Domestic sales by South Korea’s five main automakers combined fell just slightly to 106,149 units in August 2024 from 106,856 year earlier, according to preliminary data released individually by the manufacturers.

The data did not include sales by low volume commercial vehicle manufacturers while import brands are covered in a separate report.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The market decline had slowed significantly in the last two months after much steeper drops in the first half of the year, reflecting mainly weaker year earlier sales while Hyundai sales rebounded after several months of decline.

Domestic economic growth remained sluggish with highly indebted consumers under pressure from the central bank’s interest rate hikes in the last two years.

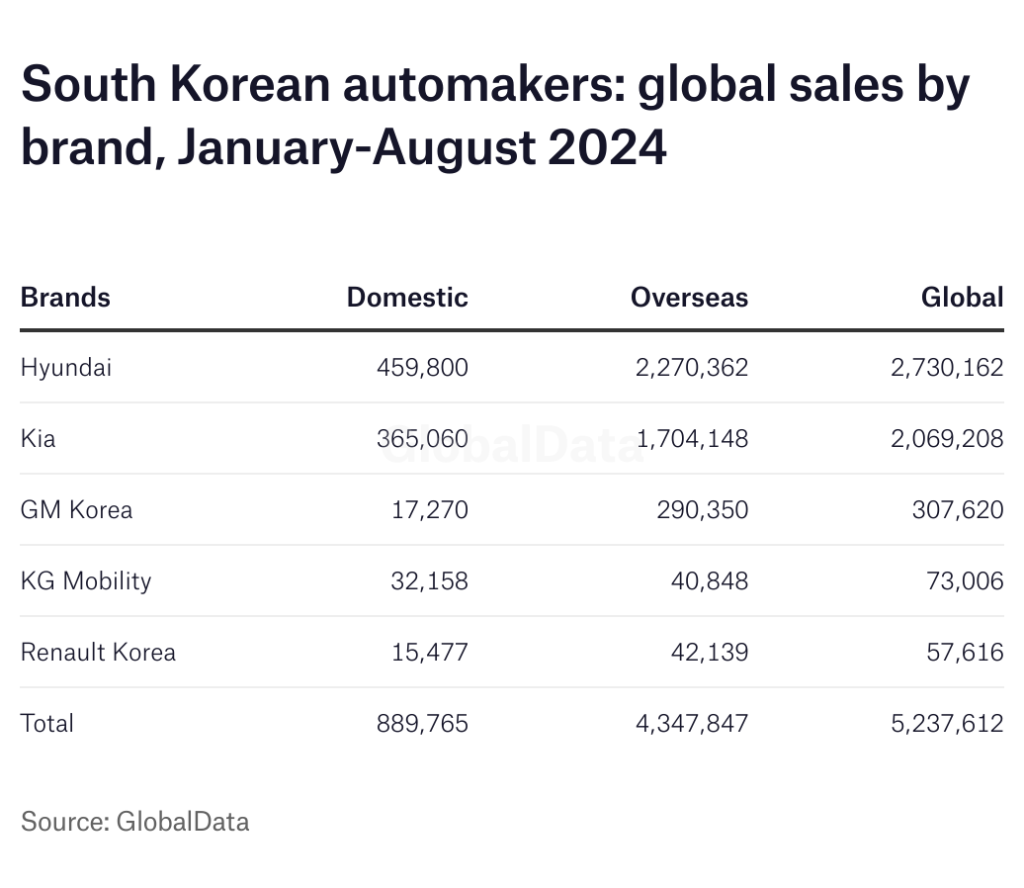

Cumulative eight month sales were down 10% at 889,765 from 983,597 units.

All five local manufacturers reported lower sales year to date (YTD) including Hyundai Motor with a 10% drop to 459,800 units and Kia with a 5% decline to 365,060.

GM Korea was the worst performer with sales plunging by 32% to 17,270 units followed by KG Mobility with a 31% drop to 32,158 units while Renault Korea sold just 13,892 vehicles, down 10% year on year.

Global sales by the ‘big five’ automakers, including vehicles produced overseas by Hyundai and Kia, fell by 1.4% to 5,237,612 units in the first eight months of the year from 5,314,112 in the same period of 2023 with overseas sales just slightly higher at 4,347,847 from 4,330,508 units.

Hyundai Motor global sales fell 5% to 332,963 units in August from 351,727 with a sharp drop in overseas sales more than offsetting higher domestic deliveries. The automaker also said it sold 20,000 BEVs globally last month. Total YTD volume declined 1.4% to 2,730,162 from 2,769,903.

Domestic sales rebounded 5% to 58,087 units in August from 55,555 after several months of decline, including 10,323 Genesis vehicles and 47,764 Hyundai of which 20,243 were SUVs. YTD sales were still down 10% at 459,800 from 509,608 with high interest rates dampening consumer demand for large purchases.

Overseas sales fell 7% to 274,876 units in August from 296,172 a year earlier while YTD volume was just slightly higher at 2,270,362 units from 2,260,295 underpinned by strong demand in North and South America plus India.

Earlier this year, Hyundai said it aimed to sell 4.24m vehicles globally in 2024, a slight increase on last year. The company lowered its domestic sales forecast to 704,000 units while increasing its overseas sales target to 3.54m helped by the anticipated completion of a new EV plant in Georgia, US in the fourth quarter.

The automaker said it was working on strengthening its “production and sales system to meet demand and respond flexibly to changes in regional markets”. It aimed to increase its global market share by introducing more BEVs and hybrids and increase profitability by strengthening its product mix with more SUVs and premium models.

Hyundai began deliveries of the new Casper A segment BEV in August and planned to introduce the Ioniq 3 and 7 BEVs by the end of the year. It was also increasing output of the Tucson hybrid to meet strong overseas demand.

Kia global sales fell 2% to 251,638 units in August from 256,038 a year earlier with domestic and overseas sales both lower. YTD sales were 1% lower at 2,069,208 units from 2,092,750 including 3,300 special purpose vehicles (SPVs) such as military and municipal trucks. The Sportage SUV remained its best selling model worldwide last month with 45,406 deliveries followed by the Seltos with 27,595 and the Sorento with 18,580.

Domestic sales, including a small number of SPV exports, fell 3% to 41,155 units last month from 42,617 a year earlier with the Sorento and Sportage SUVs and the Carnival MPV the best selling models. YTD sales were 5% lower at 365,060 units from 385,173.

Overseas sales fell by 1% to 210,483 units in August from 213,421 while YTD volume was just slightly lower at 1,704,148 units from 1,707,570 with the Sportage and Seltos SUVs plus the K3 sedan the best selling models overseas.

Earlier this year, Kia said it aimed to sell 3.2m vehicles in 2024 including 530,000 domestically, 2,663,000 overseas and a further 7,000 SPVs globally.

The company began deliveries of its new EV3 compact battery powered SUV in July, produced at the dedicated AutoLand Gwangmyeong BEV plant, with the EV4 set to follow later this year along with the new K4 sedan. The medium term plan is to sell 4.3mn vehicles annually by 2030, of which 1.6m are expected to be BEVs.

GM Korea global sales plunged by a further 51% to 15,634 vehicles in August from 31,716 a year earlier, after a 45% drop in July, with output continuing to be held back by industrial action after wage negotiations with unions broke down in July.

YTD sales were just 7% higher at 307,620 units after surging 71% to 286,727 units a year ago, with the declines of the last two months wiping out most of this year’s gains.

Local sales plunged 51% to 1,614 units last month from 3,297 units a year earlier, while YTD volume was down 35% at 17,270 units from 26,424 reflecting strong competition from Hyundai-Kia and from imports, as well as the recent production stoppages.

Exports also plunged by 51% in August, to 14,020 units after surging 94% to 28,419 a year earlier but were still up 12% at 290,350 units YTD from 260,303 previously, reflecting strong overseas deliveries of Trax in the first half of the year.

The company said the ongoing strike had resulted in the loss of 40,000 vehicles so far and it aimed to reach a wage settlement with plant workers as soon as possible to make up lost production in the remainder of the year.

Earlier this year, the automaker had set a global sales target of 529,200 vehicles for 2024 up 13% from 2023’s 468,059 units.

KG Mobility reported a 25% fall in global sales to 8,128 vehicles in August from 10,823 units a year earlier, reflecting sharply lower overseas sales, while YTD volume was down 16% at 73,006 from 86,636 units.

Domestic sales increased by 1% to 3,943 vehicles last month from 3,903 helped by the recent launch of the Actyon and a new minivan version of the Torres EVX SUV. Domestic sales were still down 31% at 32,158 YTD from 46,915 units, reflecting weak overall demand and strong competition from other domestic manufacturers and importers.

Exports continued to plunge in August, by 40% to 4,185 units after almost doubling to 6,920 a year earlier, as BEV demand in Europe continued to weaken while YTD volume was still up 3% at 40,848 units from 39,721.

Renault Korea global sales increased slightly to 8,451 vehicles in August from 8,414 a year earlier with a moderate rise in exports offset by weak domestic sales. YTD sales were down 26% at 57,616 units from 78,096 units.

Domestic sales fell 10% to 1,350 vehicles last month from 1,502, and at a similar rate to 13,892 units YTD from 15,477 as the company struggled with rising competition from domestic manufacturers and importers.

Exports increased 3% to 7,101 units in August from 6,912, mostly shipments of the Arkana hybrid (a rebadged XM3), while YTD exports were down 33% at 42,139 units from 62,619.