Total new vehicle sales in the US for May 2024, including retail and non-retail transactions, are projected to reach 1,446,800 units, a 2.9% increase from May 2023 on a selling day adjusted basis, according to a joint forecast from J.D. Power and GlobalData.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

May 2024 has 26 selling days, one more than May 2023. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 7% from a year ago.

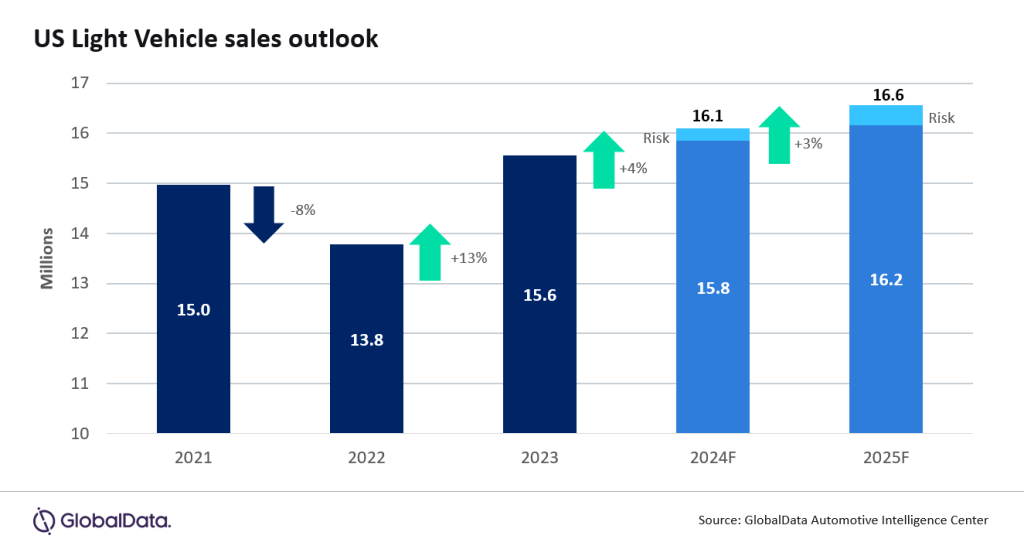

The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 16.1 million units, up 0.5 million units from May 2023.

Thomas King, president of the data and analytics division at J.D. Power said: “Expected new vehicle sales results for May represent a mixed bag of outcomes. On the positive side, the total sales pace will exceed 16 million units for the first time this year. Also, discounts are similar to last month, despite May being a month in which discounts traditionally increase to take advantage of elevated shopping activity during the Memorial Day weekend. This is good news for manufacturer and retailer profitability. However, the industry continues to produce more vehicles than are being sold, leading to rising inventories and increasing the likelihood of elevated discounts as the year progresses.”

Retail inventory is projected to finish around 1.8 million units, a 0.6% increase from April 2024 and a 52.7% increase from May 2023. Fleet mix is projected at 18%, down 1.2 percentage points from May 2023 and down 3.4% on a selling-day adjusted volume basis.

“The average new-vehicle retail transaction price is declining compared with a year ago as manufacturer incentives rise, retailer profit margins fall and availability of lower-priced vehicles increases. Transaction prices are trending towards $45,033—down $1,045 or 2.3%—from May 2023. The combination of slightly higher retail sales but lower transaction prices means that shoppers are on track to spend nearly $50.9 billion on new vehicles this month—6.8% higher than May 2023 and the second highest May on record.

“Total retailer profit per unit—which includes vehicles gross plus finance and insurance income—is expected to be $2,471, down 31.5% from May 2023. Rising inventory is the primary factor behind the profit decline and fewer vehicles are selling above the manufacturer’s suggested retail price (MSRP). Thus far in May, only 14.9% of new vehicles have been sold above MSRP, which is down from 29.2% in May 2023.”

Total aggregate retailer profit from new-vehicle sales for this month is projected to be $2.8 billion, down 21.5% from May 2023.

“Rising inventory means fewer vehicles are being pre-sold by retailers, with more shoppers able to buy directly off dealer lots. This month, J.D. Power forecasts that 33.3% of vehicles will sell within 10 days of arriving at the dealership, down from a peak of 58% in March 2022. The average time a new vehicle remains in the dealer’s possession before sale is expected to be 40 days, up from 29 days a year ago.

“Manufacturer discounts are expected to be similar to April (up $33 per unit) but have materially increased from a year ago. The average incentive spend per vehicle has grown 48.1% from May 2023 and is currently on track to reach $2,640. Expressed as a percentage of MSRP, incentive spending is currently at 5.3%, an increase of 1.7 percentage points from a year ago. Increased spending of current model year is nearly offset by lower volumes of prior model year vehicles with higher spending.

“One of the drivers of higher incentive spending from a year ago is the increased availability of lease deals, and leasing is growing accordingly. This month, leasing is expected to account for 23.9% of retail sales, up 3.3 percentage points from 20.6% in May 2023.

“After rising consistently during the past few years, average monthly loan payments are stabilizing. The average monthly finance payment this month is on pace to be $727, down $3 from May 2023. The average interest rate for new-vehicle loans is expected to be 7.1%, an increase of 17 basis points from a year ago.

“So far in May, average used-vehicle retail prices are $28,470, reflecting a 5.4%–or $1,614—decrease from a year ago. The decline in used-vehicle values is translating to lower trade-in equity for owners, now trending towards $7,866, which is down $1,438 from a year ago.”

EV trends – at a ‘low tide moment’

Elizabeth Krear, vice president, electric vehicle practice at J.D. Power said: “We’re seeing a ‘low tide moment’ for EVs right now, but it’s unclear how long it will last. EV market share peaked at 8.8% in April, with May expected to be down 0.4 percentage points. Results from the J.D. Power 2024 Electric Vehicle Consideration Study show that, for the first time since the study’s inception in 2021, EV shopper consideration has dropped from the previous year. This year, 24% of shoppers say they are ‘very likely’ to consider purchasing an EV, which is down from 26% a year ago. Shoppers who are rejecting EVs point to lack of charging station availability, purchase price, limited driving distance per charge, time required to charge and inability to charge at home or work.

“The decline in shopping interest for EVs comes as the industry has reached an all-time high in EV availability. EV availability is at 54.3—the highest it’s ever been on a 100-point scale—as it moves toward parity with gas-powered vehicles. EV adoption within the J.D. Power EV Index fell to 16.2 in April, hitting its lowest point since August 2021. EV retail share, while having some bright spots when it comes to certain models, is not growing at the same pace as EV availability. This is bringing aggressive conquest sales programs to the EV segment, so we’ll see if shoppers find them attractive enough.”