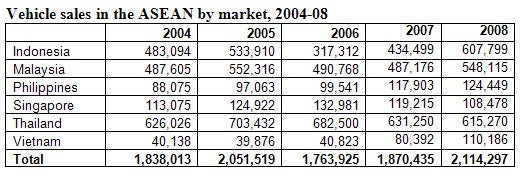

New vehicle sales in the ASEAN region’s top six markets increased by 13% to a record 2.114m units in 2008, despite a 2.5% contraction in Thailand – the region’s largest single market. But the outlook for this year is far less sanguine, writes Tony Pugliese.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Indonesia and Vietnam both reported record sales, with volumes rising by 40% and 37% respectively. Malaysia had its second-best year on record, while the Philippines reported sales volumes last seen in the mid-1990s – before the Asia financial crisis.

Thai economic activity continued to be held back by political unrest, which badly affected consumer and business sentiment in the country. The vehicle market contracted for a third consecutive year in 2008. Singapore sales fell by 9% after three years of peak volumes. The city-state’s economy shrank dramatically in the fourth quarter, by 16.9% quarter-on-quarter and 3.7% year-on-year as export demand dried up.

Indonesia, Malaysia, the Philippines and Vietnam saw demand weaken significantly in the fourth quarter and this is expected to continue in 2009. Vietnam continued to increase automotive taxes in an attempt to reduce its dependence on imports. This has distorted normal buying activity and sales are set to fall sharply in 2009. Economic activity slowed sharply in the Philippines in the fourth quarter, mostly as a result of a sharp decline in exports.

Governments across the region are implementing economic stimulus programmes in an attempt to offset the sharp fall in export demand. Interest rates are also being cut across the region as the threat of inflation dissipates. But banks have been slow to pass on these cuts and lending criteria has become more stringent.

ASEAN’s automotive markets are set to deteriorate significantly in 2009, after a stagnant fourth quarter, with volumes likely to decline by over 25% to around 1.57 million units.

Thailand

Thai vehicle sales declined in the second half of 2008 as deepening political uncertainty worsened an already deteriorating macro environment. Record-high fuel prices and fast-rising inflation had already begun to sap consumer spending power and confidence fell further as the global economic outlook continued to worsen. Fourth-quarter vehicle sales were down 14.4% at just over 154,000 units.

After sales declines of 15% and 20% in October and November respectively, the 8% volume drop in December was not seen as a sign of improvement. Strong promotional activity at the Bangkok motor show, held at the end of November, helped slow the decline but its benefits are expected to be short-lived. Inventory levels remain high and all major vehicle manufacturers have implemented extended plant shutdowns.

The Thai government expects GDP to grow between 0.0-2.0% this year, after growing by around 4% last year, but acknowledges that the outlook remains very uncertain. The Bank of Thailand has reduced interest rates by 175 basis points over the last two months to 2% and further cuts are possible. Banks have been slow to pass these cuts on to consumers, however, and lending criteria has been tightened.

Earlier this month, the government announced a THB 155 billion spending programme to help offset a slowdown in consumer spending, shrinking export markets, lower tourist arrivals and rising unemployment.

Domestic vehicle sales are widely forecast to drop by 20% this year to around 500,000 units, from just over 615,000 units in 2008. A very weak first half is expected to be offset in part by a slower decline in the second.

Indonesia

The Indonesian vehicle market had its best year ever in 2008, with wholesale volumes rising by close to 40% to 607,799 units. The economy is estimated to have expanded by 6.2% last year, underpinned by strong domestic consumption and high commodity prices for most of the year. Inflation for the year is estimated at 11.4%.

But there are clear signs that the economy is weakening, with export growth slowing sharply as weak global demand drives down prices. Tightening credit is slowing the property and automotive markets in particular. Interest rates have been cut by 75 basis points over the last three months to 8.75%, but the cost of borrowing for consumers remains high – at between 15-18% per year.

GDP growth is widely expected to fall to around 4.0% this year. Interest rates are expected to be cut to between 7.0-8.0% this year and further stimulus will come from the Government, which has increased borrowing to fund a $6.5 billion package targeting mostly the infrastructure sector.

The vehicle market has been affected by the increasing economic uncertainty, tightening credit and a weak currency. The rupiah has lost around 40% of its value against the Japanese yen since last September and 15% against the Thai baht. These are the two main sources of OE parts and CBU vehicles sold in Indonesia. Toyota, dominant automotive group, hiked prices by an average of 13% this month.

Vehicle inventories have increased sharply in the last few months and production at most major vehicle assembly plants has been cut. Toyota is said to have suspended a shift at the Karawang plant and is rotating its workforce. Industry association Gaikindo said it expects wholesale deliveries to drop by 30% this year to 425,000 units. Others, like Ford, are less optimistic given the significant inventory build-up in the fourth quarter of 2008 and predict wholesale volumes to drop to around 370,000 units. The outcome is most likely to be somewhere in between – at around 400,000 units.

Malaysia

Vehicle sales in Malaysia rose by 12.5% to 548,115 units in 2008, despite fourth-quarter sales falling by 8.5% to 118,202 units as consumer and business confidence deteriorated sharply. For the full year the economy is estimated to have expanded by around 3.5%, with fourth-quarter growth slowing as a result of a sharp drop in exports, lower household expenditure and rising caution among businesses.

Opinions vary significantly on the economic outlook for the year, with the government expecting marginally slowdown in growth to around 3.0%, while others are much more bearish. The private sector consensus puts 2009 GDP growth forecasts in the 1.0-2.0% range.

The government is implementing a MYR 7 billion stimulus package in the first quarter to help reduce the risks of a recession. A second stimulus package will be made available later in the year. Bank Negara cut interest rates from 3.5% to 2.5% this month, although lending criteria has tightened significantly in recent months and this has a significant direct effect on the country’s car market.

The recent slowdown in vehicle sales is expected to steepen significantly in the next few quarters. While the Malaysia Automotive Association expects volumes to decline by 12.5% to 480,000 units this year, others are less optimistic. Affin Securities expects sales to contract by 20%, citing the high levels of sales activity in the previous year, a lack of forthcoming mass-market models and the potential for further credit tightening as reasons to be more bearish. With exports showing no sign of an upturn, the risks are definitely to the downside and a 20-25% sales decline to around 420,000 is likely.

Tony Pugliese