Alongside our daily news coverage, features and interviews, the Just Auto team sifts through the week’s most intriguing data sets to bring you a roundup of the week in numbers

This week brought GlobalData analysis of China’s 2023 market and industry data, the latest GM quarterly financials and UK car production numbers. Oh, and Tesla was in the news for a change.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

China’s auto industry surged

The Chinese vehicle market enjoyed a very strong 2023. Despite the overall depressed economic environment, the Chinese LV market performed exceptionally well in 2023, maintaining strong momentum from when it began to pick up in the second quarter of the year, with the selling rate reaching 31.5 million vehicles per year in December. This was the seventh consecutive month that the rate topped the 30 million-unit mark.

The data table of sales by brand (remember, these wholesale figures from source include exports) makes for particularly interesting reading. BYD was top in 2023 by a considerable margin but Chery is coming up quickly in fourth place. Sales in Russia – where the Chinese have filled the gap left by Western OEMs’ exits – will be helping Chery’s overall volume, considerably. Its Russia sales in 2023 were up a staggering 207% on the previous year to 118,055 units.

More on this: China’s auto industry hit record highs in 2023

Just look at the China light vehicle market’s seasonally adjusted annualised running rate (SAAR) below. The moving average fluctuated with the pandemic, but the SAAR (blue squares) has been consistently moving up in recent years, boosted by local makers and growing sales/exports of NEVs (BEVs and PHEVs).

GM disappointed investors

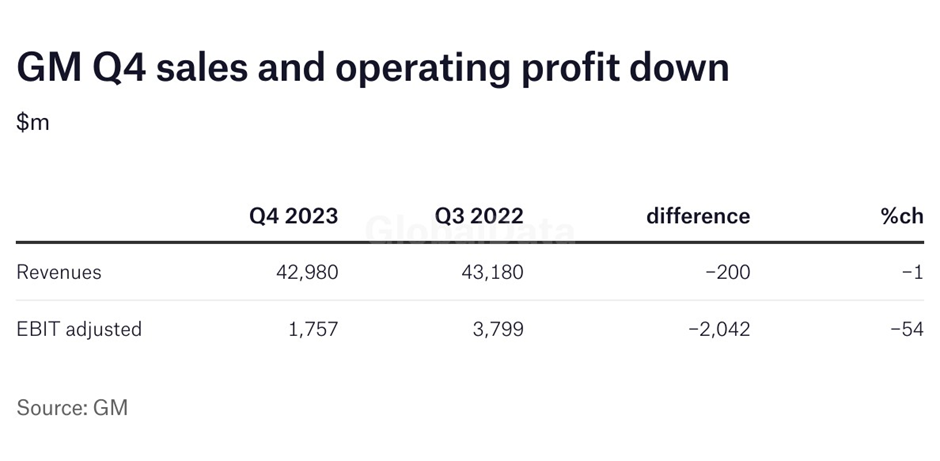

General Motors reported fourth quarter 2023 revenue of US$43bn (down 0.3% year on year, net income of $2.1bn (up 5.2%) and EBIT-adjusted of $1.8bn (down 53.8%).

According to Reuters, GM said the decrease reflected the impact of last autumn’s United Auto Workers’ strikes, higher costs at Cruise and a $1.1bn writedown related to EV battery cells held in stock.

Full year 2023 revenue was $171.8bn (up 9.6%), net income $10.1bn (up 1.9%) and EBIT-adjusted $12.4bn (down 14.6%).

For 2024, GM said tailwinds include the ‘non-recurrence of the UAW strike’, LG agreements and substantially lower EV inventory allowance adjustments as well as ‘lower Cruise expense’. Headwinds, according to GM, include lower industry pricing (yes, inevitable – in US), higher labour costs and ‘ongoing pressures in China’ (price war not going away anytime soon).

More on this: GM operating profit plunges in fourth quarter

Tesla in the news…

In the wake of Tesla’s latest quarterly results, the company’s share price took another slide. Sales and profits disappointed investors again, but so did the outlook – which is for growth of Tesla sales to moderate in 2024.

This week, we published a comment piece on Tesla: Tesla’s sheen wears off, but it’s still there.

Tesla’s headline grabbing CEO Elon Musk was in the news again, this time because his huge Tesla pay package has apparently been voided by a US judge after a shareholder challenged it in a Delaware (where Tesla is registered) court. ‘Unfathomable’ was quite an adjective to use.

More on this: Judge voids Elon Musk’s $56 billion Tesla pay package

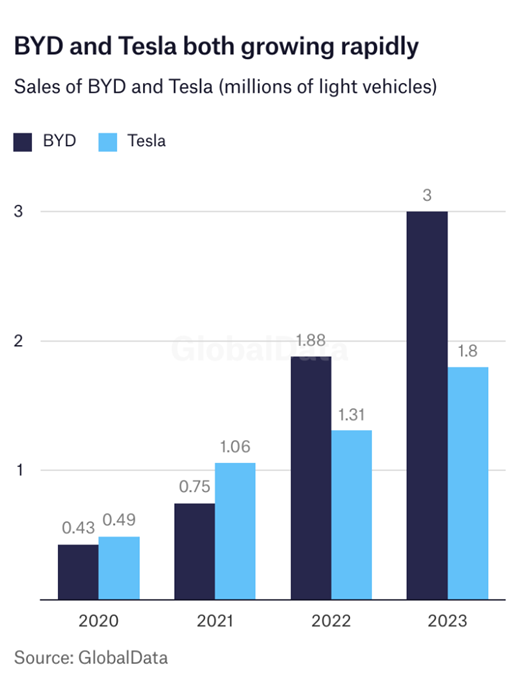

Sales of Tesla and its oft-cited emerging rival BYD show that both have been growing rapidly. Tesla cars, let’s just remind ourselves, sell at much higher price-points than BYD’s.

UK vehicle output hits a million units in 2023

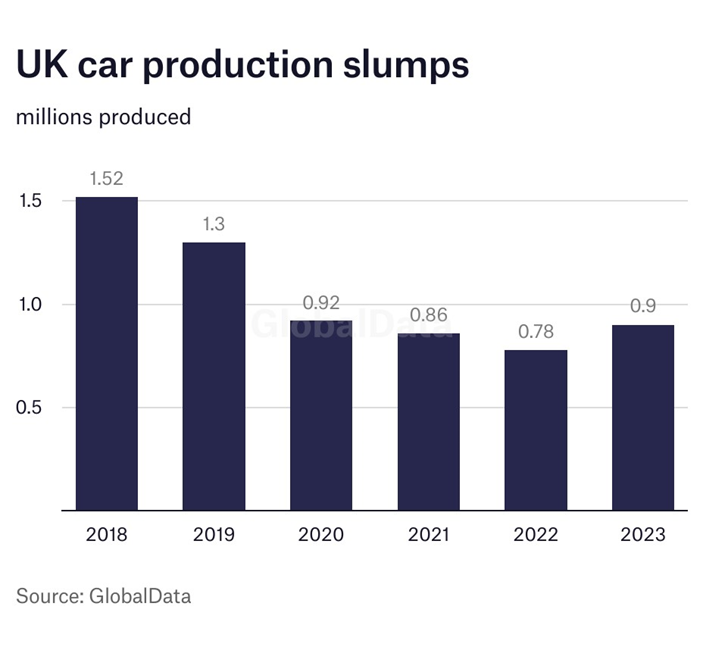

UK vehicle production hit 1,025,474 units in 2023, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT).

The easing of pandemic-related challenges, from chip shortages to lockdowns, and increasing electrified model production, combined to drive annual output above one million for the first time since 2019.

Overall, UK car production rose 16.8% to 905,117 units in 2023, its best growth rate since 2010.

So, a good year when compared to 2022 and that’s obviously welcome for the sector in Britain. Nevertheless, the picture in recent years sees the UK car industry well under where it was – in terms of car output – before the pandemic. Issues on a proposed UK-Canada FTA won’t help either.

More on this: UK vehicle output hits a million units in 2023