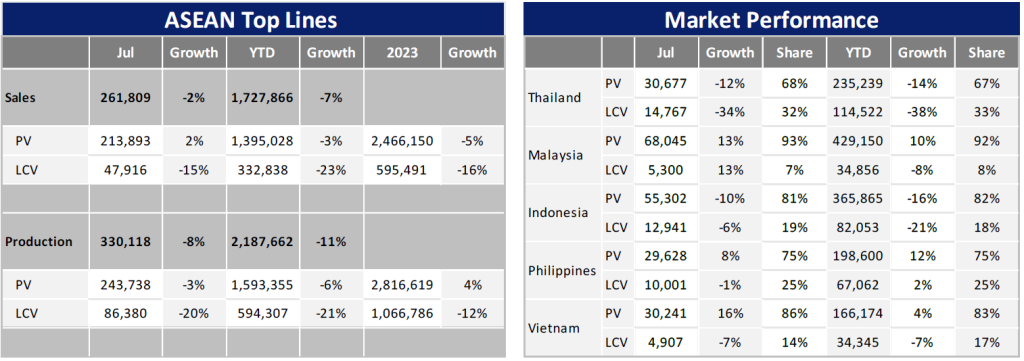

ASEAN Light Vehicle (LV) sales rebounded by 7% month-on-month (MoM) but dropped by 2% year-on-year (YoY) in July. On a country basis, Thailand and Indonesia’s LV sales remained sluggish, with weak performances on both a monthly and a yearly basis, while the rest of ASEAN5 enjoyed sales growth across the same time periods.

Looking more closely, Thailand’s LV sales dropped by 3% MoM and 21% YoY in July, reaching only 45k units and marking the lowest volume in 35 months. The declining sales trend in the country has persisted since Q2 2022, attributed to a weak economy, high household debt, and a high auto loan rejection rate. Following the pandemic, Thai GDP grew only 1.9% in 2023 and 2.3% in Q2 2024, while household debt reached 90.8% of GDP in Q1 2024. This indicates that consumer income growth is marginal and inadequate for expenses, leading the financial sector to tighten auto loan approvals. Meanwhile, buyers are delaying purchases of big-ticket items such as vehicles and property. As a result, Thailand’s LV sales are projected to drop by 19% YoY to 614k units in 2024, representing the lowest annual result in 15 years. This projection is lower than the pandemic period, with sales at 776k units in 2020 and 744k units in 2021.

For Indonesia, GAIKINDO expected that its Indonesia International Auto Show (GIIAS) event in July would serve as a turning point and boost LV demand in the country. On one hand, the event succeeded, as average monthly sales in July and August reached 69k units, an improvement from 63k units in January to June. However, on the other hand, this figure remained lower than the average monthly sales total seen in 2023, of 77k units. Additionally, sales in July and August 2024 declined at a double-digit rate of 12% YoY. According to local media reports, the tightening of auto loan approvals has been a key negative factor this year. Indonesia’s LV sales outlook has been reduced and is now projected to drop by 12% YoY to 815k units in 2024, which is lower than the post-pandemic year of 2021 when sales reached 821k units. This downward revision is based on several factors: demand continues to underperform against expectations; GAIKINDO’s request for government support for Hybrid Vehicle incentives and the reintroduction of tax cut measures to boost LV demand was officially denied in early August; and businesses are holding off on investments until the new president takes office in October and announces his economic policy.

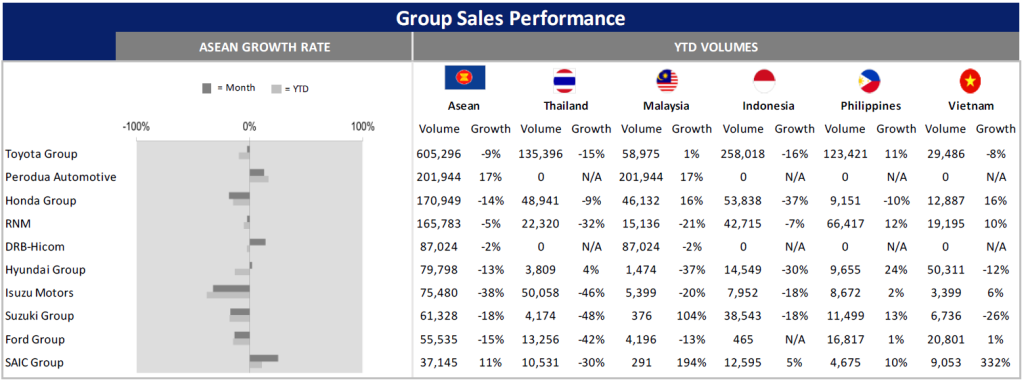

In Malaysia, July sales strongly rebounded by 26% MoM and 13% YoY, following Proton’s temporary production halt for one week in June, which resulted in deliveries being postponed until July. Based on Proton’s press release, the company estimated that overall sales in August continued to increase by 2% YoY and 1% MoM, marking the highest monthly total this year. So far in 2024, the market has been boosted by the influx of new models, including both ICEs and EVs, as well as new Chinese entrants. Moreover, Perodua, the market leader, still has a large backlog of orders as demand continues to outpace supply, which has significantly contributed to increased sales. As a result, Malaysia’s 2024 sales projection has been raised to 792k units in this report. Furthermore, the 2024 sales forecast carries upside risk and could reach 800k units due to the remaining backlog of orders and strong sales momentum for new bookings. Additionally, Malaysia’s Q2 2024 GDP grew by 5.9%, exceeding expectations and marking the highest growth rate since Q4 2022.

In the Philippines, sales marginally increased by 1% MoM and 5% YoY in July, with volumes recorded at 40k units, making it the second-best selling month this year. However, demand was disrupted by typhoons and flooding during the month, without which July sales could have seen an even higher growth rate. The Philippines’ 2024 sales forecast has been raised to 457k units in this report, as the central bank unexpectedly cut the policy interest rate to 6.25% from a 17-year high of 6.5%, citing prospects of lower inflation over the next year. Additionally, remittance inflows from Filipino workers overseas, a key factor for consumer spending, remain solid. A record-low peso has also increased the peso value of USD remittances.

Vietnam’s LV sales surged by 11% MoM and 12% YoY in July, thanks to improvements in the economy, particularly in the goods export sector and tourism business. Consequently, July became the top-selling month this year at 35k units, surpassing the average monthly sales total of 32k units in 2023. A further key development in this report is that the government has reintroduced the much-anticipated 50% registration fee reduction scheme. This temporary scheme is valid for three months, from September 1 to November 30, 2024, and, as in the past, it can only be applied to domestically manufactured vehicles, not imports. However, the positive impact of the incentive scheme is expected to be limited, as it has been implemented several times before. Therefore, Vietnam’s 2024 sales outlook has been marginally increased to 384k units.

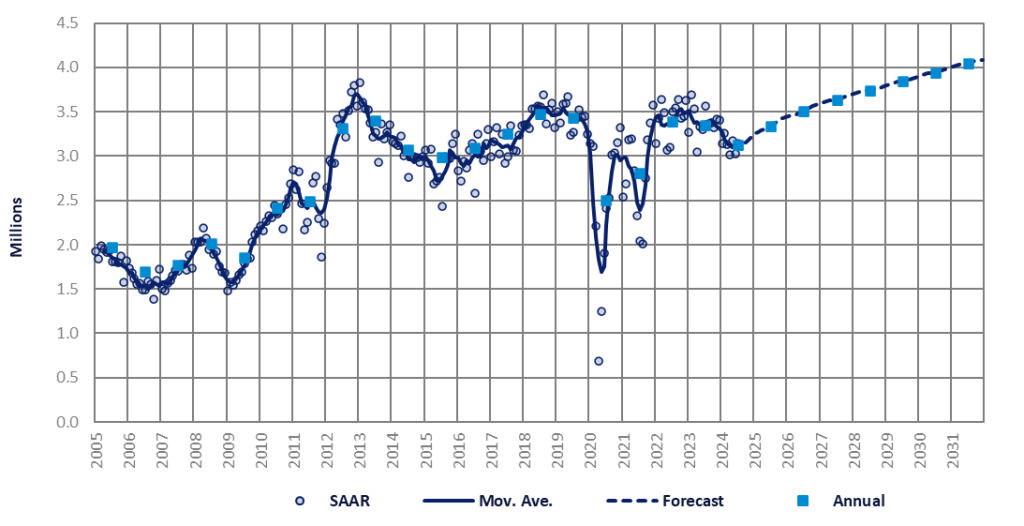

In conclusion, ASEAN’s 2024 sales are now forecast at 3.06 mn units. The near-term outlook carries downside risks, particularly in Thailand and Indonesia, as the LV market in both regions appears to be experiencing the long-term effects of COVID-19.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.