Global economic conditions have deteriorated in recent months. The national debt crisis in Europe has combined with sluggish economic performance in North America to heighten fears of renewed recession. Dave Leggett considers the outlook for major vehicle markets across the world.

Carlos Ghosn got it right recently when he said that the automotive industry is heading for record sales this year. You might be surprised that is the case given the doom and gloom in the press, but it is partly a statistical quirk provided by the contrary movements of the US and Chinese car markets in recent years. Just as the US market was collapsing in 2009, the Chinese market was more than taking up the slack as it displaced the US as the world’s biggest national vehicle market. And the global total this year is benefiting from US sales that are still coming back from the nadir of 2009, as well as still higher sales in China. And there are other places around the world that have logged growth – like Russia, for example (again coming off a low base) and ASEAN – at a time when the car market in Western Europe is struggling due to anaemic economic growth and post-scrappage ‘payback’. The net result is an expanding global market.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

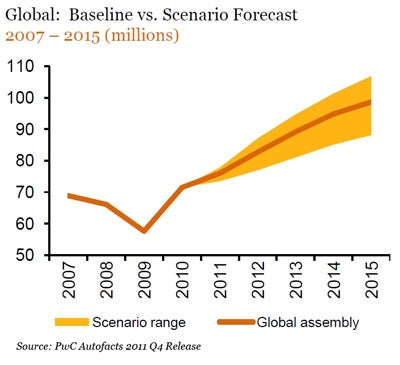

Forecasters at PwC-Autofacts say that global assembly has been coming in stronger than expected this year due to the impact of rising production in emerging markets. They forecast global vehicle assembly at 76.3m units this year, with a further expansion next year to a baseline total of 82.7m units. “But there is a need for caution and risk mitigation in the case of scenario planning,” says Autofacts’ Calum MacRae. “China, in particular, has been a major positive from a global volume perspective, and we expect Asia-Pacific to continue to be positive next year, but the global scenario planning range is weighted firmly on the downside. Overall growth of vehicle assembly next year could slow to nearer 1%.”

US vehicle market has some support

The US vehicle market may no longer be the world’s largest, but a 12.5m or thereabouts outturn in 2011 makes it easily the second largest. We’re still way off the pre-crisis norms of 16m-17m units and that helps to explain why there is a high level of confidence that the market recovery will continue. But concerns over the economy have grown lately. Unemployment is high. There is a lack of political consensus on dealing with America’s large fiscal deficit and how to lift the economy and create jobs. The professional forecasters have been revising forecasts down on the basis of evidence that economic growth is coming in lower than expected.

Downside risks weigh on the economic outlook given fiscal uncertainty, weakness in the housing market and household finances, renewed financial stress, and subdued consumer and business sentiment. The IMF maintains that “bold political commitment to put in place a medium-term debt reduction plan is imperative to avoid a sudden collapse of market confidence that could seriously disrupt global stability”.

Jeff Schuster, executive director of global forecasting at JD Power and Associates, told just-auto that there is a high degree of uncertainty over where the US economy will be next year. He picks out high unemployment as a major concern. “While unemployment is up toward the 9% level consumer confidence will certainly be held back,” he says. “And businesses also feel less confident about investing because of prevailing worries over the weakness of this economic recovery and a general sense of uncertainty over where the economy will track over the next 18 months. In these circumstances decision-makers tend to act with increasing caution,” he adds.

In the current climate of economic uncertainty, JD Power is decreasing its forecast for 2012 to 13.8m units for total light-vehicle sales (from 14.1m units in its previous forecast). Although the market forecast has been cut, that’s still 13.8m versus 12.6m estimated for 2011 – growth of almost 10%.

“The risk of a double-dip recession has increased to nearly 40 percent, driving the reduction in the forecast for 2012,” says Schuster. “While there have been recent positive signs in the economy and we expect another recession will not materialise, the recovery pace for 2012 is taking another hit, although a complete halt in growth is unlikely.”

Europe

The situation in Europe is dominated by the ongoing eurozone sovereign debt crisis, government austerity programmes and severe threats to overall financial stability. The eurozone crisis has also become a seemingly intractable political problem, further reducing consumer and business confidence across the region. The outlook for economic growth has deteriorated sharply in recent months, even on the relatively benign ‘muddle through’ assumptions that avoid a break-up of the euro currency and another severe recession that locks up credit markets and threatens major banks. If the more gloomy scenarios actually materialise, a severe recession would see vehicle markets fall back sharply. The downturn of early 2009 gives us some idea of how severe that drop could be.

JD Power Automotive Forecasting analyst Jonathon Poskitt has run through a new forecast for the West European car market based on weaker estimates for economic growth next year.

“Economic growth projections are being revised down as the eurozone’s crisis rumbles on and considerable uncertainty persists,” he says. “And that is leading to businesses becoming much more cautious with all the adverse consequences that follow for consumer sentiment and, of course, for the car market.”

Poskitt said that the latest JD Power forecast for the West European car market has been revised down to 12.52m units, almost 2% lower than 2011’s estimated 12.77m.

JD Power’s latest assessment is based on a ‘low-growth’ scenario for Europe’s economy. However, he also warned that if the eurozone crisis were to worsen with the European economy going back into recession, the car market could fall much further.

“If there were to be disorderly national debt defaults, the crisis spreading and the financial sector being heavily impacted, the European economy would clearly be in even worse shape,” he says. “In that scenario, a GDP contraction of 2% in Europe could see the West European car market fall back to nearer 11m units. That’s where the running rate had declined to before the support from scrappage incentives came in in 2009.”

Japan

Some forecasters says that the March 11th disaster has had a more damaging impact on the Japanese economy than initially projected. The particular problems of this year have added to the considerable challenge to break out of long-term economic stagnation. The high yen isn’t helping either. After logging 4% growth in 2010, the IMF forecasts that Japan’s economy will contract by 0.5% in 2011. 2012 gets a boost of 2.5% on the back of reconstruction investment. The truck industry, in particular, should see an uplift.

The Japan Automobile Manufacturers Association (JAMA) has revised its forecasts down as a consequence of the March 11 disaster. Demand for passenger cars and commercial vehicles during the second and third quarters of 2011 declined as a result of supply shortages in the wake of the March 11 disaster. Looking ahead to the fourth quarter, JAMA says that ‘strong uncertainty prevails with regard to the future of the Japanese economy in view of such negative factors as steep yen appreciation and fears of slowdowns in overseas economies’. Total demand for passenger cars and commercial vehicles in 2011 has therefore been revised to 4.25m units, down 14.2% from the previous year.

Car sales in 2010 reached 4.2m units and are projected at 3.58m units for 2011. The ending of subsidies for ecologically friendly vehicles was expected to send Japan’s car market down even before the March 11 disaster.

Although Japan’s post-new long-term regulations on heavy-duty truck emissions had been expected to generate vehicle replacement demand in 2011, and despite the anticipation that post-quake reconstruction activities will trigger a year-on-year increase in demand for standard and small-size trucks beginning in the fourth quarter, overall demand for trucks in 2011 is forecast to fall from the previous year’s level. The year-on-year slump in truck demand in the aftermath of the earthquake and tsunami on March 11 is the main factor behind a projected decline.

China

Car sales in China rose 8.8% in September compared to the same month a year earlier to 1.32m units according to data from the China Association of Automobile Manufacturers (CAAM). CAAM added that the mild rebound from May, when monthly car sales declined for the first time in more than two years, would extend through the fourth quarter as year-end promotions are likely to lure customers to showrooms.

JD Power says that it expects the car market outlook for 2011 at 12.9m units, up 8.2% from 2010. It forecasts light commercial vehicles at 4.9m units, which is still down 8.1 percent from 2010. The fourth quarter could see demand soften due to some pull forward ahead of incentives cessation and a degree of economic slowdown.

After two years of massive expansion, China’s auto market is returning to a more subdued growth pattern. The cooling has been attributed to the termination of government tax incentives and local government initiatives aimed at easing ever-worsening traffic congestion. This, some observers say, is expected to hit local car makers more than overseas players which have superior fuel-saving technologies.

JD Power warns that we should also expect more price cuts in the coming months of the year. The market situation is quite different this year from 2010, when demand dynamics were more influenced by model availability, with OEMs struggling to achieve the necessary output for popular vehicles, it says. This year output has been much higher than the wholesale sales for several months, making OEMs reduce prices to meet their annual sales targets.

JD Power is still upbeat about 2012 when it expects sales to take off in the second half. Growth is expected to come from solid demand in tier 2 and tier 3 cities, capacity expansion, easing monetary and fiscal policy and possible new investment programs after the change in government leadership due in 2012. Industry observers expect market growth in 2012 to be between 5% and 10%.

India

Car sales in India fell 1.8% in September, according to the Society of Indian Automobile Manufacturers (SIAM). It was the first decline to the market in nearly three years. The Indian car market is being adversely impacted by rising interest rates, higher car prices and more expensive fuel. Industrial unrest that has disrpupted production at market leader Maruti Suzuki has also hit sales.

SIAM has revised down its expectations for passenger vehicle sales growth in this fiscal year (to the end of March 2012) to 4-6% from a July forecast of 10-12%.

However, sales of commercial vehicles rose 18.05% to 70,634 in September, SIAM said, a sign that the economy is still carrying significant momentum.

Some local analysts believe that the market will get some support in the coming weeks from a raft of recent and imminent high-profile product launches in India, including models such as the Honda Brio, Nissan Sunny and Hyundai Eon.

JD Power’s 2011 light vehicle outlook for India is at 2.9m units, up 7% from a year ago. However, it says that it is currently reviewing the 2012 outlook in the light of higher fuel prices and impact of interest rate rises.

Russia

The Russian car market continued its sharp recovery in September with sales up by 26% on last year. The market is bouncing back from a severely depleted level, helped by a boost to economic growth that is coming from higher energy prices. Economic growth in Russia is projected by the IMF to reach around 4-4.5% pa during 2011 and 2012. Prospects for oil prices, although still strong, have weakened as global economic projections have been cut. The IMF also says that capital flows which fuelled credit, private demand, and growth before the international financial crisis, have yet to return because investors remain wary of the political uncertainty in the run-up to presidential elections and the uninviting business climate.

The Moscow-based Association of European Businesses (AEB) reported that September’s sales of cars and light commercial vehicles reached 235,552 units, 26% ahead of last year. In the first three quarters of the year, sales reached 1,921,282 units, some 45% ahead of the same period of last year.

David Thomas, Chairman of the AEB Automobile Manufacturers Committee commented: “The 26% increase for the month of September is in line with our recent expectations of a slowing but still strong growth for the remainder of 2011. The full year forecast of 2.45m cars and light commercial vehicles looks very achievable and the market prospects for the final quarter remain very positive with much improved credit availability and robust consumer confidence.”

Further vehicle market growth is expected in 2012, though a slowing on 2011’s spectacular rise appears highly probable, analysts say.

Brazil

Light vehicle sales in Brazil in the first nine months of the year stood at a little over 2.5m units, some 6.7% ahead of last year. However, evidence is mounting of a slowdown to Brazil’s auto market, though long-term prospects continue to be bright enough to attract further investment. In September, car sales were 3.2% below last year’s pace. Over the past few months a number of manufacturers have introduced extended breaks for workers as stock levels have crept up.

Brazil’s economy is slowing compared with 2010 (the IMF forecasts GDP growth of 3.8% this year versus 7.5% last year). Incentives for car purchase have also largely expired. Vehicle production turned down sharply in September.

The outlook is for the market to continue to cool in 2012, especially as the year-on-year comparison will be against a strong 2011 H1. However, the market cooling will be tempered by the fact that economic growth is forecast to stay around the 3.5% level, with price pressures increasingly contained.