Automakers’ production has been severely stunted by a global semiconductor shortage which emerged at the end of last year.

However, even after this supply issue winds down in Q3 and Q4 this year, automakers should do anything but return to the status quo. This situation is a symptom of future demand imbalances as automakers pivot towards Connected, Autonomous, Shared, and Electric (CASE) megatrends. This means they will become further dependent on chip foundries while total silicon demand elevates across all sectors.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

In the short-term, automakers must build buffer stocks of chips. In the long-term, they must be prepared to act more like consumer-electronics companies and treat their semiconductor supply chain with the same protection and foresight. This is essential as vehicles tend towards the electric and software-defined paradigm.

Consumer electronics chip demand and profitability dwarfs that of automakers

The past year has seen automakers slash production to match falling demand, while that of consumer electronics has spiked. Many automakers, operating on just-in-time manufacturing principles, cancelled foundry orders in response to demand levels. However, demand increased in Q4 2020 and automakers sought – too late – to scale up production and chip orders. Chipmakers had already prioritized consumer electronics orders, which make up a larger and more profitable segment of their business by several orders of magnitude.

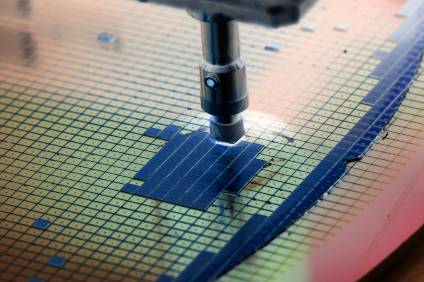

The largest foundry, Taiwan Semiconductor Manufacturing Company (TSMC), has since upped its capital expenditure to extend capacity and has committed to prioritizing automaker orders at the behest of trade officials from the US, Japan, and Germany.

The US President will also sign an executive order directing a government-wide supply chain review for critical goods. Despite this, the state of affairs won’t ameliorate quickly for the likes of Volkswagen, General Motors, and Ford, whose production will be selectively idled for several months.

Semiconductor price hikes puts low-margin business models at risk

Predictably, semiconductor suppliers hiked prices in response to burgeoning demand. This is bad news for automakers, who are effectively minnows in a captive market and whose low-margin business models will be further diminished.

Moreover, the sector’s dependence on semiconductor component providers is set to grow due to CASE megatrends. A premium vehicle needs up to 3,000 chips controlling functions from speed adjustments to steering; Deloitte estimates that 40% of vehicles’ production costs stem from electronics. With autonomous developments and the ever-saturating EV market, this proportion will only increase, with chips used for functions like battery management, infotainment, and advanced driver-assistance systems (ADAS).

The dual prospect of rising costs per unit and units per vehicle does not sit well with the low presence of the automotive sector within foundries’ hierarchy of desirable customers. The combination of the automotive sector’s supply chain vulnerability, eroding margins, and rising dependence on chips present a real challenge to all players.

Buffer stocks are only a short-term solution

Automakers must swallow the relatively low costs of storage to mitigate just-in-time failures. Take the example of Chinese technology and EV companies, which avoided supply problems by building stockpiles as a hedge against US sanctions. Similarly, Hyundai, Toyota, and BMW appear to be relatively unscathed given that they had the foresight to either avoid canceling orders during last year’s demand lull or secured good long-term access to supply.

Despite being the instigator of just-in-time production, Toyota itself was previously prescient enough to stockpile during the last financial crisis and therefore takes an agile and holistic view of balancing risk in supply chains.

As CASE megatrends take hold and the total demand for semiconductor hardware rises in the new normal, a picture emerges: this shortage episode is not the end of a pandemic-induced chapter but is, in fact, the opening symptom of a precarious, semiconductor-dependent era for the automotive sector. The winners will access and manage chip supplies most proactively and shrewdly; cross-sector technology disruption and the mounting reliance on chips means automotive companies need to become more like consumer electronics companies, not vice versa.