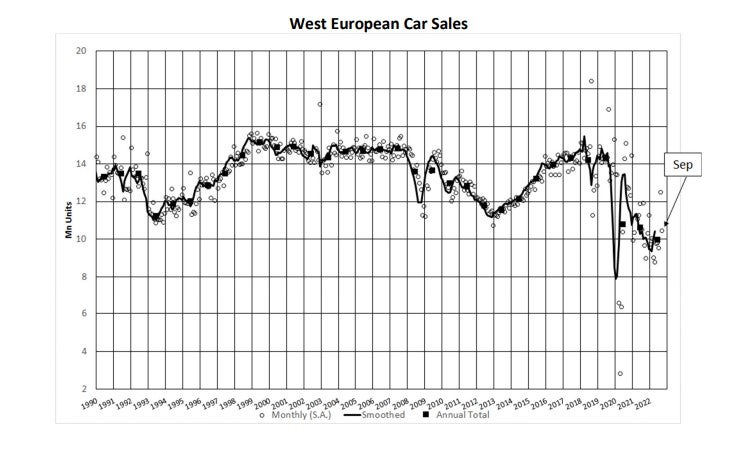

The Western Europe car market selling rate decreased to 10.5 mn units/year in September, from 12.4 mn units/year in August.

Analysts at LMC say the drop is a general trend experienced by most Western European countries, predominantly driven by continuing supply constraints.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

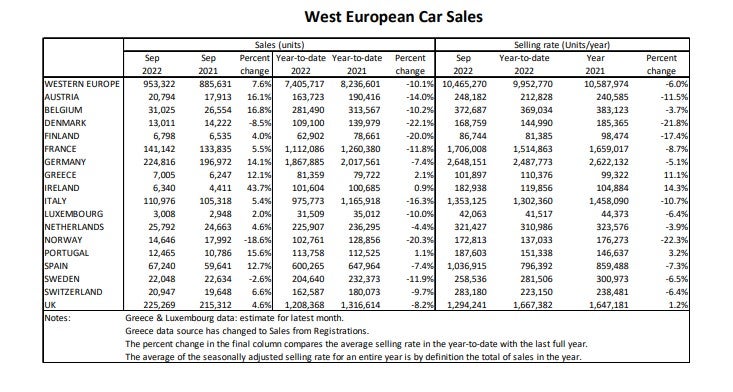

Despite the 7.6% rise in new car registration numbers in September, the year-to-date (YTD) raw sales figure is 10% lower than the same period in 2021.

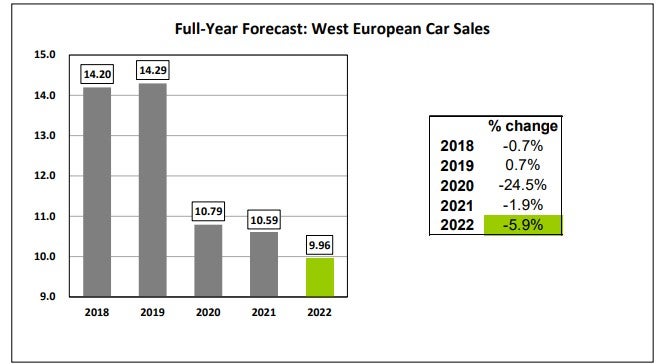

Relative to September 2021, registration numbers grew by 7.6% to 953k units. The year-to-date (YTD) selling rate improved slightly but remains relatively flat at 10.0 mn units/year, with a 6% drop from the 2021 result.

The German PV (passenger vehicle or car) selling rate in September slipped back to 2.6 mn units/year from a year-long high of 2.9 mn units/year in August. In the UK, the PV selling rate fell from 2.3 mn units/year in August to just 1.3 mn units/year. The French PV selling rate also eased back from the August figure of 1.9 mn units/year to 1.7 mn units/year in September. In Italy, the PV selling rate dropped from 1.8 mn units/year in August to 1.4 mn units/year in September. Contrary to the others, the Spanish PV selling rate improved again in September as for the first time in 2022, it climbed above the 1-mn unit/year mark, around 50k up on the August SAAR.

The 2022 forecast remains relatively flat at 10.0 mn units with strong signs that the selling rate will strengthen for the remainder of the year. Although supply constraints are still dictating the pace of vehicle sales, LMC notes that demand is also being eroded by low consumer confidence, high inflation, rising energy prices and contractionary monetary policy.

For 2023, LMC expects supply-side disruptions to ease, but warns there is a greater likelihood that falling demand will supersede supply factors as the main barrier to sales.