What does 2013 have in store for the world’s auto industry? There will always be variations in how individual firms perform, but the whole industry will be watching developments in major markets very closely. Just how far they grow or contract has major implications for everyone – for volumes, for margins and for bottom lines. We review prospects for demand in the major vehicle markets, starting with a world overview and a closer look at the US light vehicle market.

It may be hard to believe at times, but the global automotive pie is still getting bigger. Data issued by LMC Automotive shows that the global light vehicle market expanded by 5.2% to an estimated 80.9m units in 2012.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

According to the LMC data, the 2012 global gain to light vehicle sales was driven mainly by growth in the US (+13.5%), China (+6.2%) and also a big rebound to vehicle sales in Japan (+27.3%) after the natural disasters of 2011. The main negative last year was Western Europe (-8.6%).

LMC says that in the month of December the trend of improvement in China and the US continued, while weakness in Western Europe continued to slow the global expansion. It said that its expectation for 2013 is for a slower global growth rate in the 2-3% range.

PwC’s automotive analyst group, Autofacts, has said that it expects 2013 global light vehicle assembly to exceed 83m units, an increase of 5.1% from 2012’s total. Autofacts expects the global market to remain positive overall, with BRIC markets and North America driving growth, while the European Union and Japan will continue to be areas of concern. The two biggest car markets in the world are both positive. China’s appetite for cars remains high, despite growing problems of congestion and air pollution in its major cities. In the US, conditions continue to support a recovery to vehicle demand from the low of 2009, despite some concerns over a sluggish economic recovery.

In Europe, problems are at their most acute. The crisis for the European economy may have stabilised in recent months, but the business environment will remain extremely challenging for the next few years, at least. Fiat boss Sergio Marchionne is calling for help for OEM restructuring from the EU. “The EU should act and provide support to help the industry restructure and build a growth agenda,” he said in Detroit earlier this month. “Right now, too many cars are being made and we are selling them at ridiculously low prices and this can’t go on forever.” In 2013, a further market decline is in prospect for Western Europe’s car market which is now running around a fifth down on its pre-crisis peak.

Data issued by LMC Automotive shows that the global light vehicle market expanded by 5.2% to an estimated 80.9m units in 2012.

According to the LMC data, the 2012 global gain to light vehicle sales was driven mainly by growth in the US (+13.5%), China (+6.2%) and also a big rebound to vehicle sales in Japan (+27.3%) after the natural disasters of 2011. The main negative last year was Western Europe (-8.6%).

Global economy stabilises

The economic forecasters are generally taking a cautious view of the outlook for the global economy in 2013. Global economic recovery is being held back by a slower than expected recovery in developed nations. Ongoing problems and austerity budgets in the eurozone stand out. Actions from the European Central Bank in sovereign debt markets have helped dampen down the crisis since mid-2012. Financial markets have calmed. However, austerity budgets and low-growth are major concerns. And the structural reforms needed for the long-term sustainability of the single currency have yet to be agreed. In the US, the worst of the ‘fiscal cliff’ may have been dodged, but further negotiations on the federal budget lay ahead. But forecasters note that the negative dampening impact of fiscal negotiations should be mostly over by mid-year, and recoveries in the labour and housing markets are also expected to be better established in the second half.

Economic slowdown in China also held the global economy back in 2012. However, China’s economy, the world’s second largest, is showing signs of a rebound. According to the latest official data, economic growth picked up to 7.9% in the final three months of 2012, from 7.4% in the previous quarter. China’s economy, underpinned by fiscal stimulus, should once again be achieving growth rates of close to 9% by second half of 2013.

The global economy is widely forecast to grow by the same rate this year as last (2.5-3%, real terms). The first quarter, in particular, will be weak but the stage will be set for a modest acceleration of growth in the latter part of the year and during 2014.

| Light vehicle sales (units) | Selling rate (Units/year) | |||||||||

| Dec | Dec | Percent | Year to date | Year to date | Percent | Dec | Year to date | Year | Percent | |

| 2012 | 2011 | change | 2012 | 2011 | change | 2012 | 2012 | 2011 | change | |

| WORLD | 6,859,716 | 6,772,701 | 1.3% | 80,891,859 | 76,909,148 | 5.2% | 82,314,063 | 81,092,975 | 76,883,183 | 5.5% |

| USA | 1,353,418 | 1,240,263 | 9.1% | 14,464,156 | 12,748,374 | 13.5% | 15,212,752 | 14,455,261 | 12,748,374 | 13.4% |

| CANADA | 108,931 | 114,258 | -4.7% | 1,675,508 | 1,582,660 | 5.9% | 1,541,530 | 1,681,748 | 1,582,660 | 6.3% |

| WESTERN EUROPE | 883,877 | 1,057,834 | -16.4% | 13,126,192 | 14,364,932 | -8.6% | 13,395,801 | 13,390,082 | 14,364,932 | -6.8% |

| EASTERN EUROPE | 469,765 | 488,326 | -3.8% | 4,902,648 | 4,709,268 | 4.1% | 4,892,572 | 4,815,863 | 4,709,268 | 2.3% |

| JAPAN | 333,426 | 341,514 | -2.4% | 5,262,688 | 4,134,070 | 27.3% | 4,700,620 | 5,260,679 | 4,134,070 | 27.3% |

| KOREA | 144,159 | 134,931 | 6.8% | 1,507,214 | 1,541,403 | -2.2% | 1,522,977 | 1,505,668 | 1,541,403 | -2.3% |

| CHINA | 1,802,533 | 1,664,251 | 8.3% | 19,117,706 | 17,999,580 | 6.2% | 19,912,490 | 19,149,733 | 17,999,580 | 6.4% |

| BRAZIL / ARGENTINA | 410,331 | 419,145 | -2.1% | 4,324,729 | 4,376,553 | -1.2% | 4,867,516 | 4,311,730 | 4,376,553 | -1.5% |

| OTHER | 1,353,275 | 1,312,179 | 3.1% | 16,511,018 | 15,452,308 | 6.9% | 16,267,804 | 16,522,213 | 15,426,343 | 7.1% |

Source: LMC Automotive

Notes:

Eastern Europe includes Turkey.

China data includes estimate of light vehicle imports, and excludes heavy vehicles.

Brazil December 2012 result based on wholesale sales estimates.

Late reporting countries and estimates are included in “Other”.

The percentage change in the final column compares the average selling rate in the year-to-date with the last full year.

US recovery set to continue in 2013

The US car market expanded to 14.5m units in 2012, continuing the growth trend that has become established since the low of 2009 (10.4m units). The economic picture for the US, while not exactly rosy, looks much better than Europe’s.

The US vehicle market remains well down on the 16m-17m annual norms pre-2008, but it is coming back and on track to continue to rebound in 2013. This year, US light vehicle sales are expected to rise by up to 8% with prices remaining strong, according to most estimates. Replacement demand is cited by many as a factor behind strong sales in 2012, along with good availability of consumer finance.

Pent-up demand continues to exist in the market with the average fleet age in the US at approximately 11 years, according to PwC. US sales are expected to reach 15.3m units in 2013, PwC says.

LMC Automotive forecasts that the US light vehicle market will reach 15m units in 2013 (with 12.2m retail sales). “The US light vehicle sales market continues to be a bright spot in the tremulous global environment,” said Jeff Schuster, senior vice president of forecasting at LMC Automotive.

Polk forecasts that the US light vehicle market will increase to 15.3m units and see support for the market coming from a surge in new model activity. It said that new vehicle introductions in 2013 will escalate dramatically, with 43 new vehicle introductions in the US planned for the year, up nearly 50% over 2012 levels. In addition, 60 vehicle redesigns are expected in the coming year. New launch and refreshed product activity is likely to result in an uptick in registrations as showroom traffic and, in turn, sales tend to increase in the timeframe surrounding new introductions.

“Polk expects continued recovery in the industry in 2013 and 2014, a positive sign for the US economy,” said Anthony Pratt, director of forecasting for the Americas at Polk. “The auto sector is likely to continue to be one of the key sectors that lead the US economic recovery, however, we don’t expect to realize pre-recession levels in the 17 million vehicles range for many years,” he said. “However, our baseline forecast hinges on Washington’s ability to draft a budget plan that will avoid $600 billion in spending cuts and tax increases.”

Economic uncertainty due to unresolved fiscal issues at home and (actual and feared) spillover effects from slowing economies abroad will continue to slow the pace of American economic growth, including car sales, Edmunds says. But Edmunds also says that many of the same factors in play now will still support car sales momentum in 2013. It says the release of pent-up demand from buyers who deferred sales during the recession will intensify as credit conditions further loosen and the increasingly aged fleet drives more consumers back to the new car market.

Edmunds also points out that sales will receive a boost in 2013 from an expected nearly 500,000 additional lease returners compared to 2012, who will lease or buy a new vehicle when their current leases terminate.

US light vehicle market

| m units | |

| 2005 | 17.0 |

| 2006 | 16.5 |

| 2007 | 16.1 |

| 2008 | 13.2 |

| 2009 | 10.4 |

| 2010 | 11.6 |

| 2011 | 12.7 |

| 2012 | 14.5 |

| 2013f | 15.3 |

US light vehicle market to hit 16m by 2015

Polk expects a return to 16m units in the US by 2015, if not before, ‘barring any unusual activity in the marketplace’. The US market last achieved 16m units in 2007.

Large pickup segment set to grow

Polk’s analysis by segment sees the large pickup truck segment, which has declined over the past five years, growing in 2013 due to several important new launches in 2013 and into the 2014 model year. It says that GM, Toyota and Ford are planning to showcase redesigned vehicles in this segment during the next 18-24 months. Increased marketing activity to support these launches, together with a recovering market for new housing starts, which impacts registrations of new pickup trucks within the construction industry, will result in growth in this segment in the coming year, according to Polk.

The mid-size sedan segment will also continue to lead the industry, Polk maintains. Currently at more than 18.5% of the overall market, the industry’s largest by two percent, Polk anticipates it will continue to grow in the coming year.

“Recent redesigns of nearly every vehicle in the mid-size segment are forcing more competition and continued growth,” said Tom Libby, lead analyst for North America at Polk. “The current array of options for consumers in the market for a new mid-sized vehicle makes it a great time to buy a new car.”

The luxury segment in the US also will be one to watch in 2013, according to Polk, as it will see significant launch activity within its compact sedan segment, which currently accounts for 2.9 percent of the overall industry. In addition, if gas prices continue to decline, Polk analysts expect the small luxury crossover segment will continue to swell.

In addition, non-luxury compact crossover vehicles have grown by more than 50 percent in the last five years. Additionally, increased competition in this segment has created pricing pressures, which will result in continued growth, according to Polk analysts.

Polk also forecasts the industry will experience continued growth in the compact and subcompact segments, as OEMs are introducing several new models in the coming year.

“This anticipated growth is largely based on increasing CAFE requirements and significant new product launch activity in the US, as well as increased interest by younger buyers just coming into the market,” said Libby.

While the number of available hybrid models in the US will increase this year, Polk anticipates only a slight improvement in this category from its current level of approximately 2.9 percent of the overall market. Reasons for this include the continued significant price differential between hybrids and traditionally-powered vehicles, and the high number of traditionally-powered vehicles that achieve similar mileage targets as those in the hybrid segment.

Japanese and European premium brands perform strongly

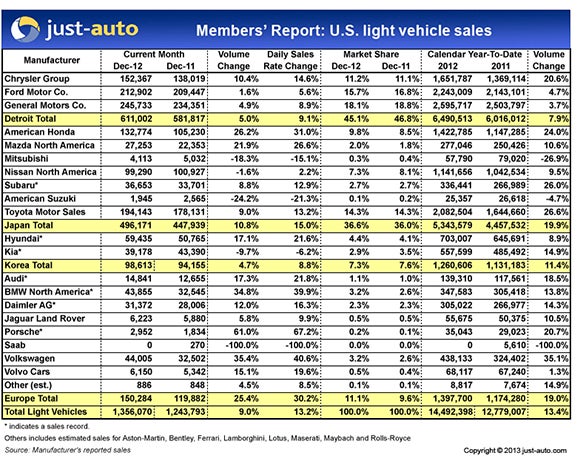

One of the stories of 2012 was the determined bounceback of the Japanese brands in the US market, coming off the supply shortages and difficulties they experienced in 2011. The Japanese brands were up 20% in 2012.

The outlook is for competitive conditions to remain tough, according to LMC’s Jeff Shuster. “The competition will be extremely tough and the revitalised Detroit makers, and others, will be determined to hang on to as much share as they can.” The Japanese OEMs will be looking to maintain momentum in 2013, especially given ongoing problems in China. They will also be helped in the US by the recent weakness of the yen. Volkswagen, a strong performer in 2012 (boosted by the success of the Passat) will also be eyeing further volume growth.

It is also worth noting that several full year sales records were set in 2012, especially in the premium segment where Audi, BMW, Mercedes-Benz and Porsche all set new annual benchmarks. Subaru, Hyundai and Kia did the same among the mainstream brands. All three Detroit companies were in positive territory last year. Chrysler reported the largest gains for both periods while Ford delivered on its boast that it would be the only brand to bring in more than 2m sales. GM increased incentives to ease a glut of full-size pickups.

Analyst takes on manufacturer performances and prospects:

Chrysler

“Chrysler’s momentum in 2012 was one of the industry’s top stories. It was the only major American automaker to grow market share last year and its new Ram trucks are proving to be a hit with both critics and shoppers. Even its underperforming Dodge Dart finally gained a little traction by the end of the year. But now that Chrysler has set a higher bar, it will be much more difficult to repeat its performance in 2013. Don’t expect too many more headlines of double-digit growth for Chrysler in the coming months.” – Edmunds.com Sr. Analyst Michelle Kreb

Ford

“Ford can once again hold up the F-Series as the best-selling truck in 2012, but its dominance slowed noticeably by the end of the year. F-Series sales were virtually flat in December, and Ford’s truck sales overall were down more than seven percent. Stronger competition from Chevy and Ram is making Ford look a little less invincible these days.” – Edmunds.com Sr. Analyst Michelle Kreb

GM

“In a strong year for the auto industry overall, GM struggled to hold up its end in 2012. Its year-over-year growth is well under the industry average, and the company couldn’t hold on to market share gains it enjoyed in 2011. The biggest disappointment is Cadillac, which was GM’s only brand to report fewer year-over-year sales. But GM’s weakness in 2012 may well prove to be its strength in 2013; Cadillac should have a stronger year this year with the help of its newest products. The new XTS and ATS already made up nearly one third of Cadillac sales in December.” – Edmunds.com Sr. Analyst Jessica Caldwell

Honda

“When you consider just how far Honda fell in 2011 following the Japanese earthquake and tsunamis, 2012 has to be considered a success. The company’s resilience is a testament to its customer loyalty: almost two-thirds of every person trading in a Honda in 2012 bought another one. The Civic, Accord and CR-V show no signs of slowing down and Honda will continue to rely on this holy triumvirate as it works to move closer to its peak market share levels from just a few years ago.” – Edmunds.com Sr. Analyst Michelle Kreb

Nissan

“Nissan crossed the one million vehicle threshold in the U.S. for the first time ever in 2012, and that’s certainly a big deal. But it would be dangerous for Nissan to overlook that it still lost market share, even though it was the only Big Six automaker to boost incentives in 2012. Nissan has a hit with the new Altima, and the Versa and Rogue are emerging as real players in their segments, and those are all important vehicles to buttress the company’s market share in 2013.” – Edmunds.com Sr. Analyst Jessica Caldwell

Toyota

“Toyota had the biggest year-over-year gains of any Big Six manufacturer, which just adds more evidence that its unintended acceleration issues are officially in the rear view mirror. Fresh products like the all-new RAV4 due out later this month should help to keep the momentum going. And Toyota’s line of Priuses should only get more popular as the hybrid and electric market steadily gains more steam.” – Edmunds.com Sr. Analyst Jessica Caldwell