In this month’s management briefing we take a look at the latest developments in major vehicle markets around the world. In this instalment, we take a look at the recovering US light vehicle market.

Pent-up demand lifts US light vehicle demand

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The economic picture for the US, while not exactly rosy, looks much better than Europe’s. Fragile household balance sheets and their linkage with housing troubles are still holding back the economic recovery. The labour market picture remains mixed.

Nevertheless economic growth in the US has picked up and has been sufficient to support a natural recovery to car demand. US GDP growth in 2012 is projected by the IMF at 2.2% and 2.1% in 2013. But that level of growth is sluggish by the standard of past economic recoveries. The IMF notes that for the US, avoiding the fiscal cliff, promptly raising the debt ceiling and developing a medium-term fiscal plan are of the essence. Now that President Obama has been re-elected, the pressure is on to do a federal budget deal with the Republicans.

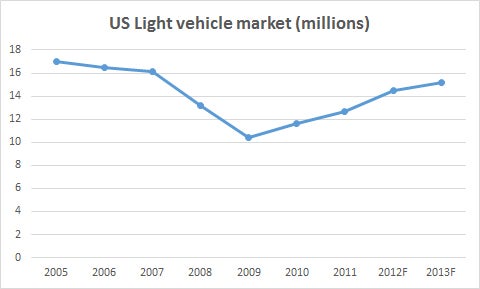

The US vehicle market remains well down on the 16m-17m annual norms pre-2008, but it is coming back and on track to continue doing so in 2012 and 2013.

LMC Automotive is maintaining the 2012 forecast for total light vehicle sales in the US at 14.4m units and the forecast for retail sales at 11.7m units. LMC said that while the forecast still rounds to the same numbers as it did in October, the overall outlook is more favourable.

The forecast for 2013 remains at 15m units for the total light vehicle market (12.2m units for retail sales). The 2013 forecast is consistent with others and represents a slower growth rate of 4% from 2012. There continues to be the possibility of accelerating the growth in 2013, as the current level of uncertainty is expected to be reduced in the first half of the year.

“The irrepressible need and willingness of consumers to replace ageing vehicles is stronger than the effects of natural disasters and fiscal turmoil both here and abroad,” said Jeff Schuster, senior vice president of forecasting at LMC Automotive. “A sustained recovery pace in auto sales is expected over the next six months, barring any fiscal cliff hangover, but the medium-term forecast is still dependent on more pronounced economic activity and growth.”

Edmunds.com forecasts US sales of 15m light vehicles in 2013, an increase of 4% over the 14.4m total expected in 2012. Economic uncertainty due to unresolved fiscal issues at home and (actual and feared) spillover effects from slowing economies abroad will continue to slow the pace of American economic growth, including car sales, Edmunds says. But Edmunds also says that many of the same factors in play now will still support car sales momentum in 2013. It says the release of pent-up demand from buyers who deferred sales during the recession will intensify as credit conditions further loosen and the increasingly aged fleet drives more consumers back to the new car market.

Edmunds also points out that sales will receive a boost in 2013 from an expected nearly 500,000 additional lease returners compared to 2012, who will lease or buy a new vehicle when their current leases terminate.

North American vehicle production

North American light vehicle production volume remains up 20% through the first 10 months of 2012, compared with the same period in 2011. Volume through October is at nearly 13.1m units, the same volume level as in all of 2011.

Vehicle inventory in early November rose to a 71-day supply – the highest day supply level in 2012 – compared with 59 days in October. The supply growth is a result of an increase in inventory ahead of anticipated year-end sales, as well as the impact of Hurricane Sandy, which caused significant damage along the US East Coast and slowed demand in the last week of October. Car inventory has risen to a 66-day supply from 51 days in October, while truck inventory has increased to a 77-day supply from 65 days.

The forecasters say that vehicle inventory levels should stabilise this month and into December, as sales are expected to recover due to consumers who had delayed their purchases last month returning to the marketplace following the storm and from additional sales due to the need to replace damaged vehicles.

LMC Automotive’s 2012 North American production forecast stands at 15.3m units, which is a 17% increase from 2011. However, a slowdown is forecast for 2013. The North American production forecast for 2013 is expected to be nearly 15.8m units, just 2% up on 2012, but “with further upside potential”.

“The continued pace of demand in North America, with sales up 13% through October, is supporting the short-term production plan and volume at the highest level since 2005,” said Schuster. “Production levels continue to be managed to demand, so a growing level of inventory is not setting off any alarms, as some inventory building is normal as a year closes.”

Japanese OEMs recover lost share in 2012

One of the stories of 2012 has been the bounce-back of the Japanese brands in the US market, coming off the supply shortages and difficulties they experienced in 2011. In the first ten months of the year they were collectively up 20% versus the same period of 2011 (with Toyota up 30%). This ‘claw back’ was widely expected, but it has meant that the Detroit Three have lost some share over the period.

Toyota has shown strong results this year in the US market from higher sales of smaller cars and hybrids. Honda/Acura has seen strong sales of the Accord, Civic and Acura MDX.

Subaru has also been a strong performer and is now looking to increase manufacturing capacity in the US in the coming years. Suzuki stands out as the contrary Japanese brand, opting to exit the US marketplace.

just-auto’s US market analyst, Bill Cawthon, notes that while incentives have not been high this year, they have played a role. are another important driver. “Though average incentives aren’t high, especially by Detroit standards of years gone by, certain brands and models have been carrying – at times – a fair amount of cash on the hood, either as rebates or subvented loans,” he says.

The outlook is for competitive conditions in the US to remain tough, says LMC’s Jeff Schuster. “The competition will be extremely tough and the revitalised Detroit makers, and others, will be determined to hang on to as much share as they can.”

|

|