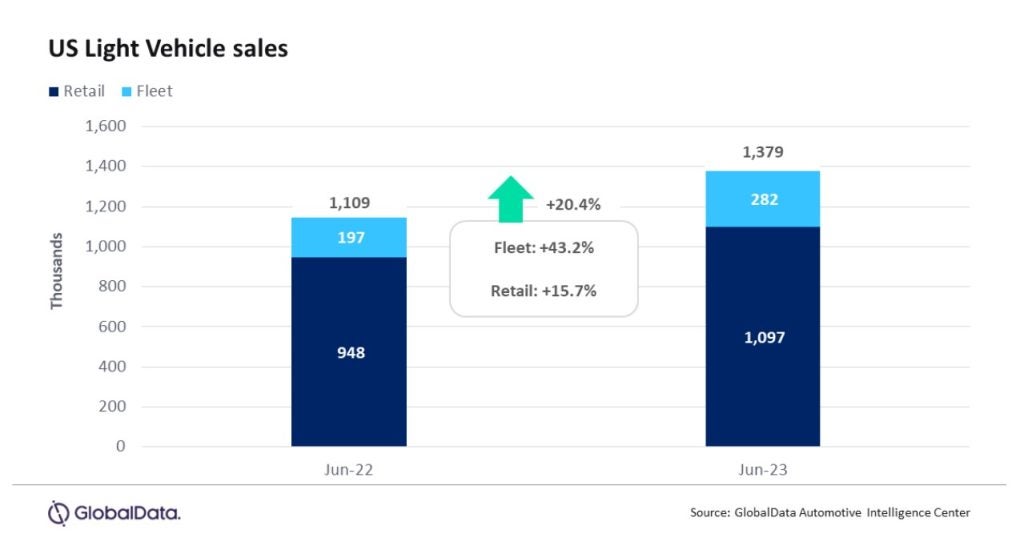

According to GlobalData preliminary estimates, US light vehicle (LV) sales grew by 20.5% YoY in June, to 1.38 million units.

GlobalData has also raised its 2023 US market forecast by half a million units after the latest monthly results.

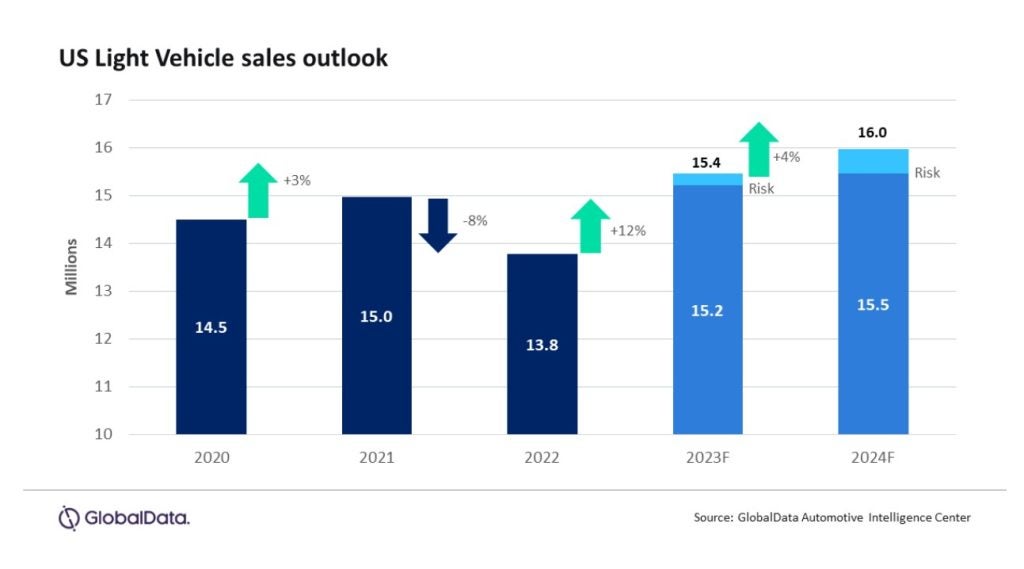

With the first half of 2023 now complete, US LV sales are estimated to have grown by 13.1% YoY, to 7.68 million units. Volumes easily surpassed year-ago levels, partly due to 2022’s weakness, which was heavily impacted by inventory shortages. Still, sales remained 8.6% below 2019 levels in the first six months of the year, showing that there is still some way to go before the market recovers to its pre-pandemic state.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “US light vehicle sales continued the trend of solid results in June, without quite hitting the heights seen before the pandemic. As inventories have increased, some unfulfilled demand from the past two years of shortages was met, and willing buyers were found despite sky-high transaction prices and still-suppressed incentive levels.”

GlobalData economic forecasts for H2 2023 remain relatively gloomy. “That makes us cautious about prospects for auto sales, but if the expected recession continues to be delayed, there is some upside risk over the next six months,” says Oakley.

Current year forecast raised

The continued strength in US auto sales has led to an increase in the GlobalData US LV sales forecast to 15.4 million units for 2022, up 11% from 2022. Fleet recovery is expected to greatly outpace retail with an increase of 37% from 2022 and volume that will be in the 19-20% share of total LVs. The forecast for 2024 remains at 16.0 million units, with risk balanced, GD says.

Inventory levels are expected to have risen by around 2.2% MoM in June, to 1.85 million units. This would translate to a days’ supply figure of 35 days, up from 33 days in May. Both domestic production and imports continue to improve, implying that stocks should increase over the coming months.

Jeff Schuster, Automotive Group Head and Executive Vice President, GlobalData, said: “The US auto market is one of the top outperforming markets in the world currently, as consumers display fortitude in the wake of the pandemic and with economic and market risk on the horizon.

“The outlook for 2023 has been increased by 500,000 units since January and has the ability to push through 15.5 million units if risk dissipates as the second half of 2023 progresses.”

EVs more affordable

Elizabeth Krear, vice president, electric vehicle practice at JD Power says that EVs from mass-market brands continue to yield high interest upon introduction. “An example is the Honda Prologue, which debuted in May as the most-considered EV.

“As the industry waits for new product, monthly price mix dynamics are at play at vehicle trim levels. Driven by the Inflation Reduction Act, pricing adjustments and model mix, the affordability factor increased notably to 94 in April 2023 from 82 in December 2022.”

Krear says pricing improvements increase affordability across a variety of models, including Tesla’s with price cuts.

“With Tesla charging network collaborations on the horizon, Ford, GM and Rivian buyers will benefit,” she says. “However, charging installation growth continues to lag the growth of EVs on the road, further straining already-limited infrastructure. One of the top reasons rejecters say they’re not likely to purchase an EV is range. Among Compact SUVs, EV ranges are just 65% of gaspowered counterparts—but EV owners say that’s nearly sufficient for them to not change their driving behaviours—another advantage for the Tesla, Ford, GM and Rivian alliance.”