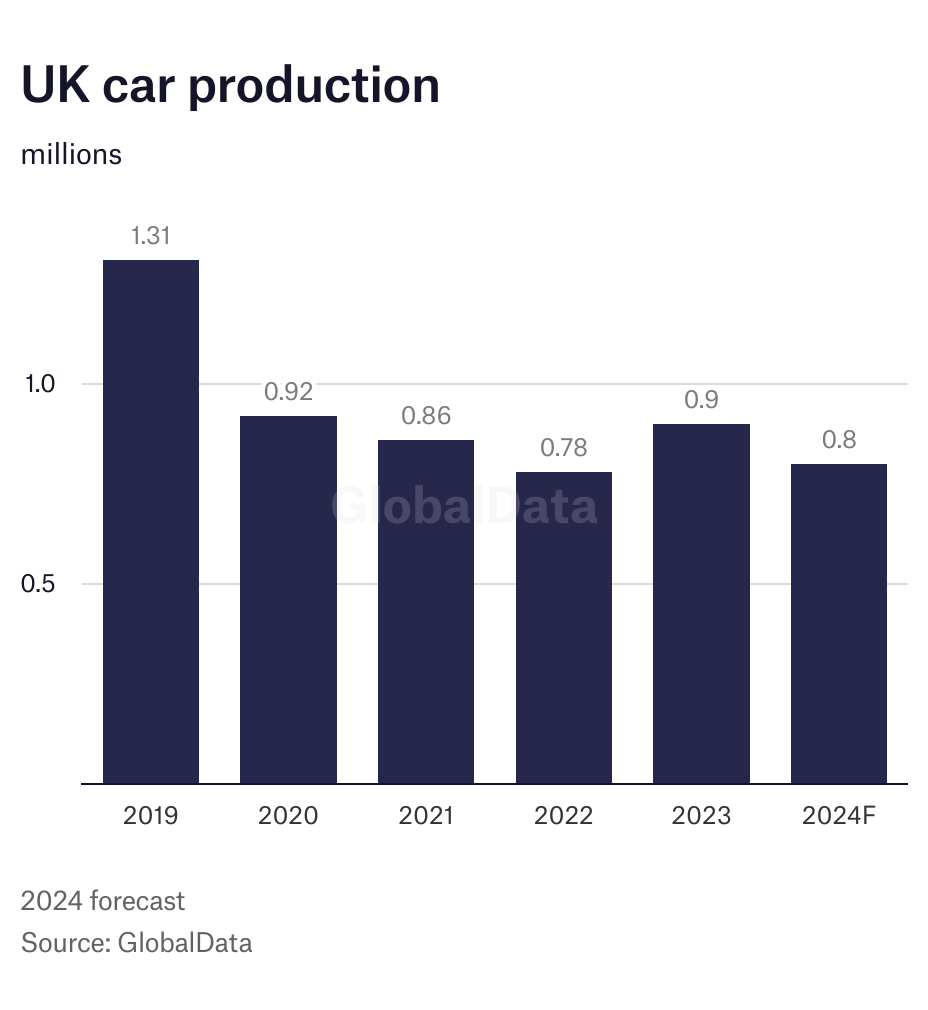

UK car output remains way under pre-pandemic levels and is struggling to recover volume as it faces challenges in electrification and developing more export business to replace recently lost manufacturing capacity, according to a GlobalData analyst.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Justin Cox, an analyst at GlobalData, points out that UK car production is running way under where it was pre-pandemic. “The UK auto industry is struggling in overall volume terms this year,” he says. “This year there is certainly some negative impact from significant model changes and that’s to be expected, but we are also seeing a slower than expected ramp-up of new Mini production at Oxford.

“Our forecast for this year sees UK car output at a little over 0.8 million units. It was much higher before the pandemic, but we see it settling in the medium-term at around a million units a year. 2019 UK car output was 1.3 million units.”

He also points out that the UK’s auto industry has been hit by structural changes to output plans by some manufacturers and some of that lost capacity will be difficult to replace. “There’s the closure of Honda’s Swindon plant and the loss of Vauxhall (Stellantis) Astra production from the Ellesmere Port plant in northwest England. Jaguar Land Rover has also moved Discovery and Defender manufacturing from the UK to its plant in Slovakia.”

In 2018, the Honda Swindon plant built some 160,000 cars (mainly Civic, but some CR-Vs) and Vauxhall (Stellantis) turned out over 77,000 Astras.

Competitive challenges

Cox also warns that the UK’s auto industry faces uncertainties arising from rules on international trade that are exacerbated by post-Brexit arrangements agreed between London and Brussels as well as the transition to electric vehicles. “Rules of origin take on new significance when examining UK-EU trade arrangements after Brexit and, crucially, the status of high value parts such as battery packs and cells and where they are coming from,” he points out. “It is something to keep a close eye on and there could ultimately also be consequences for the treatment of UK-made vehicles shipped to other markets around the world depending on how the content and its country-of-origin is treated.

“These things inevitably impact the big OEMs’ sourcing strategies – vehicles and component systems – and supply chains have already been shaken up in recent years with the impact of the chips shortage. More supply chain changes and potential disruption are coming with the energy transition to EVs and away from ICEs. The challenge for companies – and indeed, national industries or sectors – to stay competitive in the highly dynamic business landscape of the global auto industry has never been harder.”

Output down again in May

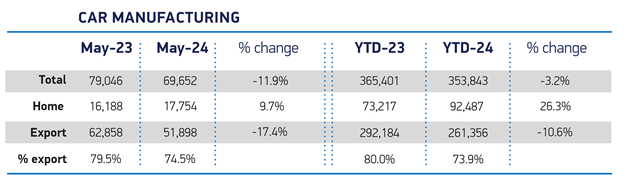

The latest figures on car production show that UK car manufacturing output declined by 11.9% to 69,652 units in the month of May.

Figures from the Society of Motor Manufacturers and Traders (SMMT) show that production for the UK market rose by 9.7% to 17,754 units in May, but did not offset a 17.4% decline in volumes for export, at 51,898 units.

Despite the overall fall, almost three quarters (74.5%) of all cars built in Britain were exported to global markets, with more than half (52.5%) going to the EU followed by the US (18.2%) and Turkey, which took 8.0% of shipments.

Electrified vehicle (battery electric, plug-in hybrid and hybrid) production remained robust, with 26,475 units leaving factory gates – representing almost two fifths (38.0%) of all output, up by three percentages points compared with May 2023.

Mike Hawes, SMMT Chief Executive, said: “Massive change is underway in the UK’s car factories as manufacturers retool for new electric models. Amid strong international competition for green automotive investment, however, the UK needs to ensure it has the most attractive conditions for manufacturing businesses and a compelling offer for existing and new investors. Essential to this is a long-term industrial strategy, which encompasses all industry, all stakeholders and all of government in the pursuit of sustainable and green growth.”