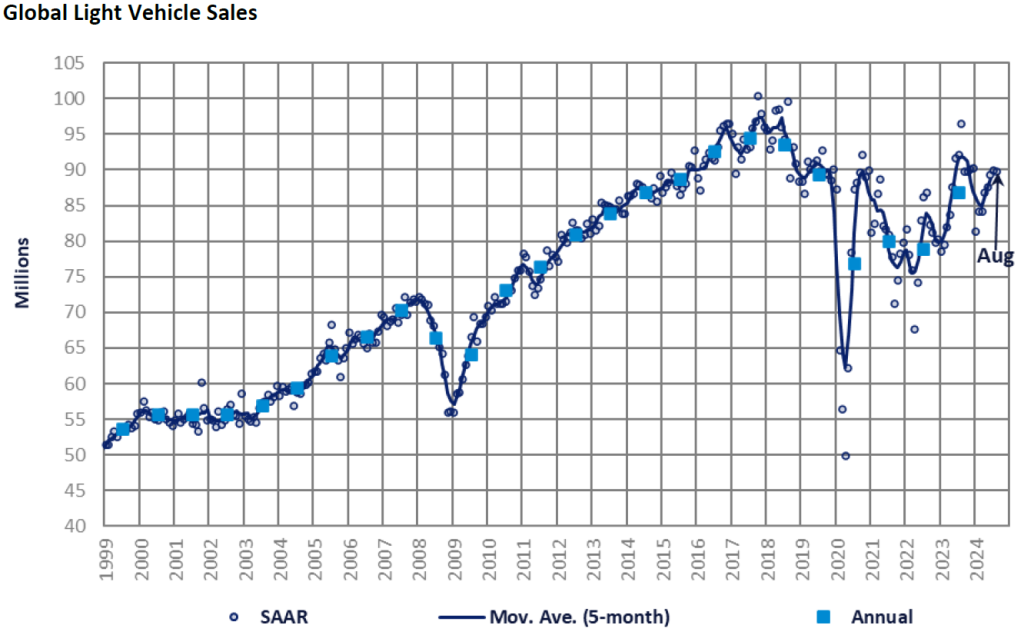

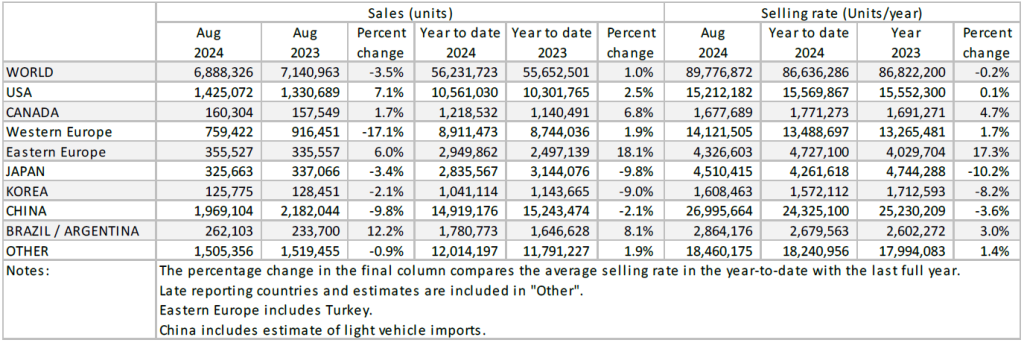

The Global Light Vehicle (LV) selling rate for August stood at 90 million units/year, broadly in line with the previous month. In year-on-year (YoY) terms, market volumes followed the recent trend and were down, at -4% versus August 2023. Year-to-date (YTD) sales remains positive; however, they are now just 1% higher than the same period last year.

At the regional level, results in August were mixed. The selling rate in China remained relatively stable this month, with the market expected to gain momentum in the near-term. In the US, volumes were up YoY; however, this result was lower than expected due to a lack of Labor Day deals. Finally, the selling rate in Western Europe improved though the market continues to face challenges with economic and political headwinds — as a result, YTD sales growth in the region has further trended downwards.

Commentary

North America

- The US Light Vehicle market saw sales improve YoY in August 2024, following two consecutive months of YoY contractions. Expectations for August sales were high, as the Labor Day weekend was considered part of the month this year, but an apparent lack of additional deals for the holiday weekend seemed to keep sales in check, while vehicle prices and interest rates remain high. Although volumes reached 1.43 million units, and sales were up by 7.1% YoY, this was lower than the initial forecast. The selling rate dropped to 15.2 million units/year in August, from the 16.0 million units/year reported in July.

- In August 2024, Canadian Light Vehicle sales marginally expanded by 1.7% YoY, bringing the monthly result to 160k units. While sales grew on a YoY basis among ongoing economic pressure, the selling rate slowed in August to 1.68 million units/year, from 1.82 million units/year in July. Looking at Mexico, sales grew by 13.0% YoY, expanding to 129k units in August, the strongest monthly result so far in 2024. Despite the robust run of sales, the selling rate slowed in August, to 1.48 million units/year, down from the 1.60 million units/year reported in July.

Europe

- The Western European LV selling rate rose to 14.1 million units/year in August. In volume terms, 760k vehicles were sold, a 17.1% decline YoY, with H2 2023 proving a strong comparative base as backlogged orders were being fulfilled. YTD sales reached 8.9 million units, an improvement of 1.9% from the same period last year. Political and economic issues continue to dampen consumer confidence and the overall outlook of the market in the near-term. It is evident that higher interest rates and vehicle pricing have negatively impacted sales and will continue to do so in the near-term, even if some easing of both takes place.

- The LV selling rate for Eastern Europe were 4.3 million units/year in August, broadly in line with July. 360k vehicle were sold, a 6% improvement YoY. Additionally, year-to-date sales were up 18.1% versus the comparative period last year. Russia continues to drive growth in the region as rapidly rising real wages increase demand. Furthermore, the looming increase of disposal fees in October has caused some sales to be pulled forward. Sales in Turkey grew slightly; however, the market is easing a little due to falling inflation, which makes vehicles a less appealing investment as a store of value than before.

China

- Preliminary data indicates that China’s domestic market is yet to gain strong momentum. The selling rate has levelled off at about 27 million units/year in June to August, after improving from the average of 22.6 million units/year between January and May. In YoY terms, sales (i.e., wholesales) declined by nearly 10% in August and 2% year-to-date, against an abnormally high base. NEVs continued to advance, accounting for 54% of retail sales of Passenger Vehicles in August.

- While the selling rate stopped rising in the recent months, the market is expected to accelerate strongly for the rest of this year. According to the data from the National Auto Trade-in Platform, the applications for the temporary scrapping subsidies soared to 800k units as of the end of August, as the government has doubled the amount of the subsidies. Other government measures, such as eliminating the required ratio of downpayment, are also helping to boost sales. And perhaps most importantly, the price war appears to be winding down, prompting consumers to go ahead with purchases.

Other Asia

- The Japanese market remains volatile, as supply is yet to normalize after Daihatsu and Toyota’s temporary production suspension due to the vehicle certification issues. A long spell of heatwaves and a series of major typhoons also disrupted production and sales in August. The Bank of Japan’s recent interest rate hike and the volatile financial markets cooled consumer sentiment, too. The August selling rate was 4.51 million units/year, down 4% from a relatively strong July. In YoY terms, sales declined by 3.4% in August and nearly 10% YTD.

- After a slowdown in July, the Korean market rebounded in August. The August selling rate was 1.61 million units/year, up 9% from a sluggish July. Yet, sales declined by 2% in August and 9% YoY, year-to-date, despite a buoyant economy. Sales have been weak this year, due to high interest rates, weaker model activities in H1 2024, and the pull-ahead effect of the temporary tax cut on Passenger Vehicles, which expired in June 2023. In August, GM Korea led the decline owing to production delays caused by a labor strike, while Hyundai posted a gain, thanks to the strong delivery of the Santa Fe SUV and the imported China-made Sonata Taxi.

South America

- Brazilian Light Vehicle sales continued their strong run of sales in 2024, as volumes expanded by 13.5% YoY, to 223k units. While sales grew on a YoY basis, the selling rate dropped to 2.45 million units/year in August, down from the 2.51 million units/year reported in July. As production increased in August, so did the level of inventory on dealer lots, as inventory increased to 269k units, up from 256k units in July. Days’ supply also increased to 34 days in August, up by two days from last month.

- In Argentina, Light Vehicle sales reached 38.8k units in August 2024, growing by 5.1% YoY. Sales are forecast to improve in the second half of 2024, and so this could be a sign of recovery. With that said, the selling rate slowed in August, to 418k units/year, down from the unusually strong 463k units/year recorded in July. Still, any selling rate in excess of 400k units/year can be considered a positive result in the current challenging economic environment.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.