While many automakers continued to face COVID-19 headwinds in 2021, Japan’s Toyota Motor Corp. seems to have fared best in 2021. Compared with key competitors Toyota excelled in sales volumes in all major markets.

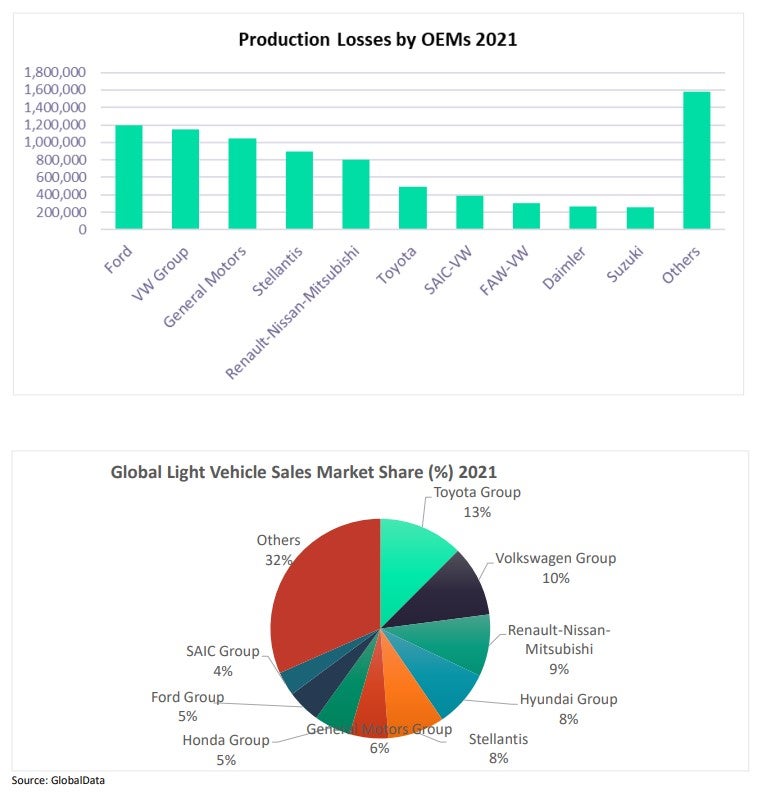

According to GlobalData’s estimates Toyota, along with its affiliate companies, sold over 10.07 million light vehicles in the 2021 calendar year, up from 9.3 million units the previous year. The performance confirmed Toyota as the world’s leading automaker in terms of sales for the second consecutive year. The year-on-year growth of 9.2% increased the gap with Toyota’s closest competitor Volkswagen Group to 1.63 million units, compared to the 250K delta in 2020. Volkswagen Group sold 8.5 million units in 2021, 5.9% down from the previous year.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Toyota has set some major milestones in 2021. Its vehicle sales reached a record high of 1.94 million units in China and surpassed General Motors in US sales, breaking the latter’s 90-year sales streak. Toyota’s global leadership is attributed to its robust supply chain network and a business strategy that remained adaptable to local markets which helped the company to steadily penetrate key automotive markets. For instance, Toyota has been on a growth spree in China for the past nine years and managed to grow above the industry average. Toyota also navigated round the impact of COVID-19 infections and semiconductor shortages better than its competitors. For example, Volkswagen’s biggest unit at Wolfsburg – which manufactures Golf, Touran, Tiguan and Seat Tarraco models – remained significantly impacted throughout the year due to chip shortages. VW Group remained second most impacted OEM after Ford, in terms of production losses. It lost 1.15 million units of production in 2021. In general, Japan and other Asian countries remained less affected by virus than Europe, acting as a positive factor for Toyota.

Over and above all factors, strong growth in hybrid and electric vehicles sales have also upped the game for Toyota in 2021, which was supported by favourable market dynamics. Fast-tracking electrification is set to further boost Toyota’s growth in the years to come.

While Toyota estimates a yearly production output (FY ending March 2022) below the initial expectation of 9 million vehicles, it is now more strongly positioned than Volkswagen to secure its leading position at least for the near term.