The number of data items in GlobalData’s patents database stretches into many, many millions. It contains worldwide Patent Publications data and performance indicators from some 100+ countries with bibliographic, citations, full text and legal status information.

GlobalData has processed the data so that it has been ‘cleansed, normalized and enriched enabling clients to gain a quick multi-dimensional perspective on innovation activity relevant to their business’.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

If we slice and dice the data by industry, such as automotive, we can obtain a unique window on the latest technology trends. In essence, we are looking upstream at a leading indicator for technological inventions and innovations. We can see where this nascent technological activity is, who is doing what and, also, where in the world they are hoping to do it. GlobalData’s database structure also means we can see what’s happening with patent applications and patents granted. Many applications to patent authorities never make it to the next phase – being granted.

However, today’s patent applications and, especially, those that make it through to being granted, could turn out to be tomorrow’s real-world innovations. If there’s a major competitive premium in being first with a technological innovation that can be followed through in practical terms, the company concerned will undoubtedly be keen to proceed further to take the necessary steps to the technology’s real-world application. It could be anywhere in the automotive value chain – for example, from the use of new materials, to specific vehicle systems and sub-systems, electronics or manufacturing processes. It could be anything from fuel systems, body panel coatings, power transmission, the engine combustion chamber, ride/suspension or – increasingly, these days – battery chemistries and systems. The emergence of complex tech taking us towards a more software-defined vehicle (SDV) with all the associated attributes and features, also means there is increasing emphasis on complex electronics and control systems.

Suppliers, as well as vehicle makers, are highly active in posting patents in territories where they want to conduct manufacturing or R&D activity (a good historical example is the GKN-developed constant velocity joint).

In automotive, technology sector findings in the patents database confirm trends in advanced technologies that are reshaping the industry – especially electrification, connectivity and advanced driver assistance systems (as well as autonomous drive). There are also one or two surprises – particularly at the level of companies (patent ‘assignees’) and who’s doing what.

Toyota has been very busy

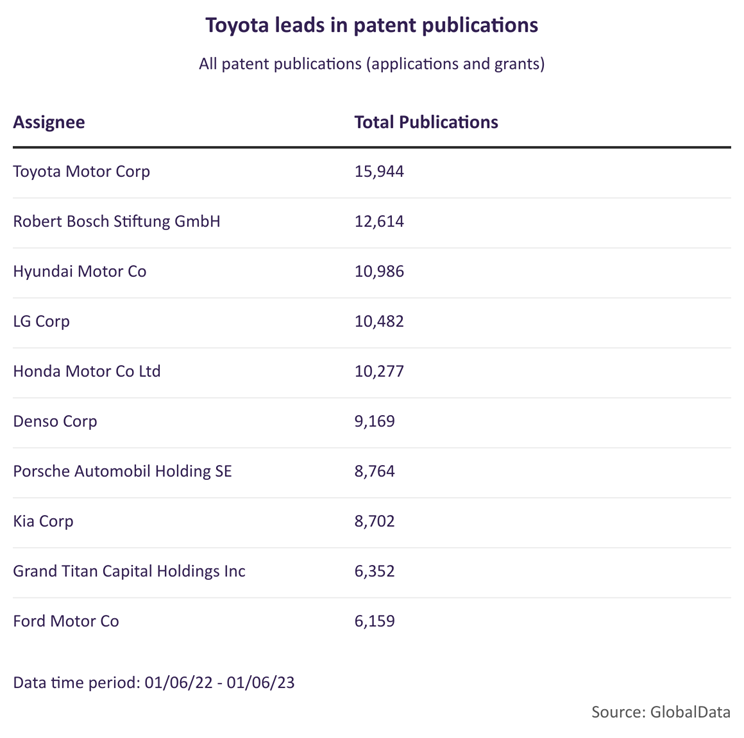

A look at all patents data published by company source (‘assignee’) in automotive over the past year (1 June 2022 to 1 June 2023, and 435,000 filings) shows Toyota firmly at the top of the pack. Intriguingly, major supplier Bosch is in second place in an overall listing that isn’t quite what you might expect to see – in terms of the companies in it and also the companies that are not in it.

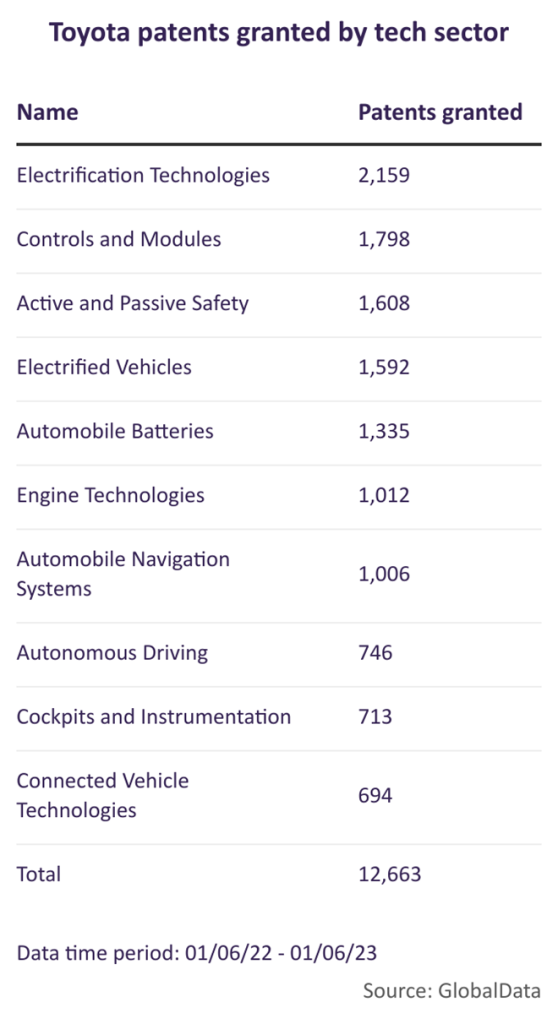

Having established that Toyota is at the top of this ranking, it is then possible to interrogate the database further to see where the company is particularly active – in terms of sub-sector categories. Unsurprisingly, electrification tech tops a list which also reflects the industry’s other major tech drivers such as active and passive safety, batteries, navigation systems and engine technologies. We can also further refine the patents data from ‘all patent publications’ to those ‘granted’ – which removes ‘applications’ from the mix. Patents granted by authorities are a more serious refinement and major step along from mere applications – many of which will never actually ever make the grade as grants.

Electrification at the top of the list is particularly significant. Toyota has been playing catch-up in electrification tech over the past few years and that is borne out by its heavy presence in electrification sector tech patents. Toyota has been more hesitant than many of its established rivals to embark on large-scale EV production. This is partially down to Toyota’s market leadership and extensive R&D in hybrid-electric drivetrains – such as Prius – that use nickel-metal hydride battery packs. Toyota has been reluctant to abandon its hybrids for purely battery-electric vehicles powered by lithium-ion cells. As is so often the case, companies come to a fork in the road and decide which way to go based on where they believe their competitive strengths are and where the risks associated with one path or another may be. Many years down the line, they face the consequences and are either vindicated or tasked with playing catch-up. Toyota realised a few years ago that when it comes to electric vehicles, it was the latter. Toyota duly ramped up its investment programmes for EV tech and vehicles.

Toyota’s hand has also been somewhat forced by the industry-wide move to adopt battery EVs. Regional regulators have defined timelines to ban the sales of combustion-powered cars. With other automakers making strong commitments to abandon combustion engines and electrify their line-ups, Toyota has now responded with its own line of battery EV models – such as the bZ4X.

Toyota has also been active in the development of hydrogen technology for future EVs – illustrated by the emergence of hydrogen powered fuel cell EV – the Mirai. A new hydrogen fuel cell car from Toyota – based on the Crown sedan – is expected to be unveiled for the Japanese market later this year. Some commentators have argued that Toyota’s alternative powertrain efforts have been skewed by attention on hydrogen rather than BEVs – but the patents database suggests that Toyota is heavily investing in innovations for different types of electrification technology and has been more active than its OEM peers.

At a recent tech day, Toyota stressed its commitment to a ‘multi-pathway’ approach that embraces BEVs and hydrogen. On BEVs it says a next-generation BEV to be introduced in 2026 will have a cruising range of 1,000 km. Further, it aims to reduce costs by 20% compared to the current bZ4X and achieve a quick charge time of 20 minutes or less. The company is also planning to use lower cost lithium iron phosphate (LFP) as a material, with widespread application in 2026-2027. There is also extensive exploration of solid-state battery tech.

Where in the world are Toyota’s patent applications being filed? Unsurprisingly, Japan leads that particular list by a considerable margin, but the US is significant in second, followed by China and Germany in a more distant fourth place. Leading a long tail of much smaller patent numbers is….Brazil!

Coming next: batteries

About GlobalData’s Patents database

GlobalData’s Patents database contains worldwide Patent Publications data and performance indicators based on company’s point-in-time IP Portfolio.

The patent publications data covers 100+ countries with bibliographic, citations, full text and legal status information. The dataset has been cleansed, normalized and enriched enabling clients to gain a quick multi-dimensional perspective on innovation activity relevant to their business. Each patent publication is tagged to GlobalData’s proprietary Industry, Sector and Thematic Taxonomy classification nodes and have associated current ownership information.

Monthly point-in-time IP portfolios for a given company are derived to further calculate 40+ Indicators suitable for Financial and Innovation Intelligence use cases, including- Thematic Investing, Identifying Innovation Alpha, Deal Sourcing, Cohort Analysis, Stock Price Performance and Trend Scouting. Off-the-shelf data is ready for >7K Start-ups, >13K Public and >12K Private companies.

Patents data can be found in GlobalData’s dedicated research platform, the Automotive Intelligence Center