Motorists’ insatiable appetite for cleaner, safer and more comfortable cars is driving demand for sensors. As part of a new research project from just-auto/QUBE, we consider the forces driving the market for automotive sensors and opportunities for the supply industry.

Sensors convert physical variables into electrical signals. During the course researching just-auto/QUBE’s latest research report on automotive sensors, we asked Swamy Kotagiri, Chief Technology Officer of Magna International for his thoughts on the ways in which the megatrend for alternative fuelled vehicles is driving innovation in sensors? He told us: “I think that one of the reasons for electrification is to reduce emissions and improve fuel efficiency. That means you have to go further with the same amount of fuel which means that the grams for CO2 per kilometre decreases. One way of achieving that is through electrification. Another is by having power only when you need it, e.g. have pumps that operate only when required which means that you have to sense when there is a lot of pressure or temperature. So that requires a lot of sensing. In the other cases, you see more aerodynamic and thermal efficiency involving uses sensors to measure the car’s engine temperature and speed which links to an active grille. There are many more examples requiring more use of sensors. All of which are a means to the end goal, namely better fuel efficiency and reduced emissions. To be able to achieve this, more use of sensors are needed.”

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

More stringent emissions regulations

Thanks to emissions regulation, performance and competitive requirements in engine design has moved from being a purely mechanical activity to reliance on electronics to manage combustion and emissions.

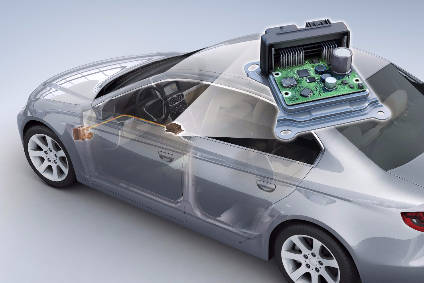

From the first engine control units (ECUs) using inputs from heating exhaust gas oxygen (HEGO) sensors to manage air-fuel ratios the responsibilities of and electronic fuel injection have mushroomed to the extent that the electronics manage events such as ignition timing, variable valve actuation, turbo wastegate control, throttle blips, and exhaust gas recirculation control.

During an interview for just-auto/QUBE, Tim Jackson, Executive Vice President Technology, Strategy and Business Development, Tenneco Inc told us: “Sensors are an interesting topic. Frankly, what we are being driven toward is the use of many more multi-function sensors where you would sense, say, temperature and pressure inside the same sensor. Even in our urea delivery systems, we are being challenged to be more accurate with our dosing in order to get to these 98 percent efficient SCR systems. So we have to move pressure sensing right up to the point of injection. We have to concern ourselves more about urea temperature because the dosing coefficient and viscosity of the urea changes with temperature. So more use of multi-function sensors, and moving them closer to the point of injection, will result. Even the sensors for diesel particulate regeneration are still delta-p sensors so the use of nontraditional sensing technology to improve the accuracy of DPF regeneration and reduce the occurrence of active regeneration and the fuel that is consumed in active regeneration is a big priority for the industry.”

Growth in demand for intelligent sensors

As cars become more ‘smarter’ – from today’s self-parking cars to tomorrow’s self-driving – the total number of connected intelligent sensors per car can only increase. Such clever sensors make the car safer, too. For example, Micro-Electro-Mechanical Sensors (MEMS) can enable pre-crash systems by using wheel sensors to measure vehicle speed, and radar or laser sensors to monitor the distance to vehicles or other objects in front and to the side of the car. The proliferation of closed-loop control systems increasingly require smart sensing solutions. “MEMS is the key to realization of most new sensors from inertial and pressure to thermal imaging,” Hans Richard Petersen, Co-Founder and Vice President of Sales and Marketing, Sensonor Technologies AS, told just-auto/QUBE.

Some of the notable technology trends with MEMS include the move to smaller sensors, extended range of sensing, improved sensing accuracy, more integrated functions and features and solid state sensing. We are also seeing a gradual switch from contact to contactless sensors as automakers demand greater durability and improved reliability and accuracy. “Everyone wants more accuracy,” added Petersen. “However it is the cost trade off that decides. This is mostly tied to better navigation, better engine control, and better sensors to support autonomous driving. We are working with Google, Apple, Uber and Toyota.”

Gesture recognition in cars is said to be the Next Big Thing

Rotating your finger clockwise at a screen could turn up the volume or a finger gesture could answer or decline a call. Such novelties will rely on sensors and cameras in the vehicle cockpit. For example, Kia has developed concepts for gesture recognition and eye movement tracking. An infra-red camera first registers the driver’s palm, and then finger, rotational and swiping movements give access to a series of menus. The eye tracking system adjusts the 3D instrument display according to the viewing angle. At a minimum, such gesture recognition wizardry requires proximity sensors to activate common options and controls as the driver’s hand approaches the screen and buttons.

Driver safety concerns fuel sensor demand worldwide

Active and passive safety systems are also driving market growth. In all of the systems outlined in just-auto/QUBE’s component sector intelligence service on active and passive safety systems, sensors play a key role. Lasers, radar and video cameras represent some of the sensors currently available for monitoring a vehicle’s immediate surroundings, many of them now in their second and third generation of development. They allow tailor-made solutions for all vehicle categories, for whatever purposes they are used, and are significantly cheaper than complete system packages. As the push for driverless cars continues, more and more ultrasonic sensors are required for each level of automation in order to monitor the car’s immediate environment. Such advanced driver assistance system (ADAS) technologies also require high precision sensors for monitoring the car’s state of operation.