Ride-hailing giant Uber saw its passenger numbers plummet during the Covid-19 pandemic. But as people stayed home and businesses furloughed its staff, there was a flipside: its delivery service – Uber Eats – saw a surge in activity as restaurants looked for ways to keep operating amidst a time of great uncertainty and empty tables.

Forbes reported that in the US, Uber Eats experienced an increase of around 10% in the first few weeks of the Covid-19 lockdown.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

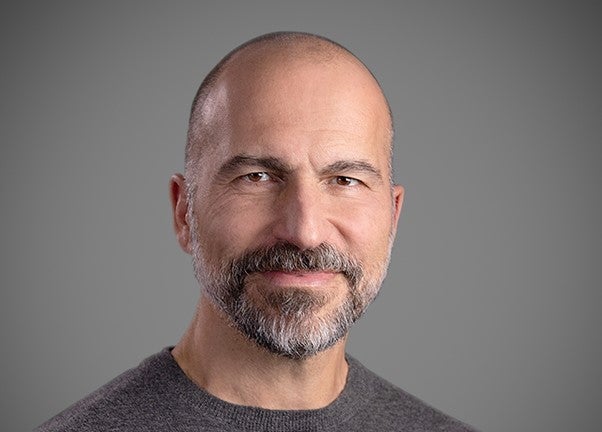

Post-pandemic, the firm’s recovery picked up the pace, though this has slowed recently. Speaking at a recent Goldman Sachs fireside chat, Uber CEO Dara Khosrowshahi outlined the company’s plans for its delivery vertical.

Post-pandemic recovery

“Covid forced us as a company to really take a hard look at what we considered core to the business,” Khosrowshahi said. Uber saw “significant growth” on its delivery side during the pandemic, which prompted it to “rearchitect the business as a platform.”

Previously mobility and delivery were vertical standalones but the growth the firm experienced “enabled Uber to bring the platforms together,” he said.

The return to office brings Uber an upside

During the pandemic, offices around the world saw their workforces become fully remote. In its wake, many firms eased into hybrid-working arrangements – but that bubble seems to be bursting.

Industry giants such as Amazon, Disney and JPMorgan – as well as Uber – have instructed employees to return to the office. According a poll by ResumeBuilder, 90% of US companies surveyed said they would return to the office by the end of 2024.

And while some may see this shift in a negative light, for Uber, the return to work presents positive opportunities.

“We are seeing weekday commutes as [a] particular strength,” Khosrowshahi said. “As more companies like us are telling their teams, ‘Hey let’s get back to the office.’”

In terms of the demand trends for Uber’s consumers, the firm was “quite optimistic,” despite goods service levels and expenditures on service not being back to where they were pre-Covid.

“We think that generally the pent-up demand for services continues to be pent-up, and as long as we’re in a strong supply position, we see very, very strong growth coming,” he continued.

In the US, the average Uber driver is earning $35 per utilised hour, and drivers were staying on the platform for longer, Khosrowshahi said. “As we enter peak season [October, November, December], we’re in a strong position as it relates to our supply position,” he maintains. “Earnings are healthy.” He also said that inflation was driving more ‘earners’ to Uber, which accounted for some of the strong supply position.

Khosrowshahi also noted that Uber has found the formula for increasing (spending) activity on the platform, which focuses on getting users to use different services. He gave the example of someone who books an UberX, being able to be moved to the delivery/grocery segment.

Uber’s partnership with Domino’s Pizza

In July this year, Domino’s Pizza announced it had partnered with Uber Eats which would be Domino’s exclusive third-party platform in the US until at least 2024. It is expected to launch by the end of 2023.

Commenting on the announcement, Domino’s CEO Russell Weiner had said the deal “could make Domino’s available to millions of new customers around the world.”

“They’re the last large merchant out there who haven’t worked with aggregators – so their decision to launch with us reflects generally the value of aggregation and the fact that we are bringing incremental audience to our restaurant partners, to our grocery partners as well,” Khosrowshahi said.

“Domino’s talks about anticipating a billion plus dollars of gross bookings on our platforms. We will work together to make sure that prediction comes true.”

On Uber’s delivery side, Khosrowshahi said the firm wanted to “build a delivery platform that’s standalone as best of breed.” The demand for delivery had proven to be “quite resilient”, and he said Uber expected delivery growth in the back half of the year.

Uber’s Q2 2023 delivery gross bookings were up 14%, an increase from 12% growth posted in Q1 2023.