We take a look at vehicle makers’ exposure to the deepening Russia-Ukraine crisis.

The world watched in horror as Russian forces began their advance on Ukraine last month. International condemnation was swift with many global nations lining up to enact swift financial sanctions on Russia targeting both individuals and institutions to pressure the country into ceasing hostilities.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Alongside governments, many international companies have taken action to isolate Russia, heaping further pressure on its leadership. Sportswear giant Nike has suspended sales in the country, Paramount Pictures has ceased distribution of its films in Russia, while Apple has said it will stop sales of iPhones and other products in the country, and Google has stopped featuring Russian state publishers on its news platforms. In addition, shipping giants Maersk and MSC have both said they will halt the running of ships to and from the country.

Automotive players around the world have also responded to Russian aggression with condemnation and actions that will isolate the country further. OEMs including Volvo Cars, Toyota, Ford, Jaguar-Land Rover, General Motors, BMW, Daimler Trucks, AB Volvo Trucks and motorcycle maker Harley Davidson have all ceased export operations to Russia, with Ford confirming that it had suspended its Ford-Sollers Russian joint venture effective immediately in response to the invasion. These announcements were made within the space of just a few days so it’s likely that even more international automakers and suppliers may opt to abandon their Russia operations as momentum builds against the country.

Stop-sale orders are likely to impact each automaker’s vehicle sales to some extent, so which OEMs have the most exposure to Russia, and what proportion of their sales are they likely to lose as a result?

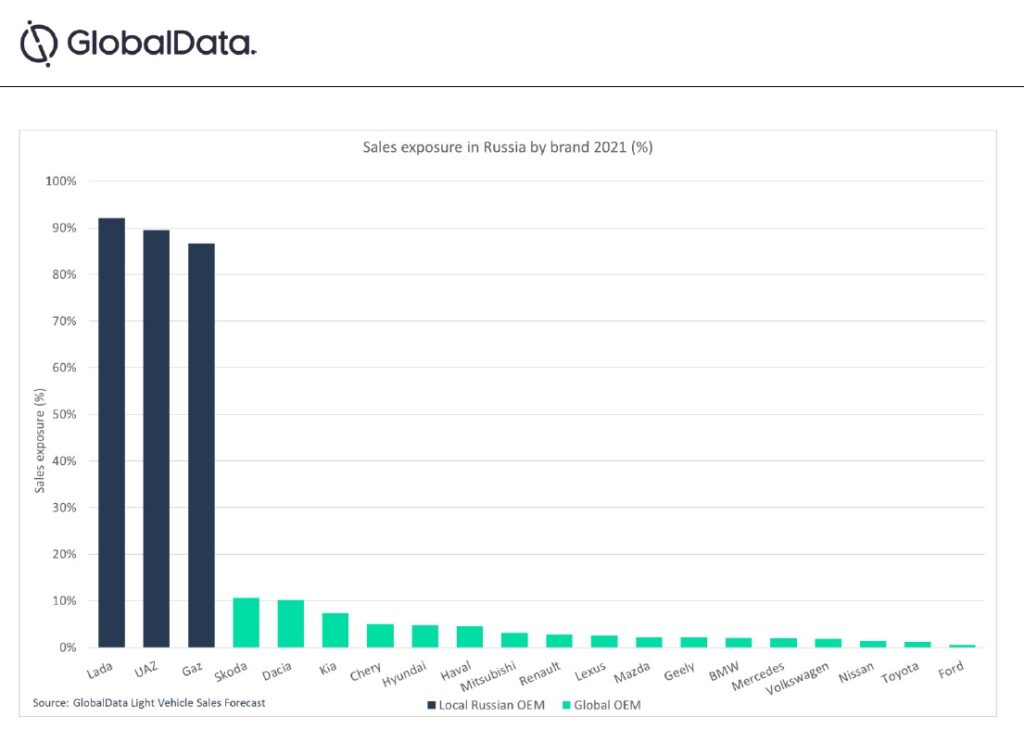

Looking to data from GlobalData’s Light Vehicle Sales Forecast, we can see that, unsurprisingly, Russia’s local automakers including Lada (AvtoVAZ), UAZ and Gaz carry the greatest exposure, earning 92.2%, 89.5% and 86.7% of their sales from the country respectively. Clearly, these players are not going to stop sales in their home country, but they are likely to struggle to secure the parts and components they need if more auto companies opt to halt or limit sales in Russia. Lada’s parent AvtoVAZ is around 68% owned by Groupe Renault and could face significant difficulties if its French partner was to pull out.

On the international stage, budget brands Skoda and Dacia carry relatively high exposure to Russia thanks to their popularity in the country. Both OEMs sold around 90,000 vehicles in Russia in 2021, accounting for 10.7% of global Skoda sales and 10.2% of global Dacia sales – making Russia the second-largest single market for both. If they halt operations in Russia, both of these brands are likely to lose most or all of those sales, but they are still more insulated than native Russian players thanks to the protection afforded by being part of large international auto groups and their diversified sales footprints.

Both Kia and Hyundai also enjoy significant sales success in Russia, with the former achieving nearly 210,000 Russian sales in 2021, and the latter earning nearly 180,000. However, both of Hyundai Motor Group’s brands are sold widely on the global stage so their exposure in Russia amounts to just 7.4% for Kia and 4.7% for Hyundai.

Interestingly, a handful of Chinese auto players have slightly higher exposure to Russia than many other export markets. Notable examples include the Chery and Haval brands which both secured around 37,000 sales in Russia in 2021. For Chery, that represents 5% of its global sales – not a vast sum, but enough to make Russia its third-largest market after China and Brazil. Similarly, Haval’s 2021 sales in Russia amount to 4.6% of its total sales, making the country the second-largest market for Great Wall Motor’s SUV-focused brand. Volvo parent Geely also sells models in Russia, with its around 26,000 sales in 2021 equating to 2.2% of its global sales, making Russia its third-largest sales market after China and Malaysia.