The US light vehicle market finished the month of March with 1.25 million units sold, a 22% decline over March 2021 (which was a strong month). The US market continues to be impacted by a parts shortage that is generating extremely low vehicle inventories.

The annualized rate of sales (SAAR) as just 13.4 million units in March, according to GlobalData unit, LMC Automotive.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

March also saw General Motors top the market, although it ended the first quarter behind Toyota. Indeed, Toyota’s RAV4 was the only vehicle to sell more than 100,000 units in Q1. Tesla also solidified its leadership in the premium segment, outselling BMW by about 20,000 units.

March 2022 was the fifth weakest month for US light vehicle sales since 2000.

In Q1, sales totalled 3.29 million units, down by 16% from Q1 2021. Historically, and under normal demand conditions, volume would have been closer to the 4 million mark at this point in the year.

Analysts at LMC now predict that supply chain disruptions will last throughout 2022. Global light vehicle sales are now projected to increase by just 1% to 82.6 million units – a forecast that has seen a cut of nearly 3 million units since February.

Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive, told Just Auto that Toyota is navigating the chips shortage better than Ford: “Although March sales were slightly better than expected, there is still a lot of disruption in the marketplace. General Motors outsold Toyota in March, but ended the quarter behind its competitor. They were the only two OEMs to sell more than 500,000 units in Q1. Yet, Toyota’s RAV4 was the bestselling vehicle in the US for the second consecutive month, as the chip shortage continues to hurt Ford’s output to a higher degree. The F-150 was outsold by both the Chevrolet Silverado and Ram 1500 in March.

Amorim also points out that among the established OEMs, only Mazda and Tesla sold more than in March 2021. In addition, Tesla is increasingly positioning as the leader of the premium segment, selling more than 100,000 units in a quarter for the first time ever. “Tesla was ahead of BMW by approximately 20,000 units,” he notes

There were no major surprises in the various segment performances, but a recovery in sales of the Chevrolet Equinox and Honda CR-V took Compact SUV to the top of sales ranking. It was also the segment that fell the least among the five most popular ones, down by 10% YoY, compared to an 18% drop in sales of Midsize SUVs. Small SUVs faced the steepest decline at -37% YoY, as OEMs continue to focus on more profitable models.

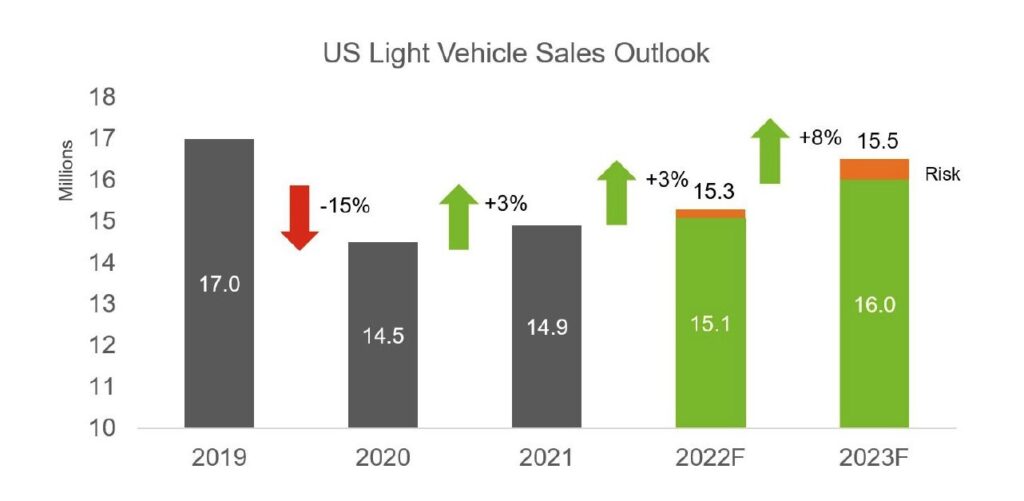

LMC has cut the outlook for US light vehicle sales in 2022, given the recovery is expected to be hampered by lack of inventory. Volume is now expected to finish the year at 15.3 million units, down by 500,000 from last month. The recovery pace is now expected to be slower than it was at the beginning of the year. Q1 North American production levels are likely to be about 50,000 units lower than we expected last month and periodic downtime and slower line rates continue to keep supply constrained.

Moreover, LMC says the extension of supply disruptions will probably spill into 2023, prompting a 400,000-unit reduction that takes the topline volume for the year down to 16.5 million units, still an 8% increase from 2022.

Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive said: “Given March’s performance, we feel that the risk is balanced in Q2, but there is further downside risk in H2, as we are still forecasting the selling rate to improve to an average of 16.2 million units from a forecast of a 14.3-million-unit pace in H1. Vehicle pricing remains a significant headwind, even as supply improves. The pandemic and fallout from shortages in the supply chain have fundamentally altered the buying process including how much inventory is carried on dealer lots and the level of incentives going forward. The industry will recover, but much will likely function differently than it did historically.”

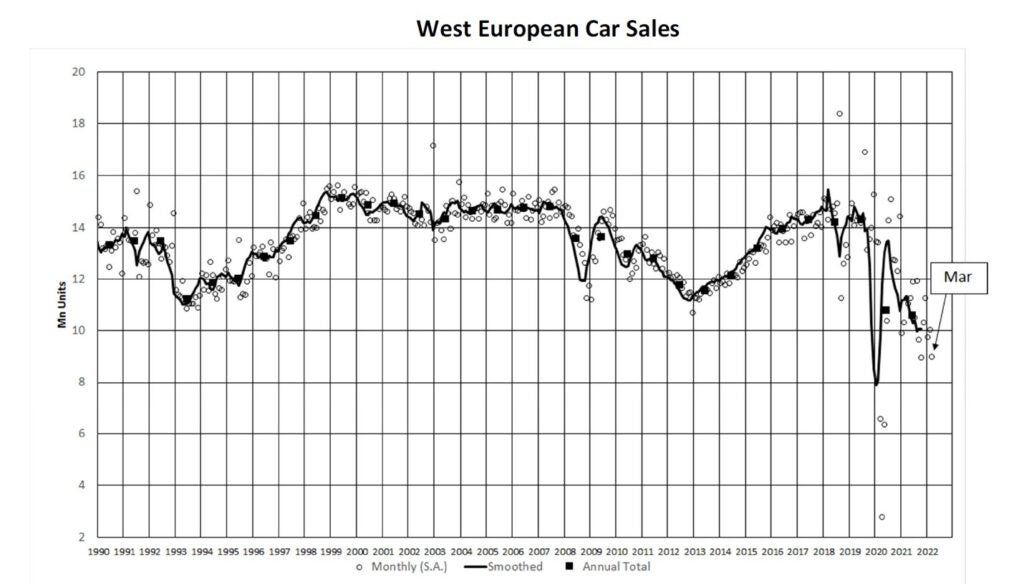

West European SAAR drops to just 9 million a year in March

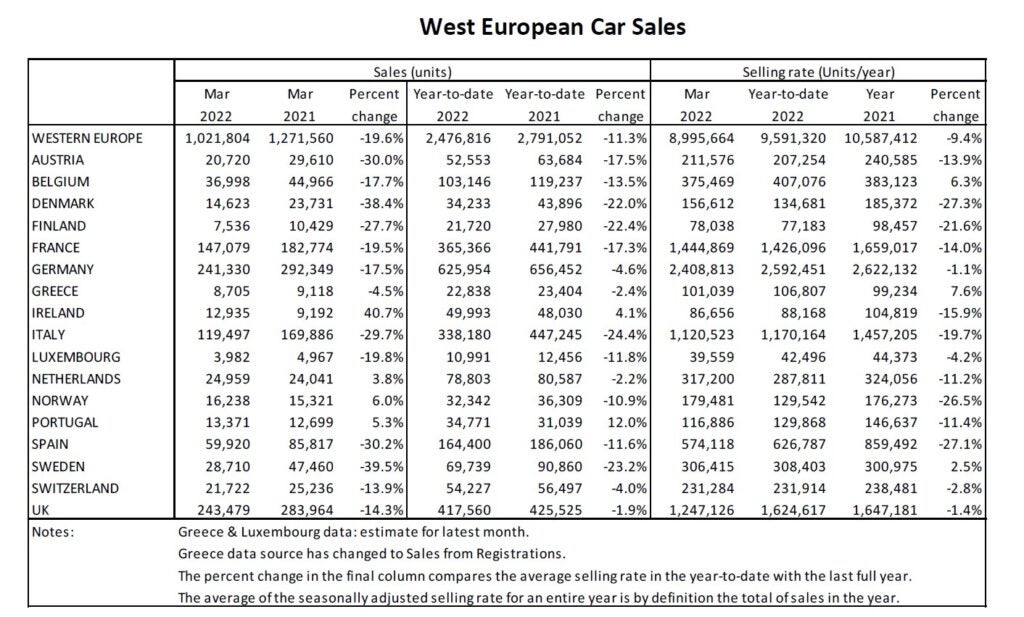

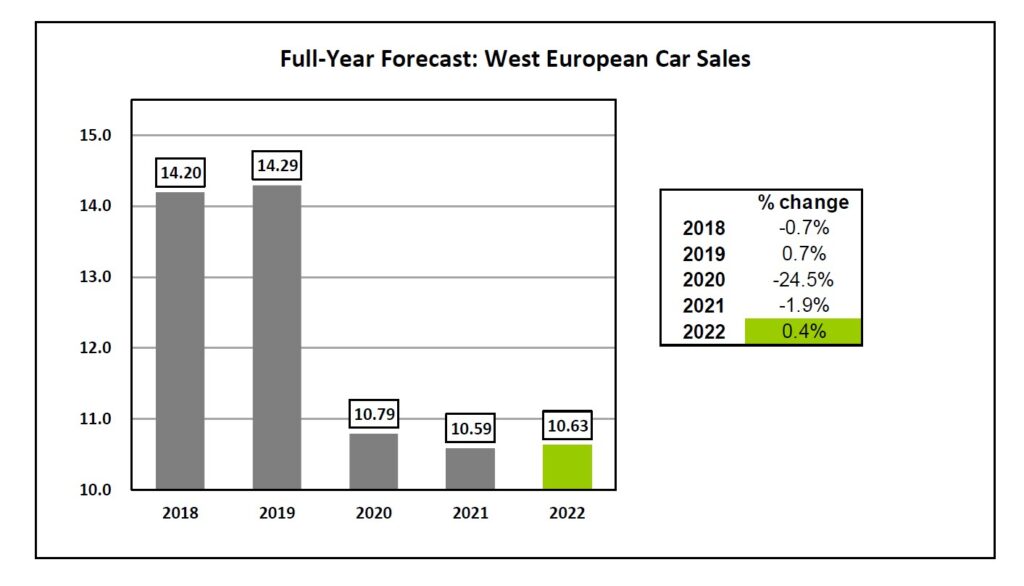

The West European selling rate for passenger cars dropped to 9.0 million units a year in March, from 10 million units/year in February, bringing the Q1 2022 average to just 9.6 million units/year. LMC describes the start to 2022 in Europe as ‘very disappointing as the automotive industry continues to endure the impact of supply problems’. To make matters worse, war in Ukraine only adds to these issues.

In Germany, the selling rate fell slightly to 2.4 million units/year in March, from 2.7 million units/year previously. The UK PV selling rate dropped to 1.2 million units/year in March, from 1.9 million units/year

in February. For France, the selling rate remained at a disappointing 1.4 million units/year. In Spain, the selling rate fell to 574k, from 700k units/year previously, after a trucker strike delayed deliveries. Finally, in Italy, the selling rate dropped to 1.1 million units/year in March, from 1.2million units/year in February.

LMC’s West European forecast has been trimmed since last month as registration statistics continue to languish in the face of supply bottlenecks, these exacerbated due to the war. “We still anticipate selling rates to improve over the course of 2022 but now at a slower rate than forecast last month,” said LMC analyst Jonathon Poskitt. “The war will chip away at underlying demand as well, through higher‐for‐longer inflation and lower real incomes, though our view is that the initial impact on registrations will be felt through a worsening of supply constraints, as, at least for now, demand is still outstripping supply.”

Russia light vehicle market down by 63% in March

War in Ukraine and its economic impacts have already caused the Russian vehicle market to collapse. Figures released by the AEB in Moscow show that the Russian light vehicle market (cars and LCVs) in March plunged by 62.9% to just 55,129 units sold – equivalent to an annual market of under 700,000 units.

Unlike the usual practice, the AEB press release containing the data was notably devoid of any comment on the data or market trend from a member of the AEB Automobile Manufacturers’ Committee.

Analysts forecast that the Russian vehicle market will see a big fall this year due to much lower economic growth and problems of supplying the market. Western brands have halted shipments of vehicles and parts to Russia and domestic producers are having difficulties obtaining parts sourced internationally.

GlobalData market data shows that the Russian light vehicle market reached 1.67 million units in 2021, around 4% up on last year. Analysts expect extensive shutdowns to automotive manufacturing plants in Russia this year in the face of continuing supply disruptions and much lower demand. However, much depends on the path of the Ukraine crisis over the remainder of the year and its economic impacts.

One possibility is that Chinese vehicle makers will fill the gap caused by the absence of Western brands.