The global transmissions market has changed rapidly in the recent past. The requirement for greater fuel efficiency in particular has brought a great deal of dynamism to the global transmission market. In this month’s management briefing we bring you selected extracts from just-auto QUBE’s research service, Global light vehicle transmissions and clutches market. This third instalment looks at market forecasts by transmission type.

Overview

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Amidst the constant technological change in the transmissions market, there is no single solution in terms of the optimal solution for reducing emissions and fuel consumption.

The transmissions product range itself is wide, ranging from conventional MTs, AMTs, planetary ATs, CVTs and DCTs to future hybrid and electric systems of diverse configurations. This diversity of approaches, each claiming to do the best job of its kind for the money, is partly explained by the differing levels of acceptance each technology enjoys across the world’s car markets. Acceptability itself is an amalgam of familiarity, availability, reliability, usability and affordability and how these are judged in terms of a market’s living style, sophistication, prosperity, aspirations and road conditions.

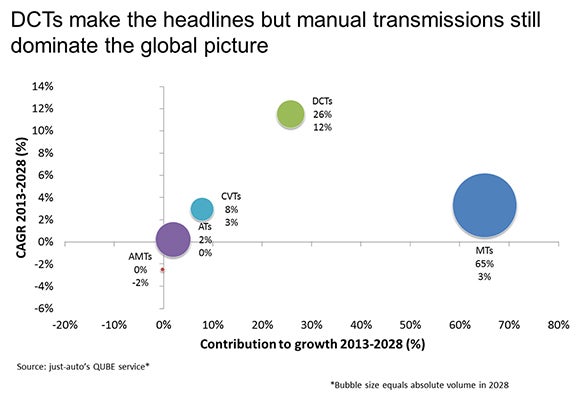

It is widely believed that Americans are wedded to ATs while Europeans prefer MTs. However, such accepted wisdoms will not hold forever, although despite the success of the new transmissions technology which have emerged in recent years, established transmission technologies still have a big part to play. just-auto’s analysis calculates that manual transmissions in 2012 accounted for just under 61% of the global market; we estimate 2013 will be c60.5% manual, a level which will fall slowly through to the 2020s to around 58%. By contrast, DCTs should reach c7% globally 2017 and at least 11% during the 2020s, although this could well be an underestimate.

In our view, the main loser as DCTs grow will be conventional ATs which are expected to fall from 29% in 2012 to around 17% in 2027 In total, we expect CVTs to hold a c8% share globally, although depending on the long term success of this technology in China, India and indeed North America (especially at the Japanese VMs, it could climb above 10%. The long-term rate of CVT growth will be interesting to observe as the technology has seen a renaissance in terms of its acceptance in North America. Honda is increasing its CVT offering and this could result in a higher take-up of CVTs in the long run.

While a relatively new technology and still accounting for a relatively small absolute number, DCTs should demonstrate the fastest growth of all types of transmissions, up by more than 10 times from 0.4% global share in 2008 to almost 5.5% in 2015, reaching nearly ast 7% in 2017 and over 11% in the next decade.

Manual transmissions

While firmly embedded in the American automotive psyche, ATs have certainly not entirely overshadowed conventional MTs gearboxes elsewhere. Under pressure from newer types of transmission, MTs may be expected to decline or even disappear completely in some mature markets, but they still have a lot of life left in them. There remains strong demand for MTs in “emerging” markets such as China, Russia and India, where many buyers can only afford an MT or the closely-related clutchless semi-automatic AMT, although this is and will remain a minor part of the market.

Thus the MT is expected to continue to maintain a significant share globally, with Western Europe, Eastern Europe including Russia, South America and Asia including China as its most important markets. One change which has yet to be fully worked through is what will be the effect on the Japanese market as Japan’s vehicle manufacturers move production from Japan to the markets where the cars are sold – this could ultimately result in the end of Japanese fitment of MTs as production of Japanese models with MT could shift to the markets where they are sold, although we are still some years away from this scenario becoming a reality. In China for example, the MT remains the most popular transmission option; in other large emerging markets, ie Russia and India, tremendous scope for MTs remains as market volumes have a long way to go before car ownership patterns get close to the levels in developed markets in Europe and North America especially. MTs are coming under pressure from DCTs especially but they still have a lot of life left in them. That said, we think the main loser to DCTs will actually be conventional ATs.

Advantages such as existing production capacity being in place, good fuel economy and driver control sustain the MT’s place in car makers’ vehicle platform planning. Over time, considerable incremental improvements have been made to the MT’s driveability and efficiency, thanks to detail attention to features such casing design, gears, shafts, selector mechanisms, synchromesh, clutches, seals, bearings, lubricants and additives. The MT certainly has a long term future in the global automotive market.

Automatics

Automatic transmissions have been the mainstay of the North American market for many many years, with most of these systems supplied by in-house facilities at the VMs. In Europe and Japan, a much higher proportion of automatic transmissions are supplied by outside suppliers, such as ZF and JATCO. While these suppliers have developed capability in other transmission types, their commitment to and belief in automatics remain undimmed.

Specifically, JATCO has said how it sees continued potential for automatic transmissions to be sold alongside CVTs in the small car market. Reflecting this trend, in August 2010, it announced a new 4-speed automatic transmission for small front wheel drive cars, the JF414E. Compared to the unit it replaced, this new transmission assembly is approximately 11% shorter and 15% lighter, as well reducing friction losses by around 1/3 compared to comparable units. This transmission started production in Shizuoka and was installed first in the Nissan March sold in China. However, our view is that outside Japan and indeed Korea (which has a higher proportion of automatics than Japan), small cars with conventional automatic transmissions will become increasingly rare as the benefits of DCTs become more widely appreciated – and as CVTs penetrate some of the entry level segments. This explains the steady decline in the AT penetration rate in Japan for example.

DCTs – dual-clutch transmissions

Our forecast for DCTs is conservative at this stage as noted elsewhere in this analysis. Even so, we expect the number of DCTs fitted worldwide to more than double from 1.46 million in 2011 to around 2.89mn in 2013; it should more than double to around 6.37 million units in 2016 – and then almost double again by 2022 when we project global volumes of around 12.1 million units.