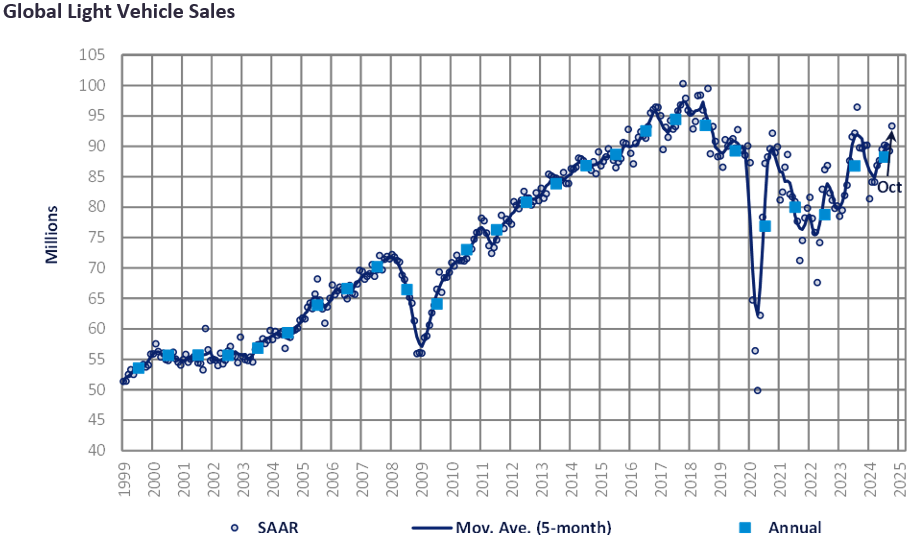

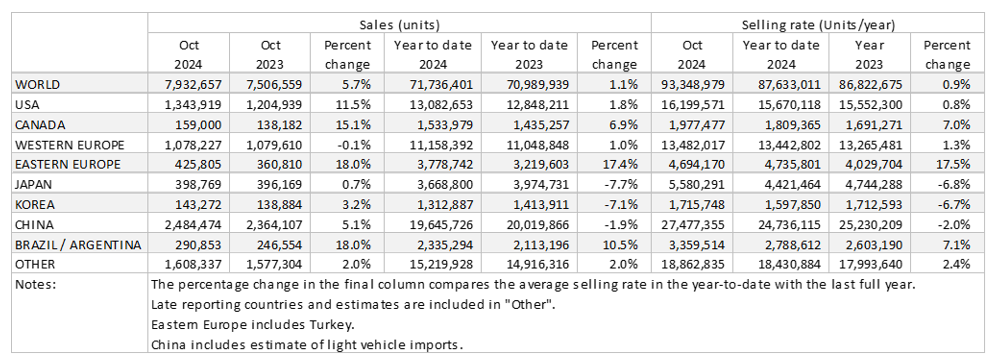

The Global Light Vehicle (LV) selling rate for October stood at 93 million units/year, an improvement from the September results. In YoY terms, market volumes rebounded from the previous months’ downward trend. YoY sales were up 6% versus October 2023. YTD sales have experienced a modest increase of 1% compared to the same period last year.

In October, sales experienced a resurgence across most regions. Sales in China grew 5% YoY, as the domestic market saw a modest recovery driven by subsidies and the ongoing price war. In the US, sales grew nearly 12% for the month, driven by additional selling days and new model releases. Finally, sales in Western Europe remained broadly flat, as the region continues to experience significant political and economic headwinds.

North America

The US Light Vehicle market saw sales increase YoY in October 2024, surpassing expectations, partly due to having two additional selling days compared to the same period last year. Sales volume totaled 1.34 million units in October, growing by 11.5% YoY, or by 3.4% when adjusted for the number of selling days in the month. The annualized selling rate accelerated to 16.2 million units/year in October, up from 16.0 million units/year in September, the highest of the year to date. As more 2025 model year vehicles entered the market, average transaction prices increased in October, to US$45,064, up by US$528 MoM, but still US$581 lower than the figure from a year ago.

Canadian Light Vehicles sales increased by 15.1% YoY in October, to 159k units, while the selling rate reached 1.98 million units/year, up from 1.93 million units/year in September. Despite a lukewarm economy, the market appears to be benefitting from a slight easing in transaction prices and declining interest rates. In Mexico, sales grew by 12.1% YoY, to 127k units, while the selling rate slowed to 1.45 million units/year, the lowest of the year to date. While this was a disappointing outcome, it would be unwise to read too much into one month’s result in what has been a strong market this year.

Europe

The Western European LV selling rate stood at 13.5 million units/year in October, an improvement on September. YTD sales passed 11 million units, an improvement of 1% from the same period last year. Overall, the outlook for Europe remains unchanged. The current economic and political headwinds have created an unfavorable environment for improving car sales, while pricing remains high. We expect some improvement moving in 2025 as monetary policy easing continues as well as the release of less expensive EV models; however, the election of Donald Trump and the potential tariffs present risks to larger economies in Western Europe.

The LV selling rate for Eastern Europe remained relatively unchanged in October at 4.7 million units/year. 430k vehicles were sold, an improvement of 18% YoY. YTD sales remain strong, up 17% from the previous period last year. Despite the rise in recycling fee rates, sales in Russia continued to experience robust growth as importers preemptively stockpiled a substantial number of cars, which should suffice for the next month or two. Sales in Turkey continued to fall and follow the trend seen last month.

China

Preliminary data indicates that the Chinese domestic market finally started to pick up, supported by the ongoing temporary scrapping subsidy program and the massive price cuts. The October selling rate is estimated to be 27.5 million units/year, up 7% from September. However, that rate was not much higher than the June and July rates of above 27 million units/year (before the scrapping subsides were doubled in August). In YoY terms, Passenger Vehicle sales growth (i.e., wholesales) turned to positive (+8.7%) in October after five months of decline, while Light Commercial Vehicle sales continued to fall by double digits. It is reported that the share of NEVs in Passenger Vehicle sales continued to exceed 50%, with Chinese brands advancing strongly.

Looking ahead, sales are expected to continue to surge ahead of the expiry of the scrapping subsidies in December. However, depressed consumer confidence suggests that the positive impact of the incentives will be subdued. Following the announcement of the unprecedented level of monetary stimulus in September, the government unveiled the much-awaited USD 1.4 trillion fiscal package to bail out debt-ridden local governments, but that has so far failed to impress investors and consumers.

The Japanese market accelerated sharply in October, as supply has finally started to catch up after the vehicle certification issue led to temporary production and/or delivery suspensions at a number of OEMs earlier this year. The October selling rate surged to 5.58 million units/year, up 23% from September, and the highest rate since 2019. Toyota has resumed the production of the last three models in the issue (the popular Yaris and Corolla variants), which contributed to a big surge in supply and sales. However, Daihatsu (a leading Mini Vehicle maker) has again halted production of a few of its models since late October due to the issue, indicating that it will take some time before supply normalizes.

In Korea, too, sales accelerated for the third straight month in October after a sluggish H1 2024. In October, the selling rate exceeded the 1.7 million-unit mark for the first time since November 2023 and reached 1.72 million units/year. Growth was driven by a number of new model launches from smaller players, such as Renault Korea’s Koleos SUV, KG Mobility’s Actyon, and Kia’s new affordable BEV, the EV3. In contrast, Hyundai’s performance was lackluster. Light Commercial Vehicle sales continued to decline by double digits, due to the aging model cycle and high financing rates. In YoY terms, total Light Vehicle sales increased by 3% in October (the first YoY gain since November 2023), but declined by 7% year-to-date.

South America

Brazilian Light Vehicle sales were exceptionally strong in October, as volumes expanded by 21% YoY, reaching almost 250k units. With the country experiencing a bump in sales, the selling rate grew to 2.86 million units/year in October, up from 2.71 million units/year in September, and the highest for any month since January 2015. Low unemployment, robust GDP growth and more generous discounting appear to be combining to return Brazilian sales to pre-pandemic sales levels, after several weaker years.

In Argentina, Light Vehicle sales reached 41.5k units, growing by 4.2% YoY. The selling rate reached 500k units/year, the highest since July 2019. With inflation starting to ease, higher consumer confidence and a wider range of vehicles available than during the import restrictions, sales are enjoying a resurgence, although volumes are still well below the levels seen during the market’s golden years.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.