and 6.3% respectively, October’s performance was still 48.4% off October 2019’s total of 134,669 units and 52.8% off the five-year pre-Covid average for the month.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Exports drove volumes with more than eight in 10 (81.2%) cars made heading overseas, equivalent to 56,469 units, while 13,055 cars were turned out for the domestic market.

Export growth was led by rising shipments to the US (26.4%), Japan (6.0%), South Korea (68.7%), Australia (125.4%) and Turkey (1298.7%), although the total volumes to these markets remain comparatively small. By far the majority of cars (54.9%) heading overseas went into the European Union, even though exports to the bloc declined 2.7%. UK production of battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) vehicles rose again, with combined volumes up 20.3% to 24,115 units. Year-to-date, UK car factories have produced a record 61,339 BEVs, up 16.2% on the same period in 2021.

Mike Hawes, SMMT Chief Executive, said: “A return to growth for UK car production in October is welcome – though output is still down significantly on pre-Covid levels amid turbulent component supply. Getting the sector back on track in 2023 is a priority, given the jobs, exports and economic contribution the automotive industry sustains. UK car makers are doing all they can to ramp up production of the latest electrified vehicles, and help deliver net-zero, but more favourable conditions for investment are needed and needed urgently – especially in affordable and sustainable energy and availability of talent – as part of a supportive framework for automotive manufacturing.”