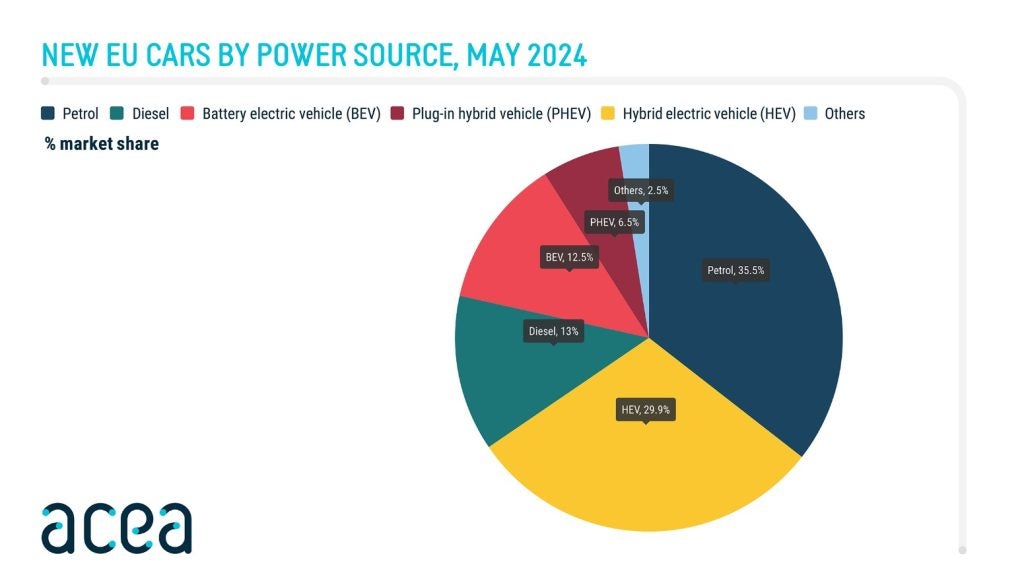

According to the European automakers trade association ACEA, battery electric cars accounted for 12.5% of the EU car market in May, a decrease from 13.8% the previous year. However, the result was an uptick from April when the share was 11.9%.

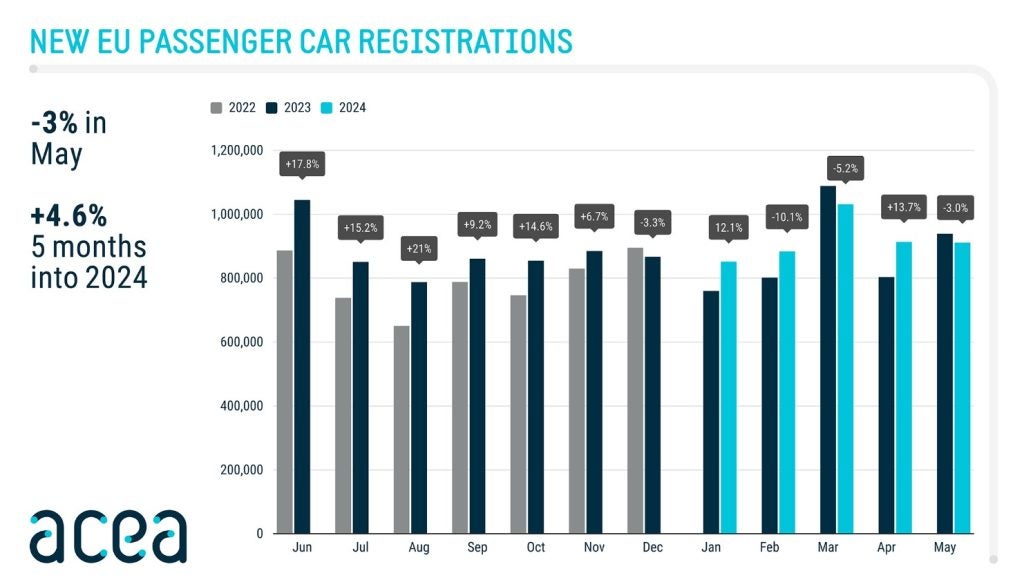

In May 2024, overall new car registrations in the European Union decreased by 3% on last year’s pace, with declines observed in three out of the region’s four major markets: Italy (-6.6%), Germany (-4.3%), and France (-2.9%). Spain, on the other hand, achieved a modest growth of 3.4% last month.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Despite the downturn in May, year-to-date car registrations over the first five months of 2024 increased by 4.6% to 4.6 million units. The bloc’s largest markets all showed a similar performance, with Spain (+6.8%), Germany (+5.2%), France (+4.9%), and Italy (+3.4%) recording growth so far this year.

See also: In data: Sales continued to struggle in Western Europe in May

In May, battery-electric cars accounted for 12.5% of the EU car market, a decrease from 13.8% the previous year. Meanwhile, hybrid-electrics continued to expand their presence, growing from 25% to nearly 30% of the market. The combined share of petrol and diesel cars fell to 48.5%, down from 52.1%, now representing less than half of the market.

Electrified car markets

In May 2024, ACEA said that registrations of battery-electric (BEV) cars declined by 12% to 114,308 units, with their total market share dropping to 12.5%. Belgium – now the third-largest market by volume for BEVs – and France were the only key markets to record growth, at 44.8% and 5.4%, respectively. In contrast, Germany (-30.6%) and the Netherlands (-11.7%) experienced significant declines last month. From January to May, a total of 556,276 new battery-electric cars were registered, marking a 2% increase from the same period the previous year.

EU plug-in hybrid car registrations also saw a decline of 14.7% last month, with significant decreases in two of the largest markets: Belgium (-36.6%) and France (-19.4%). Germany managed a modest increase of 1.7%, but this was not enough to offset the overall negative trend. In May, plug-in hybrids accounted for 6.5% of the total car market, with 59,333 units sold.

Despite an overall market decline, hybrid-electric was the only segment to post growth, with car registrations increasing by 16.2% in May to over 272,568 units. Three of the four largest markets for this segment – France (+38.3%), Spain (+25.4%), and Italy (+7.4%) – recorded solid gains, while Germany experienced a slight decline of 0.7%. This growth pushed the hybrid-electric market share to nearly 30%, up from 25% in May 2023.

ICEs

In May 2024, petrol car sales decreased by 5.6% to 323,551 units, with notable declines in key markets such as France (-20.3%) and Spain (-1.8%). On the other hand, Italy and Germany posted modest growth rates of 4.1% and 2.1%, respectively. As a result, the petrol market share declined from 36.5% to 35.5% compared to May of the previous year.

The diesel car market saw an even steeper decline of 11.4% to 118,733 units, accounting for 13% of the market. Significant decreases were observed in major markets like Italy (-30.5%), France (-24.8%), and Spain (-15.4%). Germany experienced a modest increase of 3.2%.

Europe’s diesel share ‘flatlining’

GlobalData estimates that diesel share of the European car market as a whole (includes non-EU markets such as UK) stands at around 15%.

“It is flatlining really,” says GlobalData analyst Al Bedwell. “The ultimate direction of travel may be obvious, but there is a hardcore of diesel users out there for whom these powertrains still offer a relatively attractive solution for their needs. Automakers are offering fewer diesel products, but there are buyers out there and a small market to serve – though in the long-term it will diminish further.”