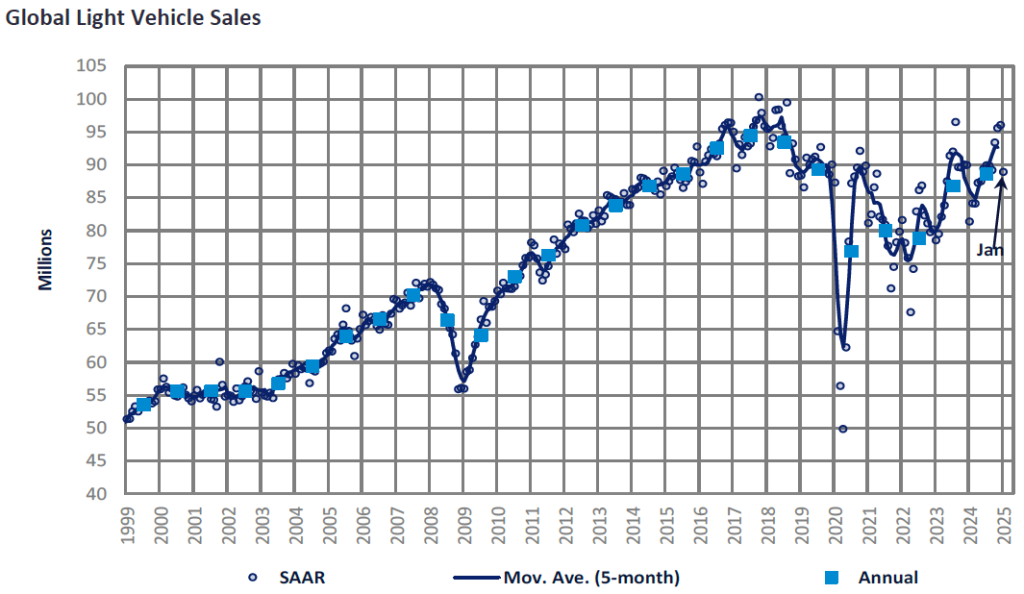

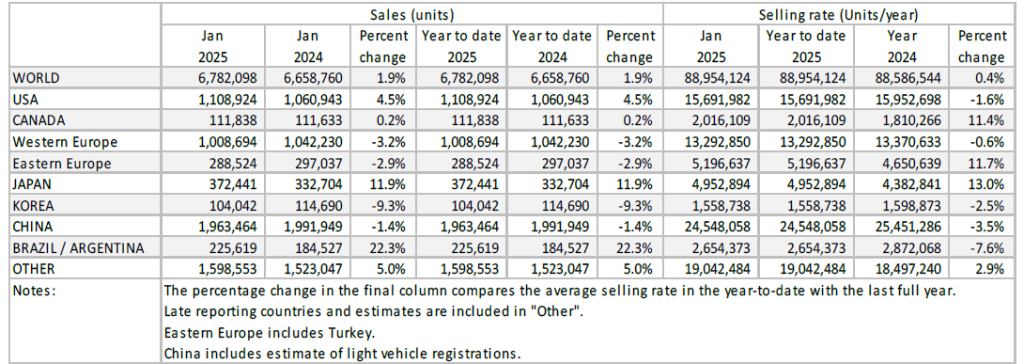

In January, the Global Light Vehicle (LV) selling rate stood at 89 mn units/year, in line with the 2024 full-year result. Market volumes recorded a modest result of 2% growth year-on-year (YoY), with 6.8 mn units sold.

The key markets of US, China, and Western Europe saw varying results in the first month of 2025. In the US, the market improved in the wake of economic uncertainty revolving around potential Trump tariffs. In China, sales saw a slight decline — the extension of the scrapping subsidies was unavailable to half the country’s provinces before the Lunar New Year. Finally, sales in Western Europe declined in the face of increasing political and economic headwinds; however, BEV sales posted a solid improvement.

The key markets of US, China and Western Europe, were comfortably higher YoY. In the US, total year sales stood at 16 million units, the best since the pandemic, while sales in Western Europe improved slightly from previous lackluster results. China’s car market performed well as government incentive, scrappage subsidies, and strong demand for NEVs helped aid consumer demand.

See also: Global automotive market forecasts for 2025

North America

US Light Vehicle sales totaled 1.11 mn units in January, growing by 4.5% YoY. With the same number of selling days as in January 2024, a direct comparison was possible. The annualized selling rate eased to 15.7 mn units/year in January, down from 17.0 mn units/year in December.

The market appeared to carry on largely as normal, despite uncertainty over the new Trump administration’s policies on tariffs and EV tax credits. Average transaction prices were measured at US$45,374 in January, down by US$1,015 MoM, but still up by US$500 YoY. While incentives were up by 26.6% YoY in January, it is clear that affordability has not disappeared as an issue.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn Canada, sales totaled 112k units in January, growing by 0.2% YoY. The selling rate was estimated at 2.02 mn units/year, down from 2.17 mn units/year in December. From a historical perspective, last month’s result compares favourably with almost any January in the past, with the exception of 2018. Mexican LV sales reached 124k units in January, up by 10.7% YoY, as the market continued to demonstrate resilience despite macroeconomic uncertainty. The selling rate accelerated to 1.55 mn units/year in January, up from 1.36 mn units/year in December.

Europe

The LV selling rate for Western Europe slipped back to 13 mn units/year in January from a strong finish to 2024. In YoY terms, market volumes fell by 3.2%. Overall, we expect LV sales growth to remain broadly flat in 2025. Despite the expectation of further interest rate cuts and the introduction of competitively priced models, the region faces increasing uncertainty in the face of numerous economic and political headwinds, including the threat of Trump tariffs.

The LV selling rate for Eastern Europe reached 5.2 mn units/year in January. 289k units were sold, a modest decline of 3% YoY. Russian sales remained strong with sales up 9% YoY; however, the market has now slowed down from the high growth rate of last year as the economy begins to cool. Sales in Turkey were down 15% YoY — contraction here is likely to continue as inflation eases.

China

The Chinese domestic market decelerated sharply in January, despite the extension of the scrapping subsidy program, which was originally set to expire at the end of 2024. Preliminary data indicates that, after adjusting for holidays, the January selling rate was estimated to be only 24.5 million units/year, a 14% decrease from a solid December. In YoY terms, sales declined by about 1% in January, although sales a year ago were also weak. The government announced the extension of the scrapping subsidies on 8 January, but reportedly the program was not available to consumers in about half of the country’s provinces before the Lunar New Year holiday. This contributed to the slowdown in sales, particularly for NEVs, which benefit the most from the incentive program.

While detailed data is yet to be available, it is reported that ICEs outsold NEVs for the second straight month in January. This is partially because a significant portion of demand leading up to the Lunar New Year comes from rural areas and first-time vehicle buyers, where ICEs are more prevalent. Nonetheless, the influx of increasingly affordable and attractive high-tech NEV models will likely continue to drive the market. The price war is set to continue, with BYD, the market leader, announcing price cuts for EVs with advanced autonomous driving features to less than $10,000. Other major EV makers, such as Tesla, Xpeng and Nio, are offering discounts and financing incentives as well.

The Japanese market is off to a strong start in the New Year. The January selling rate was 4.95 mn units/year, up 9% from a weak December. In YoY terms, sales increased by nearly 12% in January, as sales last year were impacted significantly by supply shortages caused by the vehicle certification issues. With production and deliveries mostly normalized, a catch-up in supply is now boosting sales. However, consumers and businesses remain wary about sticky inflation, falling real wages, and growing global uncertainty. The Bank of Japan raised interest rates in January and is committed to its efforts to exit from decades of ultra-loose monetary policy, which could dampen sales this year as well.

The Korean market started the New Year on a sluggish note, amid the ongoing political crisis, increasing global uncertainty, and a slowing economy. Renault Korea’s temporary plant shutdown for retooling affected its local sales as well. The January selling rate was 1.56 mn units/year, flat from December. Due to the crisis, the won is hitting record lows against the US dollar, businesses already started to cut jobs, and foreign tourists are cancelling trips to Korea. Yet, consumer confidence edged up in January after a marked fall in December, suggesting that consumers are already getting used to the political turmoil, as they proved to be resilient during the past political crises.

South America

Brazilian Light Vehicle sales totaled 160k units in January, growing by 5.0% YoY. Despite the positive YoY position, the selling rate slumped to 2.14 mn units/year in January, down from 2.64 mn units/year in December, and the lowest rate since March 2024. While it does appear that seasonality may be shifting to produce more sales in the later months of the year, the slowdown could also be a sign of weakening demand as interest rates have been increased in recent months.

In Argentina, the market demonstrated remarkable strength in January, as sales jumped to 65.7k units, up by 103% YoY, and the highest total for any month since May 2018. Traditionally a key month for LV sales, the selling rate hit 515k units/year in January, the highest since July 2019. Easing inflation, increasing consumer confidence and greater availability of imported models all helped to boost the market.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.