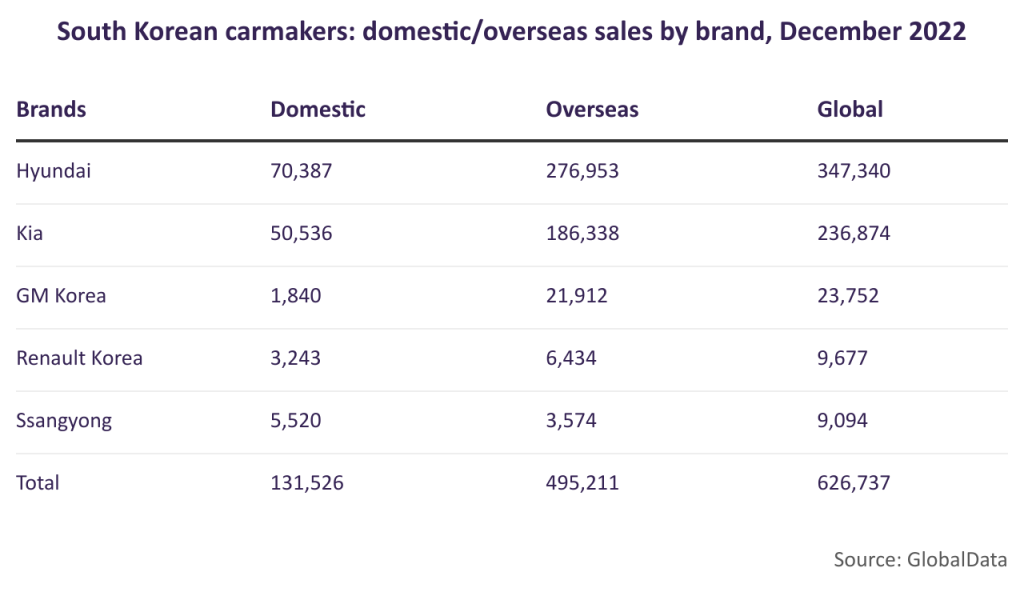

Domestic sales by South Korea’s five main automakers combined rose by just under 2% to 131,526 units in December 2022 from 129,392 units a year earlier, according to preliminary wholesale data released individually by the companies. The data do not include sales by South Korea’s low-volume commercial vehicle manufacturers such as Tata-Daewoo and Edison Motors, as well as sales of imported vehicles which are covered in a separate report.

Domestic sales last month were lifted by continued improvements in semiconductor supplies and recent new model launches – particularly by the leading domestic brands. Hyundai reported a 6.5% rise in local deliveries to 70,387 units while Kia’s sales were up by almost 6% at 50,536 units. The smaller brands struggled to keep up, with Ssangyong’s sales falling by 5% to 5,520 units; GM Korea’s sales dropping by 27% to 1,840 units; and Renault Korea sales plunging by 55% to 3,243 units.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

In the whole of last year the overall domestic market declined by just under 3% to 1,392,179 units from 1,431,264 in 2021.

Global sales among the country’s “big-five” automakers, including vehicles produced overseas by Hyundai and Kia, increased by 8.6% to 626,737 units in December from 577,249 units a year, reflecting mainly stronger overseas sales, while full-year volumes were up by almost 4% at 7,396,374 from 7,121,004 units. Overseas sales increased by close to 11% to 495,211 units last month from 447,857 a year earlier and were more than 5% higher at 6,004,195 units year-to-date from 5,689,743 units.

Hyundai Motor’s global sales increased by 4% to 347,340 units in December from 333,977 a year earlier, reflecting buoyant domestic and overseas demand fuelled by recent new model launches. Global sales in the whole of last year were just 1.4% higher at 3,944,579 units compared with 3,890,726 units in 2021, with production held back by shortages of semiconductors.

Domestic sales rose by almost 6.5% to 70,387 units last month from 66,112 a year earlier, reflecting strong demand for SUV models and for the upmarket Genesis brand. The company launched the all-new Grandeur sedan and Ioniq 6 EV in October, which helped increase sales in the final two months of the year. Full-year domestic sales were down by 5.2% at 688,884 units from 726,838 units, however.

Overseas sales increased by 3.4% to 276,953 units in December from 267,865 units, helped by strong sales in the Americas, India and the Asia-Pacific region. Full-year sales were almost 3% higher at 3,255,695 from 3,163,888 units despite significant headwinds in the first half of the year including the suspension of the company’s operations in Russia, Covid disruption in China and significant supply chain shortages.

Hyundai is targeting an almost 10% increase in global sales to 4.32 million units in 2023, helped by “optimized business strategies tailored for each region”. This includes 3.54 million overseas sales and 781,000 in its home market. The company said it plans to more flexibly respond to market changes, accelerate its transition to electrification, respond to global environmental regulations and optimise production, logistics and sales by region. It plans to launch the all-new Kona and Santa Fe SUVs in 2023, as well as the Ioniq 5 N – its first high-performance EV.

Kia’s global sales rose by almost 14% to 236,874 vehicles in December from 208,268 a year earlier, driven by strong domestic and overseas sales. In the whole of last year the automaker increased its global sales by 4.6% to 2,903,619 units from 2,776,359 units. The brand’s three best-selling models last year were SUVs, starting with the Sportage with 452,068 global sales, followed by the Seltos with 310,418 units and the Sorento with 222,570 units.

Domestic sales rose by 5.7% to 50,536 units last month from 47,789 a year earlier, driven by strong demand for SUVs, while full-year deliveries were just slightly higher at 541,068 units from 535,016 units. Overseas sales rose by over 16% to 186,338 units in December from 160,479 and by 5.4% to 2,362,551 units last year from 2,241,343, reflecting robust sales in most regional markets including North and South America, Europe, Asia-Pacific and India.

Kia has set a target of increasing its global sales by over 10% to 3.2 million global sales in 2023, including 585,120 domestic sales and 2.61 million overseas. The automaker said it will focus on implementing strategies tailored for different markets, develop purpose-built vehicles (PBVs) with flexible production systems and launch customer-centric products and solutions. It also plans to strengthen its EV line-up globally, starting with the launch of the EV9 SUV in early 2023.

GM Korea’s global sales surged by 76% to 23,752 vehicles in December from a weak 13,531 units a year earlier, driven by strong exports. Over the full year sales were up by almost 8% at 264,875 units from 237,044, despite an acute global shortage of semiconductors particularly in the first half of the year.

Local sales fell by 27% to 1,840 units last month from 2,519 units a year earlier and were down also by 27% at 41,307 last year from 56,863 in 2021, despite the automaker beefing up its domestic line-up with imports from the USA – with the upgraded Equinox and Tahoe SUVs the most recent arrivals.

Exports almost doubled to 21,912 units in December from 11,012 units, driven by higher shipments of the Trailblazer SUV, while full-year volumes were up by over 24% at 223,568 from 180,184 units.

GM Korea ceased operations at its Bupyeong 2 plant at the end of 2022 following the discontinuation of the Trax and Malibu models. Production is now concentrated at the Bupyeong 1 and Changwon plants, which have a combined production capacity of 500,000 vehicles annually on three shifts. They make the Trailblazer SUV and the Spark mini car respectively.

The company is looking for a strong recovery in 2023, helped by the introduction of a new cross-over vehicle at the Changwon plant in the first quarter of the year and increased production of the Trailblazer at Bupyeong.

Renault Korea saw its global sales fall by 24% to 9,677 units in December from 12,718 a year earlier, reflecting mainly weak domestic sales. Overall sales in the whole of last year were up by almost 28% at 169,641 units from 132,769, however.

Domestic sales continued to fall last month, by almost 55% to 3,243 units from 7,162 a year earlier, and were 7% lower at 52,254 units over the full year compared with 56,184 units previously. Exports were almost 16% higher at 6,434 units in December from 5,556 units a year earlier and were up by over 53% at 117,387 in 2022 from 76,585, as the company stepped up shipments of the XM3 and QM6 SUVs to Europe.

Renault plans to produce its first EV model in 2026, by which time it expects the local EV market to have expanded to 20% of overall vehicle sales – rising further to between 30% and 40% by 2030.

Ssangyong Motor’s global sales rose by 4% to 9,094 vehicles in December from 8,755 units a year earlier, reflecting higher overseas sales. Over the full year its total sales were up by 35% at 113,660 units from 84,106 units.

Domestic sales fell by 5% to 5,520 last month from 5,810 a year earlier, while full-year volumes were up by 22% at 68,666 from 56,363 units. The company launched its first battery-powered SUV early last year, the Korando e-Motion, to help strengthen its domestic sales.

Exports increased by over 21% to 3,574 units in December from 2,945 units a year earlier, while year-to-date volumes were more than 62% higher at 44,994 from 27,743 units. In October the automaker signed a deal to supply Saudi National Automobiles Manufacturing Company with some 170,000 semi-knocked down Rexton SUVs over a six-year period starting in 2023.