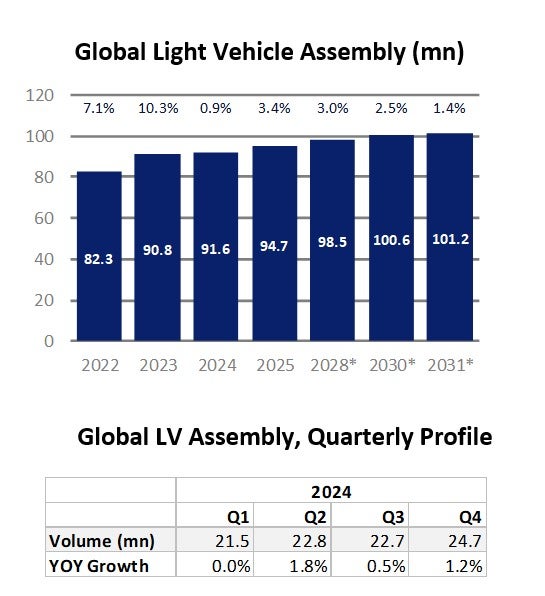

GlobalData’s world Light Vehicle (LV) production forecast remains broadly on track for 2024 (+0.9% YoY) with pricing actions, incentives and lower interest rates expected to help to mitigate recent hesitancy in the wider demand environment. Global light vehicle production is forecast at 91.6 million units in 2024 and 94.7 million units in 2025.

LV pricing development is set to be key for the outlook of LV production this year, according to GlobalData. This reflects the industry’s exposure to a more ‘realistic’ underlying demand environment as the cushion of backlog orders and inventory replenishment has been increasingly eroded.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

While Government-led market subsidies and the ongoing price-war are expected to support China’s LV production this year, vehicle price discounting – to selectively manage vehicle stock growth – is increasingly beginning to appear in both North America and Europe.

After double digit growth to LV production in China in 2023, to 29.06 million units, growth is forecast to moderate to under 2% in 2024.

GlobalData analyst Justin Cox says that production volumes in China are being sustained by stimulus measures to boost the domestic market, but that there is also support from exports, too. “We are seeing that the Chinese OEMs have real strength in their electrified or NEV offerings – both at home and overseas,” Cox says. “New product launches are also supporting overall volumes for Chinese makers. However, the price war there makes it a very tough market for foreign brands.”

In North America, overall production this year is forecast at 16.1 million units, some 3% up on 2023. Cox says the forecast remains on track as continued supply side improvements combine with solid domestic and export demand. “Management of OEM inventories will be key for the [NA] outlook,” he says.

“Currently, incentives and discounting are increasing, but more output ‘discipline’ by OEMs provides a downside risk to volume.”

See also: US May vehicle market forecast to increase