The European Automobile Manufacturers’ Association (ACEA) has said it is making an urgent plea to the European Commission to act immediately to prevent taxes being imposed on electric vehicles traded between the EU and the UK from January 2024.

If the Commission fails to act, a 10% tariff will be placed on EU electric vehicle exports to the UK – its largest trading partner. The same tariff would apply in the other direction – UK shipments of EVs to the EU.

The rules are designed to ensure that EU-produced electric cars are largely made from locally sourced parts. However, vehicle makers in the UK and the EU say they are not ready. As EV sales ramp-up, the supply of sufficient batteries from European plants will be a huge industry challenge for the region.

The new rules of origin applying from January 2024 apply to shipments of cars across the English Channel under the terms of the Brexit deal negotiated between London and Brussels – the UK-EU Trade and Cooperation Agreement. A higher local content – UK or EU – is stipulated from 2024 (up from 40% to 45% of an EV by value and 60% of the battery pack) makes it difficult for EVs to qualify as tariff free.

ACEA said the only way to avoid 10% duties will be to source all battery parts and some critical battery material in the EU/UK. ‘This is practically impossible to achieve today,’ the trade association said.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Driving up consumer prices of European electric vehicles, at the very time when we need to fight for market share in the face of fierce international competition, is not the right move – neither from a business nor an environmental perspective,” stated Luca de Meo, ACEA President and CEO of Renault Group. “We will effectively be handing a chunk of the market to global manufacturers.”

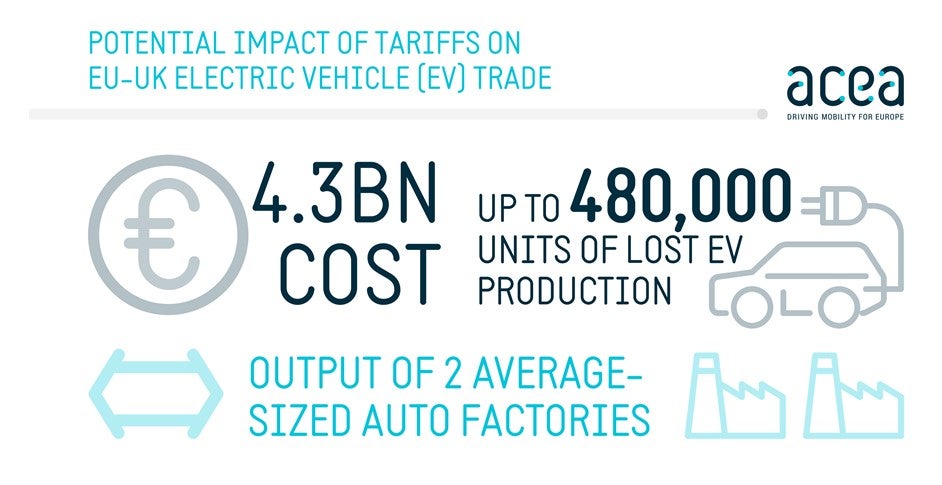

ACEA said the tariff could cost EU vehicle makers €4.3 billion over the next three years, potentially reducing electric vehicle production by some 480,000 units, the equivalent output of two average-size auto factories.

“Europe should be supporting its industry in the net-zero transition as other regions do – not hindering it,” added de Meo. “There is a very simple and straightforward solution: extend the current phase-in period for battery rules by three years. We urge the Commission to do the right thing.”

ACEA said massive investments are being made in European battery supply chains, but ‘more time is needed to build up the kind of scale needed to meet the rules of origin’.

Some analysts expect a deal to be struck to postpone the tighter rules of origin impacting EVs, but recent press reports suggest that it is still some way off, with the EU side reluctant to make changes to the existing UK-EU Brexit deal terms. However, the strong statement from ACEA increases the pressure for postponement – coming from the automotive industry within the UK and also in the EU area.