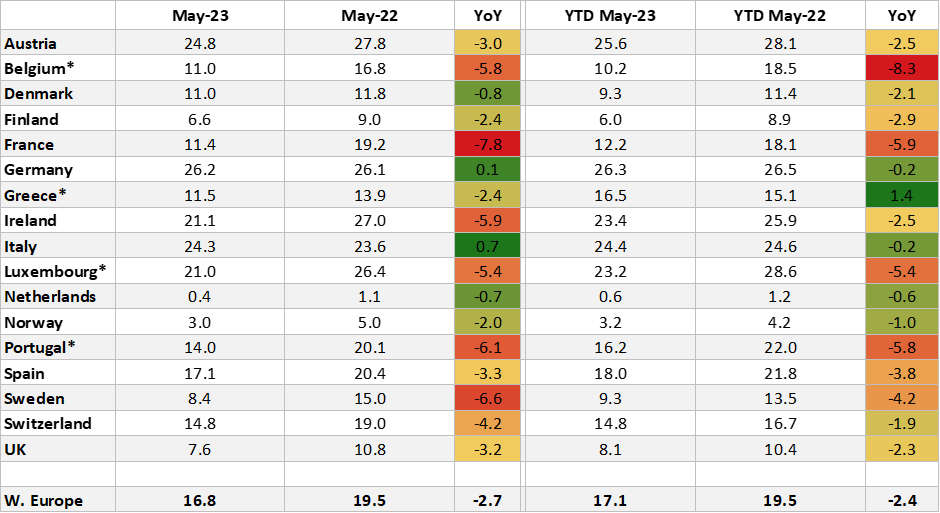

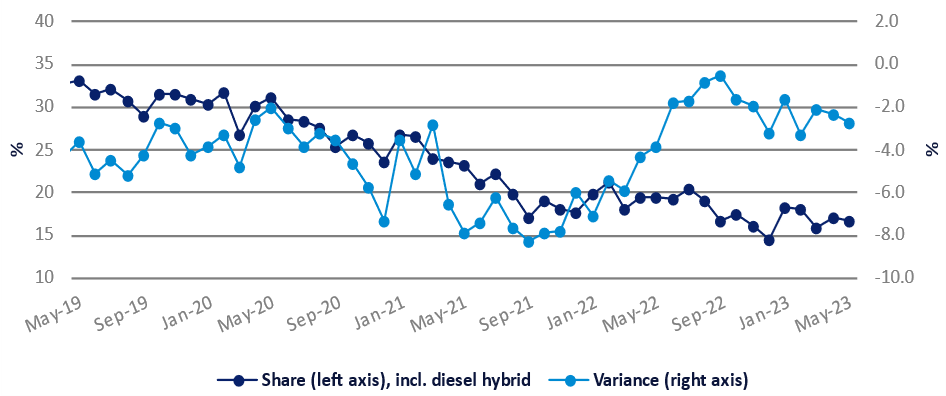

Provisional May diesel share figures for the European region, published by GlobalData, indicate that 16.8% of new car sales were fitted with a diesel engine, including diesel hybrids. April share is confirmed at 17.1%m, according to GlobalData.

GlobalData analyst Al Bedwell points out that although the diesel share of the West European car market is at a historically low level, diesel sales in Europe are being supported by an easing of supply constraints in the industry. “Diesel volumes were much higher in May versus a year-ago,” he says. “Though diesel is obviously much depleted in recent years compared with where it used to be, the market for diesel cars in Europe is nevertheless reasonably robust. The trend decline won’t go away, but it’s a decline occurring at a very modest pace – which is to be expected as the market whittles down to what might be termed the ‘hard core’ diesel customers.”

The latest share figure is a 2.7pp drop from the year-ago result while volume, conversely, rose by around 5k units to just under 170k sales. However, this figure may change slightly upon receipt of a few of the smaller markets for which GlobalData says it does not yet have data. So, volume-wise the diesel market, though much depleted over recent years, is reasonably robust, with decline continuing at a modest pace, currently around 0.25pp per month.

At a market level France was the only country to see substantial YoY volume loss in May with a total that is 7.8k units lower than a year earlier. Both Germany and Italy had bigger diesel markets in May 2023 than in May 2022, adding a total of more than 18k sales to the May achievement relative to the previous year. Much of this is because diesel is receiving an uplift as supply constraints in the industry ease and delivery volume overall in the region is now on an upward trend. Diesel fuel has come off the high peaks seen in 2022 and this is helping to sustain demand versus other options, though the diesel model offer continues to contract.

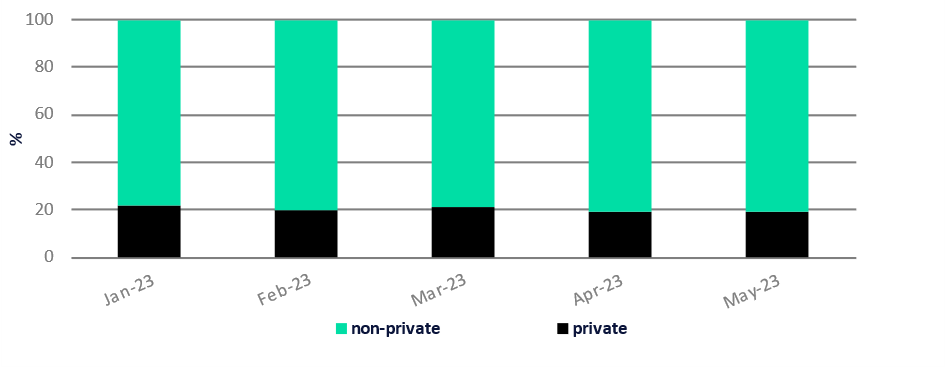

Diesel sales have been moving relentlessly away from the private sector. The chart below shows the situation to May. As well as smaller diesel cars being removed from sale, the fiscal advantage for many private users has gone, while for business users covering higher mileages, cost-savings may be available.