Daimler has cut its growth forecast for the global car market, citing lower demand in emerging markets and a plunge in Russian sales.

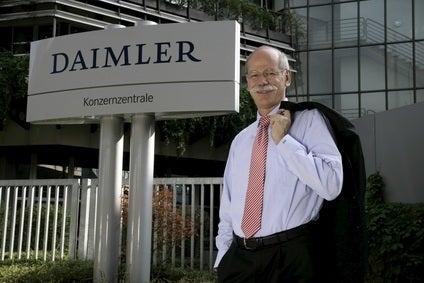

According to Reuters, Daimler chief executive Dieter Zetsche said he now expected the global car market to grow by 3-4% this year, down from a previous forecast of 4-5%.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Other executives who spoke to the news agency shared his caution, particularly over Europe where a six-year sales slump has left demand around 20% below pre-crisis levels and sluggish economies have put a question mark over whether the gap will close anytime soon.

“Perhaps we will arrive at 13m or 13.5m (overall vehicle sales in Europe). But the market won’t return to (the pre-crisis level of) 15.5m, I’m sure of it,” Volkswagen CEO Martin Winterkorn said on the eve of the show.

A source familiar with the matter told Reuters that car sales in Germany rose by more than 5% in September, bouncing back from a decline in August and giving a year to date increase of 2.9%.

But demand has been erratic and executives are particularly concerned about Russia – once tipped to overtake Germany as Europe’s largest market – where new car sales fell 26% year on year in August due to a slowing economy hit by western sanctions over the crisis in Ukraine.

“Earlier this year, momentum was at the upper end of expectations but it’s flattening out a bit,” Ford Europe chief executive Stephen Odell told Reuters, referring to the broader European market.

BMW chief executive Norbert Reithofer said price levels in Europe had improved, but not by as much as the automaker’s managers would have liked.

He forecast it would take more than three years for the European market to return to pre-crisis levels.

“The Russian market will come back. One has to think in longer terms,” Winterkorn told Reuters. “It’s right, we cut production (temporarily in September at the Kaluga plant) but Russia will come back, I’m convinced of that.”

Toyota also expects to ride out the worst of the slump in Russia’s car market and stuck to its goal of increasing sales in Europe next year, the report said.

European operations chief Didier Leroy told Reuters that, while sales of entry-level cars in Russia were down 25-30%, hurting many of its competitors, demand for premium vehicles was down a more modest 8%.

Vehicles such as the Camry and Lexus have helped Toyota to boost its share of the declining Russian market by about 1% this year, he added.

Zetsche told the news agency growth was also slowing in emerging markets such as Brazil and Argentina but played down fears of a sharp slowdown in China.

“Growth has slowed, but from a much broader base,” he said. “We must not forget that it is the second largest economy. We see double-digit growth this year.”