Domestic sales by South Korea’s five main automakers combined fell 11% to 117,064 units in May 2024 from 131,090 year earlier, according to preliminary data released individually by the manufacturers.

The data did not include sales by low volume commercial vehicle manufacturers while import brands are covered in a separate report.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The domestic vehicle market continued to decline last month despite a pick up in economic activity in the first quarter of the year, with highly indebted consumers choosing to delay large purchases after the central bank hiked its benchmark interest rate from 0.5% to 3.5% in the last few years. Cumulative five month sales were also down 11% to 559,325 units from 627,200 units previously.

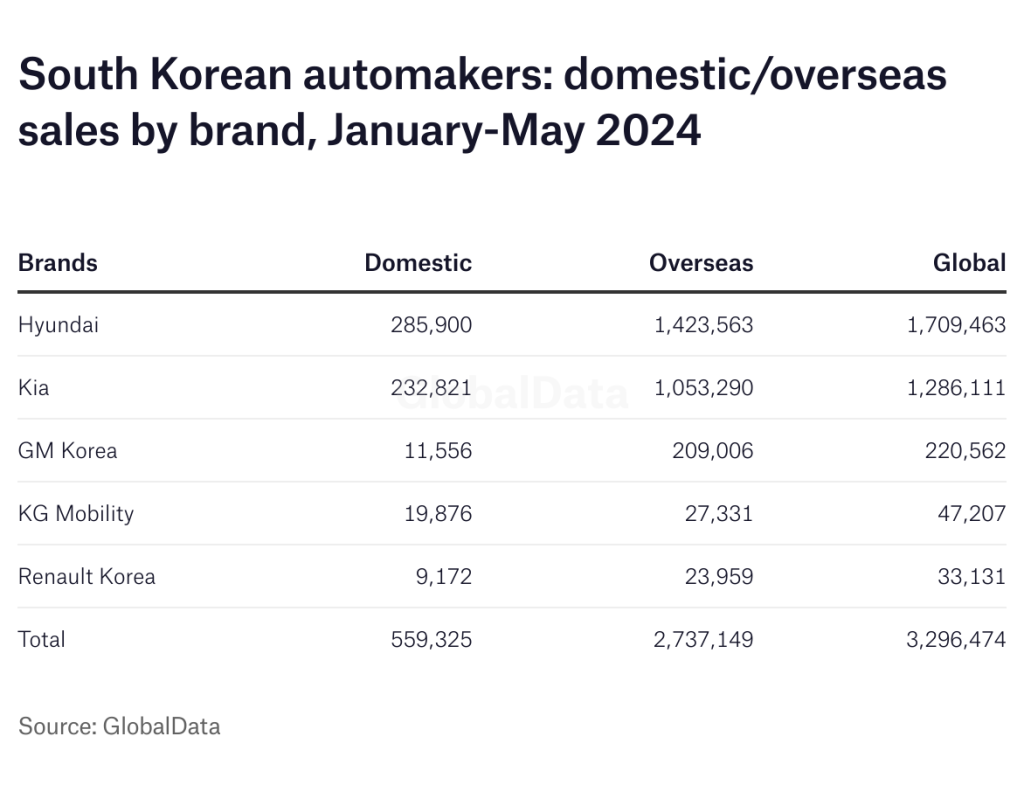

All five local manufacturers reported lower sales in the first five months of the year: Hyundai Motor with a 12% drop to 285,900 units; Kia with a 4% decline to 232,821 units; and GM Korea with 16% fall to 11,556 units. KG Mobility was the worst performer with sales plunging 40% to 19,876 units while Renault Korea sold just 9,172 vehicles locally in this period, down 13% year on year.

Separate industry data showed sales of hybrid vehicles surged 46% to 99,832 units in the first quarter of 2024, while sales of battery electric vehicles (BEVs) plunged 25% to 25,550 units.

Global sales by the big five automakers, including vehicles produced overseas by Hyundai and Kia, increased slightly to 3,296,474 units year to date (YTD) from 3,280,758 units in the same period of last year, underpinned by a 3% increase in overseas sales to 2,737,149 from 2,653,738 units.

Hyundai Motor sales rose 2% to 356,223 units in May from 349,637 a year earlier, with lower domestic sales offset by stronger overseas deliveries. The automaker said it sold 17,000 BEVs last month. Total volume YTD was slightly higher at 1,709,463 from 1,706,354 previously.

Domestic sales fell 9% to 62,200 units last month from 68,680 a year earlier, including 10,136 Genesis vehicles and 52,064 Hyundais of which 20,921 were SUVs.

YTD sales were down 12% at 285,900 from 326,387 units, with sales also affected by production line refurbishment and maintenance work at a number of factories in the first quarter of the year.

The company introduced a facelifted, extended range Ioniq 5 BEV in March and plans to introduce the Ioniq 7 BEV by the end of the year.

Overseas sales rose 5% to 294,023 units in May from 280,957, driven by strong demand in North and South America and in India, while YTD volume was up 3% at 1,423,563 units from 1,379,967 units.

Hyundai aims to sell 4.24m vehicles globally in 2024, including sales of its Genesis luxury brand, a slight increase on last year. The company lowered its domestic sales forecast to 704,000 units, while increasing its overseas sales target to 3.54m units helped by the anticipated completion of its new US plant in Georgia in the fourth quarter.

Hyundai also said it was working on strengthening its “production and sales system to meet demand and respond flexibly to changes in regional markets”. The company planned to increase its global market share by introducing more BEV and hybrids and increase profitability by strengthening its product mix with more SUVs and luxury models. The company has also said it planned to increase output of the Tucson hybrid in the second half of the year to meet strong overseas demand.

Kia global sales fell 2% to 264,313 units in May from 270,009 a year earlier, with domestic and overseas sales both weaker year on year. YTD sales were down 1% to 1,286,111 units from 1,297,657, including limited volume of special purpose vehicles.

Domestic sales, including a small number of SPV exports, fell 9% to 46,494 units last month from 50,823 a year earlier with the Sorento and Sportage SUVs and the Carnival MPV the best selling models. YTD sales were 4% lower at 232,821 units from 243,228 previously.

Overseas sales fell slightly to 217,819 units in May from 219,186 with YTD volume also slightly lower at 1,053,290 units from 1,054,429 and the Sportage and Seltos SUVs and the K3 sedan the best selling models.

Earlier this year, Kia said it aimed to sell 3.2m vehicles in 2024, including 530,000 domestically, 2,663,000 overseas and a further 7,000 SPVs globally. Kia unveiled its new compact EV3 SUV last month, produced at its dedicated AutoLand Gwangmyeong plant, with the EV4 set to follow later this year along with the new K4 sedan.

The medium term plan is to sell 4.3m vehicles annually by 2030, of which 1.6 million are expected to be BEVs.

GM Korea global sales rose 27% to 50,924 vehicles in May from 40,019 units a year earlier as the automaker continued to enjoy strong demand following the introduction of the Trax crossover vehicle at its Changwon plant last year. YTD sales were up 34% at 220,562 units from 164,475 units a year earlier with the Trailblazer SUV and Trax by far the company’s best-selling models, albeit with most output exported.

Local sales plunged 51% to 2,340 units last month from 4,758 units a year earlier, while YTD volume was down 16% to 11,556 units from 13,825 units.

Exports increased 11% to 48,584 units in May from 43,593 while YTD volume was up 39% to 209,006 units from 150,650 previously.

KG Mobility reported a 17% fall in global sales to 8,130 vehicles in May from 9,830 units a year earlier, with both domestic sales and exports sharply lower, while YTD sales were down 14% at 47,207 from 54,722 units.

Domestic sales fell 18% to 4,129 units last month from 5,051 a year earlier amid sluggish local demand and as competition from other domestic manufacturers and importers continued to intensify. YTD domestic sales were down 40% at 19,876 from 33,211 units, despite the launch last year of the Torres EVX SUV powered by lithium iron phosphate (LFP) batteries. A minivan version of the EVX was launched last month.

Exports fell 18% to 4,129 in May from 5,051 a year earlier but were up by 26% at 27,331 units YTD from 21,691 units after the company signed a number of significant export orders from Middle East distributors in the last two years while sales in markets such as Australia, Turkey and in Europe also increased. The company said it would “explore new markets in Latin America” to help strengthen global sales.

Renault Korea global sales rose 56% to 6,678 vehicles in May from 15,154 a year earlier, reflecting a sharp fall in exports while domestic sales improved. YTD global volume was down 42% at 33,131 from 57,550 units.

Domestic sales increased by 7% to 1,901 vehicles last month from 1,778 a year earlier, while YTD sales were down 13% at 9,172 units from 10,549 units, as the company struggled with rising competition from domestic manufacturers and from imported brands.

Exports plunged 64% to 4,777 vehicles in May from 13,376 units a year earlier and were down by 49% at 23,959 units YTD from 47,001 units.

The company said it continued to overhaul its product range with plans this year to phase out its aging SM6 mid-size sedan a throwback to when Samsung was still its joint venture partner. The company has now adopted Renault’s global Losange emblem for the domestic market and said it would focus mainly on producing SUVs, BEVs and hybrids to help revive sales.

Earlier this year Renault Korea said it planned to launch new hybrid models under its Aurora 1 programme, including a Geely-based mid-sized hybrid SUV in the second half of 2024.

The company also agreed with Geely group to produce the Polestar 4 BEV at its Busan plant from the second half of 2025, for sale locally and for export.

Management had also discussed sourcing EV batteries with local producers LG Energy Solution, SK On and Samsung SDI.