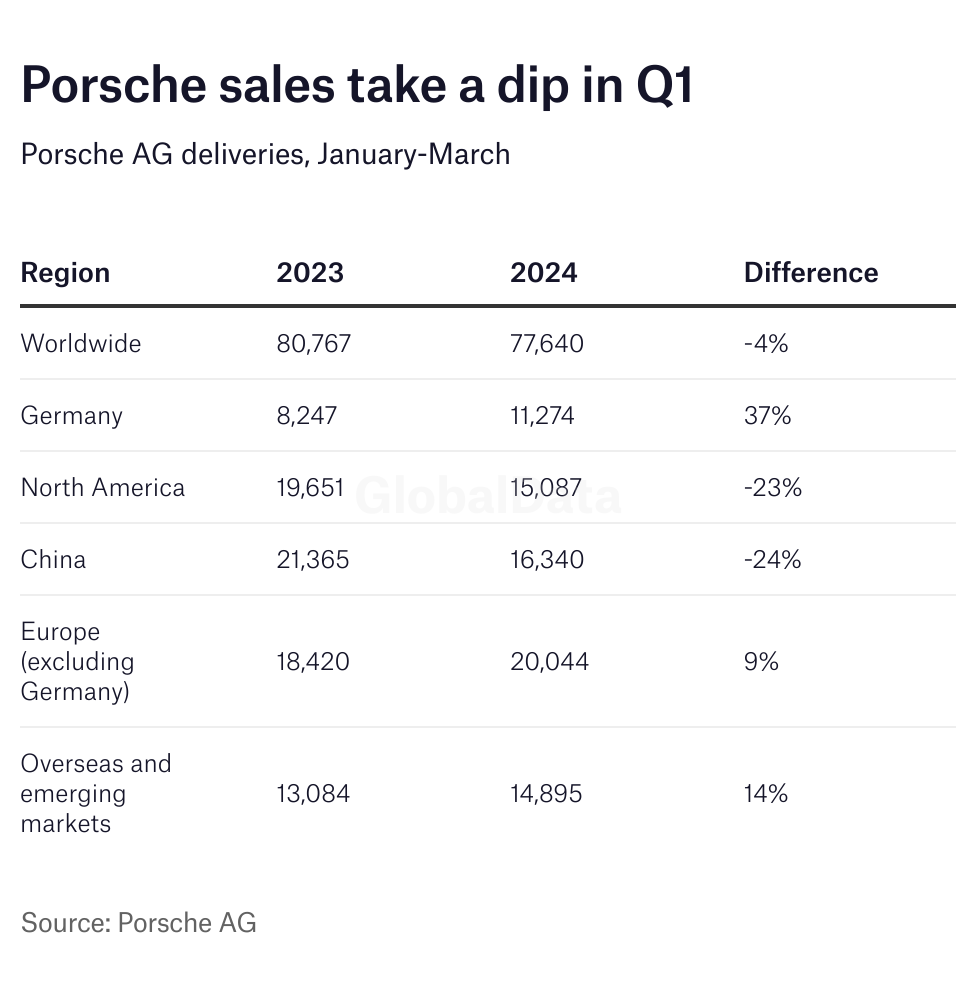

Porsche said its first quarter 2024 deliveries remained “stable” after selling 77,640 vehicles worldwide, a decline of 4% year on year.

China sales however fell 24% to 16,340 vehicles. Porsche blamed “the focus on value oriented sales, the continued tense economic situation in [China] and a strong equivalent period in the previous year due to initial post-Covid catch-up effects”.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

North America volume fell 23% to 15,087 vehicles explained mainly by “a customs related delay in the shipping of some models”.

MORE: Porsche sales dip in first quarter

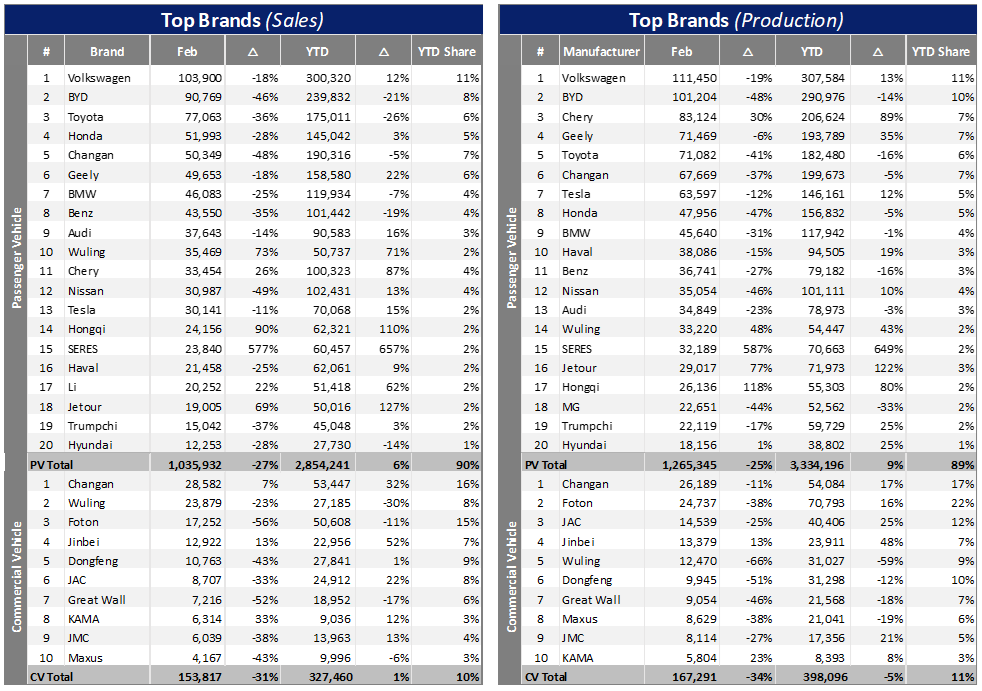

In terms of markets, there was some ostensibly positive news from China. The market rebounded from a sharp decline in February, when deliveries were held back by the Lunar New Year holidays. But the underlying picture for the start of the year is still pretty weak. There’s also a brutal price war going on. A recent example of the operational difficulties being experienced there came from Volkswagen: China drags VW down.

According to GlobalData, weak underlying demand means the price war has only intensified. Led by Tesla, OEMs are rushing to offer discounts and incentives for both NEV and ICE models. Prices of ICEs are falling rapidly, eroding automakers’ earnings, and the never-ending price war may be causing consumers to take a wait-and-see approach.

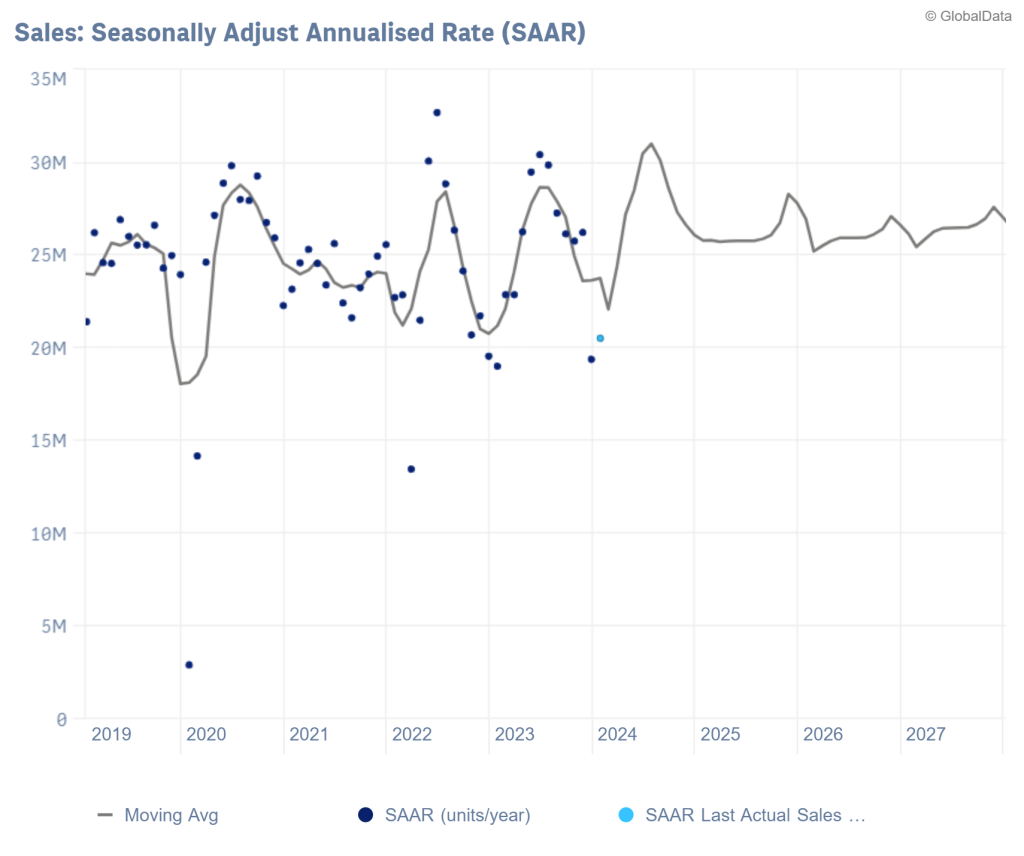

GlobalData forecasts that the 2024 light vehicle market in China will grow by just 1.8% to 25.7 million units, with a flat to low-growth trend for the medium term – with the market projected at around 27 million units in 2030. The annualised running rate trend (below chart) shows that sales have been bouncing around according to volatile demand conditions and growing uncertainty over China’s economic prospects.

MORE: China sales rise 10% in March

GlobalData’s latest analysis from China suggests the price war after the Spring Festival heated up rapidly, forming a considerable wait-and-see trend.

MORE: China’s auto market – GlobalData report

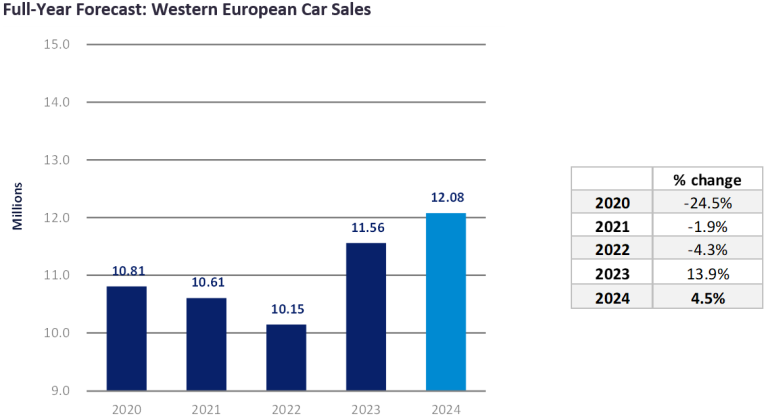

The Western Europe new car (Passenger Vehicle – PV) selling rate slipped back in March, to 11.3 million units/year, with 1.3 million vehicle registrations – in YoY terms, this is 2.5% below March 2023.

Despite this negative result, first quarter sales grew by 4.7%, helped by strong growth for the first three months in France, Italy, and the UK, along with mostly positive results in other countries. Thanks to a more supportive supply environment, the Western Europe PV market is forecast to surpass 12 million units in 2024, which would be the strongest annual result since the COVID-19 pandemic.

March was not a great sales month for the region though.

MORE: Western European car market shows signs of decline in March

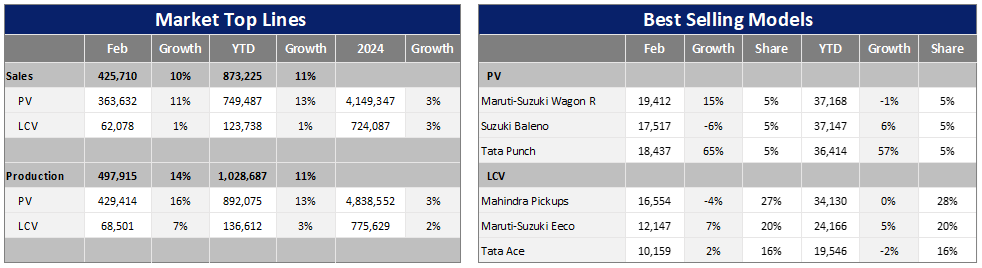

Turning to India, the latest GlobalData analysis suggests that market demand in India is now levelling off and that stocks are high. India’s light vehicle (LV) market has demonstrated resilience and growth, with sales reaching 426k units in February, a 10% increase year-on-year (YoY). However, this figure represented a 5% decline month-on-month (MoM), as OEMs had replenished their inventory in January following a destocking exercise at the end of 2023.

MORE: February sales dip slightly in India, while high inventory pose a challenge

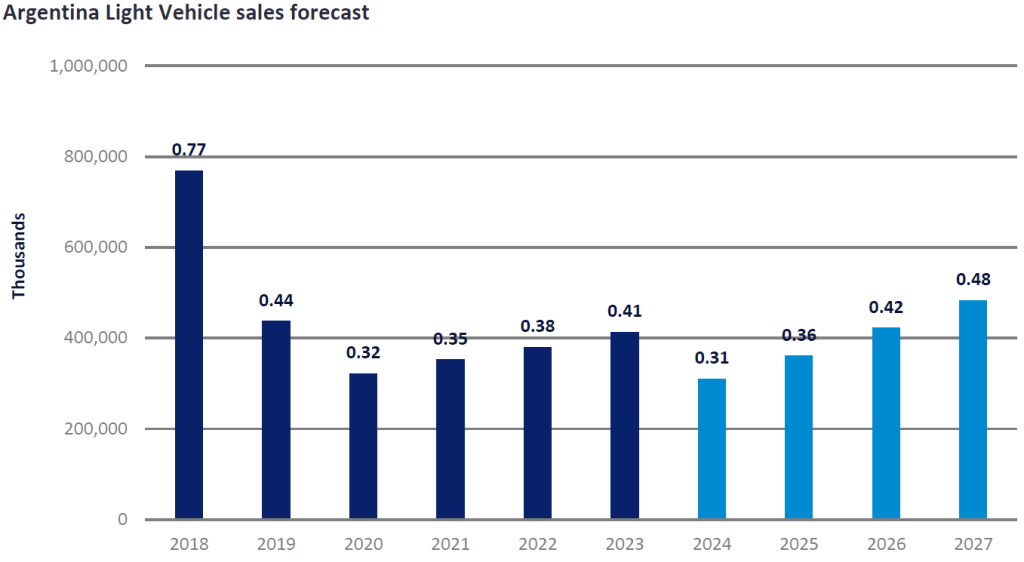

Import restrictions have been lifted in Argentina. A GlobalData report suggests the government has opened the door to higher vehicle sales with the removal of a key mandate. The big question is: will it make a difference.

The automotive market in Argentina displays all the characteristics of your favourite rollercoaster, as the country saw its sales reach 769k units in 2018, before dropping to 322k units in 2020 due to headwinds associated with the COVID-19 pandemic and the semiconductor and parts shortages. The country has been constantly grappling with economic issues that have put a strain on its citizens and Light Vehicle (LV) sales. Recent developments in the economic outlook for the country could disrupt the auto industry, even as the government has opened the door to higher vehicle sales with the removal of a key mandate.

MORE: Import restrictions have been lifted in Argentina, but will it make a difference?