Global sales of China-made vehicles rose by almost 10% to 2.69 million units in March 2024 from 2.45 million units a year earlier, according to passenger car and commercial vehicle wholesale data compiled by the China Association of Automobile Manufacturers (CAAM).

The market rebounded from a sharp decline in February, when deliveries were held back by the Lunar New Year holidays. Domestic economic growth in the country remains sluggish, however, with the property sector still struggling to recover from some largescale bankruptcies in previous years – meaning that the export sector was the main driver of growth in the first quarter of 2024.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Overall vehicle sales rose by just under 11% to 6.72 million units in the first quarter from 6.08 million units in the same period of last year, including a 33% rise in exports to 1.32 million units. Sales of new energy vehicles (NEVs), comprising mainly battery electric vehicles (BEVs) and plug-in hybrids (PHEVs), rose by 32% to 2.09 million units – including a 24% rise in exports to 307,000 units.

Last month the government said planned to relax loan downpayment requirements to help support the vehicle market, with consumers being able to borrow up to 100% of the price of a vehicle instead of between 80%-85%.

Overall vehicle production in the country increased by just over 6% to 6.61 million vehicles in the first quarter from 6.21 million previously.

China market price war

According to GlobalData, weak underlying demand means the price war has only intensified. Led by Tesla, OEMs are rushing to offer discounts and incentives for both NEV and ICE models. Prices of ICEs are falling rapidly, eroding automakers’ earnings, and the never-ending price war may be causing consumers to take a wait-and-see approach.

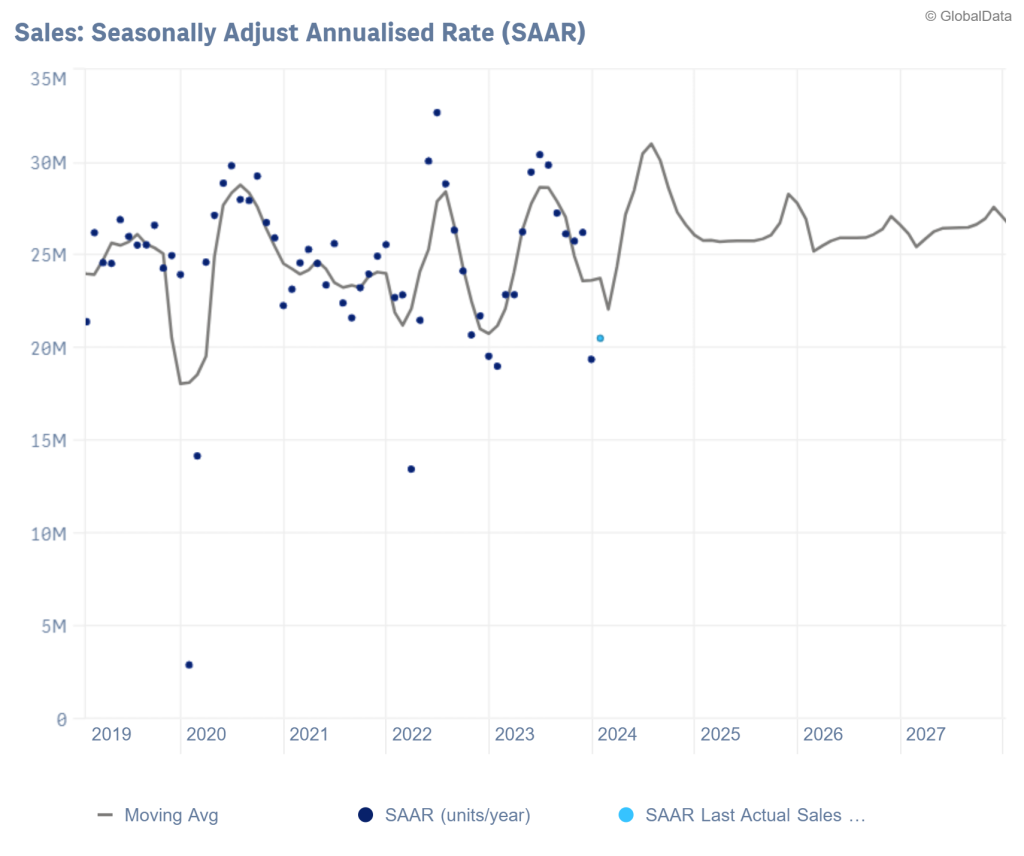

GlobalData forecasts that the 2024 light vehicle market in China will grow by just 1.8% to 25.7 million units, with a flat to low-growth trend for the medium term – with the market projected at around 27 million units in 2030. The annualised running rate trend (below chart) shows that sales have been bouncing around according to volatile demand conditions and growing uncertainty over China’s economic prospects.

Manufacturer performances

SAIC Motor said its global sales fell by just over 6% to 834,153 vehicles in the first quarter of 2024, including a 12% drop in overseas sales to 226,675 units. Overall NEV sales surged by 48% to 210,133 units. SAIC Volkswagen’s first-quarter sales increased by 10% to 248,000 units and SAIC-GM-Wuling’s sales were up by 16% at 224,000 units.

FAW Group reported a 9.5% increase in global sales to 743,000 units year-to-date, including a 46% increase in own-brand sales to 208,000 units.

BYD’s overall first-quarter sales increased by 14% to 626,263 units – including a 153% increase in overseas sales to 97,899 units. Passenger BEV sales increased by 13% to 300,114 units and PHEV volumes were up by 14% at 324,284 units, while commercial vehicle sales fell by 55% to 1,865 units.

GAC Group’s sales fell by 24% to 402,800 units year-to-date, while Great Wall Motor reported a 25% rise to 275,330 units and Geely Auto‘s global salesincreased its sales by 49% to475,720 units – including 144,125 NEVs.

Tesla overall shipments from its Shanghai plant fell by 4% to 220,000 units year-to-date, to account for around 51% of Tesla’s global sales, while the brand’s retail sales in China were up by 15% at 132,960 units.