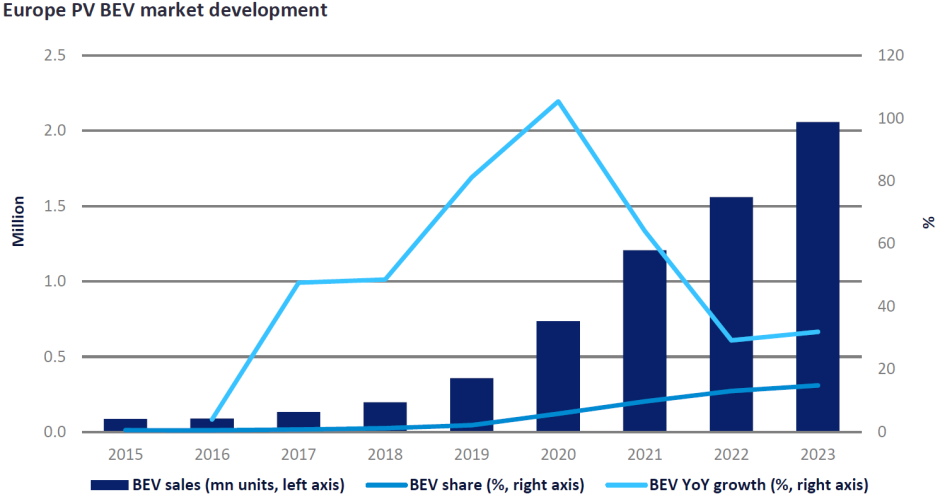

Are fears of a slowdown in Europe’s BEV demand justified?

Last year Europe’s Passenger Vehicle (PV) BEV market grew 32% with positive growth in all months apart from December, which was off a very high base in December 2022. The growth achieved was better than many forecasters indicated at the start of last year (and better than in 2022), with some expecting growth to be flat. BEV sales volume came in at just under 2.1 million units which is half a million more than were sold in 2022.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

However, it is clear there has been some recent slowdown in the market for BEVS, but it depends where you look. Some brands are doing considerably better than others, with the likes of MG and Tesla standing out as strong performers in 2023.

The chart below illustrates just how rapidly the electric car market in Europe has grown in recent years – volume and share. However, the talk in the industry is of the supply-side factors (especially battery making capacity/costs) and demand-side factors (consumer hesitancy, charging network constraints, still-high purchase prices) that could constrain future BEV growth or, well, cause a signifcant pause. The early adopters may well have been relatively straightforward compared with the next phase.

It’s a little bit chicken and egg. As the volumes for BEVs rise much higher, unit costs om major components and indeed, the vehicles themselves, naturally fall, creating room for lower price-points that, in turn, stimulate higher sales. It will happen, but getting there is no walk in the park. Despite recent BEV sales growth, the products still come with relatively high price tags and are stubbornly difficult for volume players to make a profit on. Which is where incentives to kick-start the market for the good of all can be a good idea. Just ask the Chinese…

More: Fears over a slowdown in Europe’s BEV demand are growing

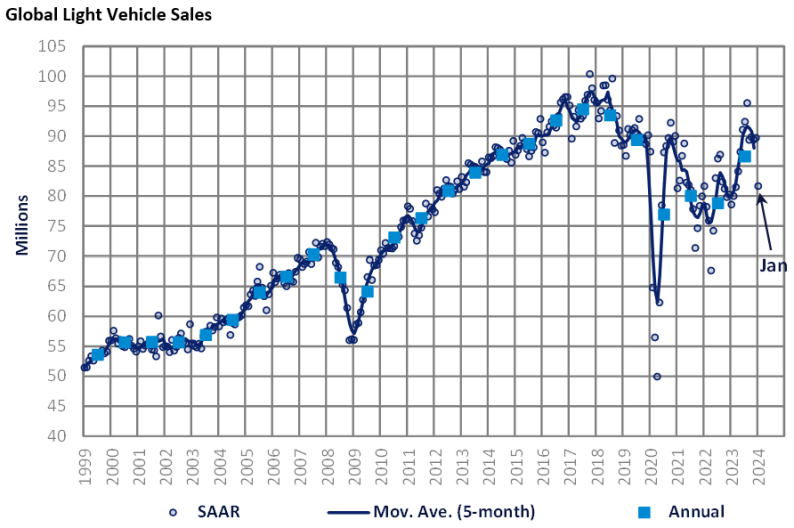

Global vehicle market slowed in January

Key markets saw selling rates fall back in January, according to GlobalData. Key markets saw selling rates fall back in January. In the US, there were signs of pricing easing back at a faster pace. In Europe, it was a mixed picture as Western Europe’s selling rate slowed while Eastern Europe’s rate improved. China’s comparable selling rate was also weaker from December to January, even though raw sales grew well, YoY.

More: Global light vehicle sales rate down in January

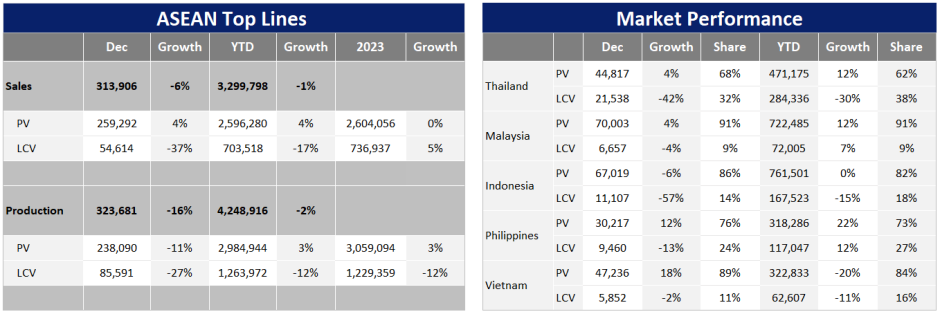

Mixed picture for markets in SE Asia

ASEAN 2024 light vehicle sales are forecast to increase 1%, according to GlobalData analysis. It’s been a mixed picture for sales trends in the major markets of the region.

More: ASEAN 2024 sales projected to marginally increase with a lower sales outlook in Malaysia

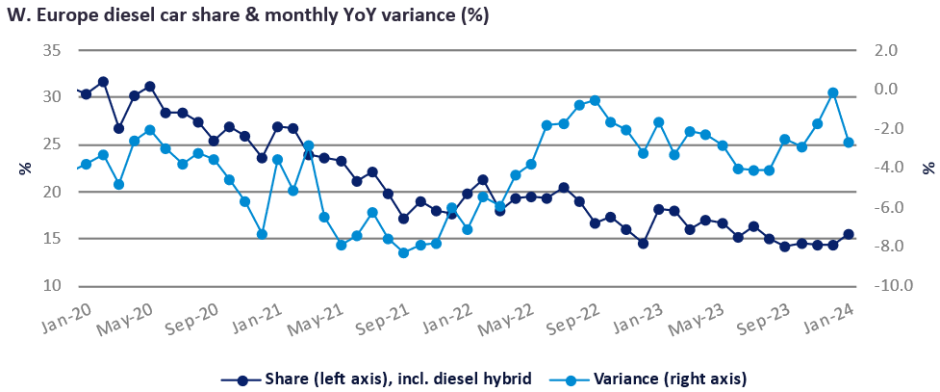

Diesel holds steady in Euope

According to GlobalData, January saw another month of low MoM variation in the share of new diesel car sales in the region. It seems that after the major share decline, diesel share of the car market is effectively flatlining. That’s probably to be expected as the diesel customer base shrinks to the ‘diehards’ who are innate enthusiasts or for whom good ol’ diesel better fits their usage patterns than the powertrain alternatives. There are still plenty of diesel car products available and the manufacturers won’t desert that part of the market while there are good levels of sales to be had.

More: Western European diesel share sees small uptick in January