You could forgive the automotive industry for feeling a little bruised at the moment. It was already straining to address CASE megatrends – Connected cars, Autonomy, Shared mobility, and EVs – but then had to endure the financial and production disruption wrought by the double whammy of the COVID-19 pandemic and the subsequent chip shortage.

Despite the many forces conspiring to make life harder for auto OEMs and their suppliers, we have witnessed an impressive amount of resilience and adaptability across the industry as it responded to each crisis. However, as far as actual sales of vehicles are concerned, the recovery we have seen has not necessarily been evenly distributed.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

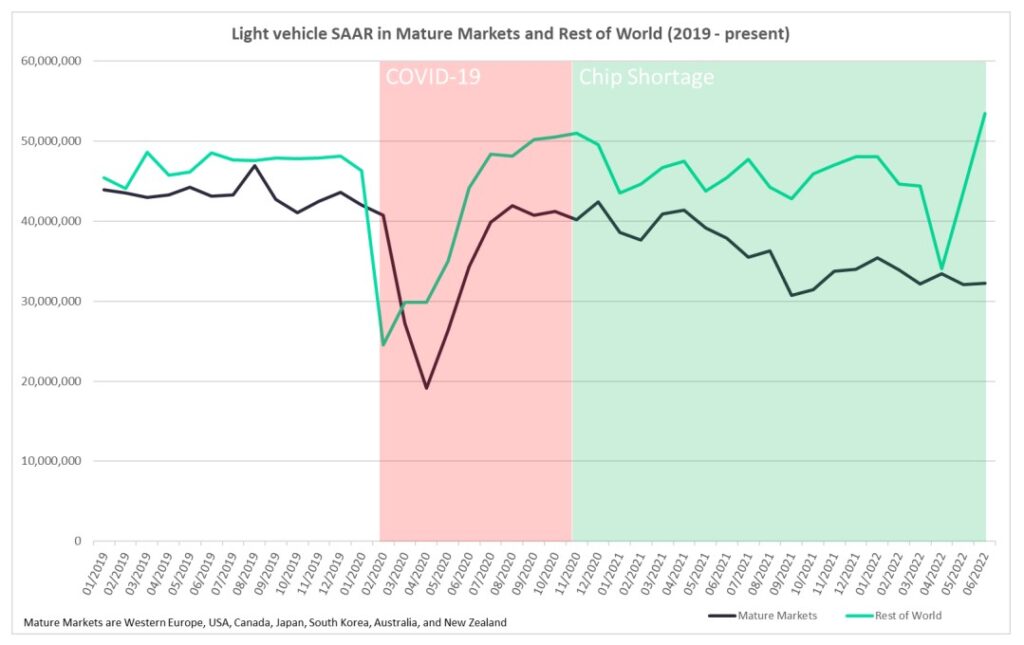

In the chart below, we have compared the seasonally adjusted annualized selling rate (SAAR) of vehicles around the world from 2019 to the present day, overlaid with approximate timings for major geopolitical disruptive forces. We have split global markets into two categories with roughly equal sales at the start of 2019 – one being mature markets such as West Europe, the US, Japan and Australia; while the other includes the rest of the world, generally made up of less-mature auto markets.

Tracking the SAAR as it moves in response to market forces and disruptions reveals that, in general, sales rates in mature markets have not recovered as well as those in typically less-mature markets. In fact, while mature markets mostly sprang back from the significant initial drop caused by COVID-19 lockdown orders, they have shrunk somewhat in the period through to the present day. Conversely, auto markets from the rest of the world have proved to be a little more robust by remaining closer to their pre-pandemic levels – even reporting a significant improvement into June 2022.

A key factor behind the disparity is the greater use of semiconductor products in automotive systems destined for vehicles sold in mature markets. These models tend to feature a greater number of ADAS, infotainment and semi-autonomous driving components than more affordable models sold in less mature markets. As such, OEMs had a harder time securing supplies to build more tech-heavy models for mature markets, choosing to prioritize higher-value, more profitable model lines, leading to a larger proportional drop in sales compared to less mature markets.

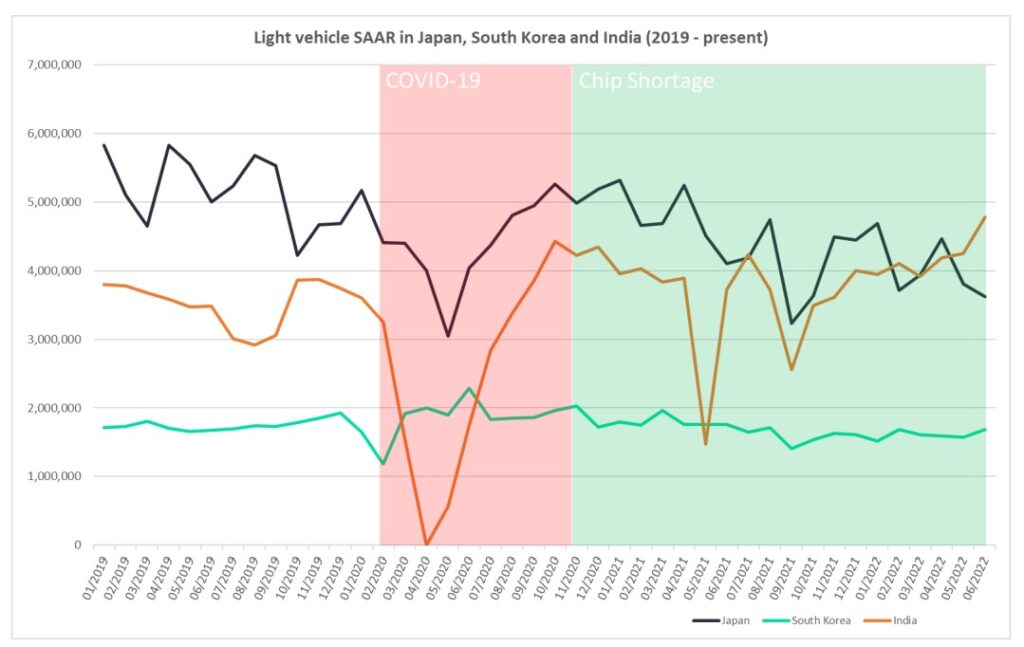

Drilling further into the data, we can look at more specific per-country cases to compare the impact recent disruptive forces have had, and assess the quality of their recovery. In the chart below, we take a look at India, a less mature market, compared to two markets of roughly similar size that we consider to be more mature: Japan and South Korea.

While the Indian market has clearly experienced more dramatic variance over the last few years, its overall SAAR trend has been upwards, especially within the last 12 months. In comparison, Japan’s SAAR has been trending downwards overall since its post-pandemic peak at the start of 2021. South Korea, on the other hand, has mostly flatlined over the reporting period, experiencing less disruption but also no real SAAR growth compared to India.

Again, semiconductor products are likely to be the key culprit here. The majority of vehicles sold in India by the likes of Maruti Suzuki, Tata, Mahindra and Hyundai are substantially ‘de-contented’ compared to those sold in mature markets to enable them to hit a lower price point for Indian buyers. De-contenting a vehicle means omitting many components that commonly contain semiconductors such as ADAS sensors, airbags, advanced infotainment systems, and can even include examples such as fitting manually cranked windows in place of power-operated units.

There are many factors that influence vehicle sales and, thus, the overall SAAR figures reported across various countries, but the data above does suggest that mature markets are struggling more than their counterparts from the rest of the world. It would appear that the appetite in those markets for ever-more-complex on-board systems makes it much harder to build enough vehicles in the wider context of limited semiconductor supply.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center