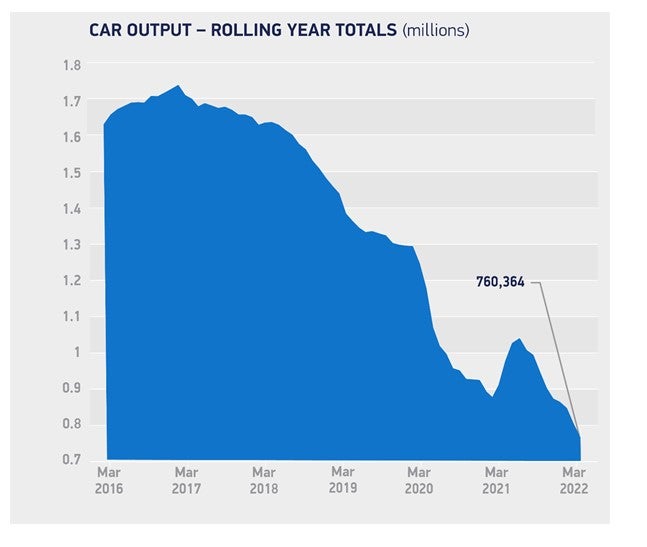

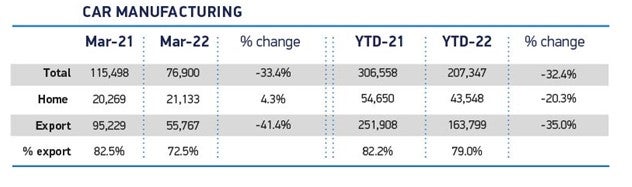

UK car output was down 32.4% during the first three months of 2022, with almost 100,000 fewer units made than in the same period last year, according to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT).

With production volumes still constrained by the ongoing global shortage of semiconductors and other components, 207,347 new cars were built during the first quarter, down from 306,558 in pandemic-affected Q1 2021.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Output in the last month of the quarter fell by more than a third, down by 33.4% year-on-year, with 76,900 units made compared with 115,498 in the same month last year. This decline, resulting in the weakest March since the financial crisis in 2009,1 was driven primarily by a decrease in production for overseas markets, which fell by 41.4%.

Exports to the US saw the greatest decrease during March, dropping by 63.8% year-on-year, largely due to the closure of Honda’s plant in Swindon in July 2021 which manufactured for the US market, while exports to the EU declined by 24.5%.

The SMMT said that production volumes remain constricted with the ongoing global semiconductor shortage, the Ukraine crisis exacerbating parts supply challenges and manufacturers facing an increasingly challenging economic environment with rising energy costs and other inflationary factors.

Mike Hawes, SMMT Chief Executive, said: “Two years after the start of the pandemic, automotive production is still suffering badly, with nearly 100,000 units lost in the first quarter. Recovery has not yet begun and, with a backdrop of an increasingly difficult economic environment, including escalating energy costs, urgent action is needed to protect the competitiveness of UK manufacturing. We want the UK to be at the forefront of the transition to electrified vehicles, not just as a market but as a manufacturer so action is urgently needed if we are to safeguard jobs and livelihoods.”

Chris Knight, Automotive Partner at KMPG, said that despite the weak result for Q1, manufacturers are adapting. “Car production volumes remain below pre-pandemic levels, but manufacturers have adapted, profiting from focus on a buoyant electric vehicle market, and prioritising components into higher-margin cars generally,” he said. “Inflation driving up production costs further compounds this approach.”

However, he also warned that challenges remain.

“Once the market eventually moves beyond these constraints and stabilises, a continued focus on such high margin production will likely be at conflict with maintaining market share – particularly with increased, and lower-cost, competition emerging.

“A focus on prioritising available components and materials into higher-margin vehicle production and sales has been to the detriment of some parts of the fleet industry.

“But with rental and leasing markets beginning to recover as travel and commuting again increases, leasing companies will be looking at which manufacturers have, and haven’t, supported them during these challenging times. An increase in hybrid working may of course change the nature of company car schemes forever and lead to less miles driven, but in turn it could drive more consumers, whether supplemented by a vehicle allowance or not, to look at rental options as an alternative to ownership. This was a trend we were already seeing pre-pandemic, particularly in urban areas and amongst younger consumers. And the tightening cost of living squeeze will only increase the number of people assessing whether short or medium term rental or leasing is a more affordable model for them than buying a vehicle.”