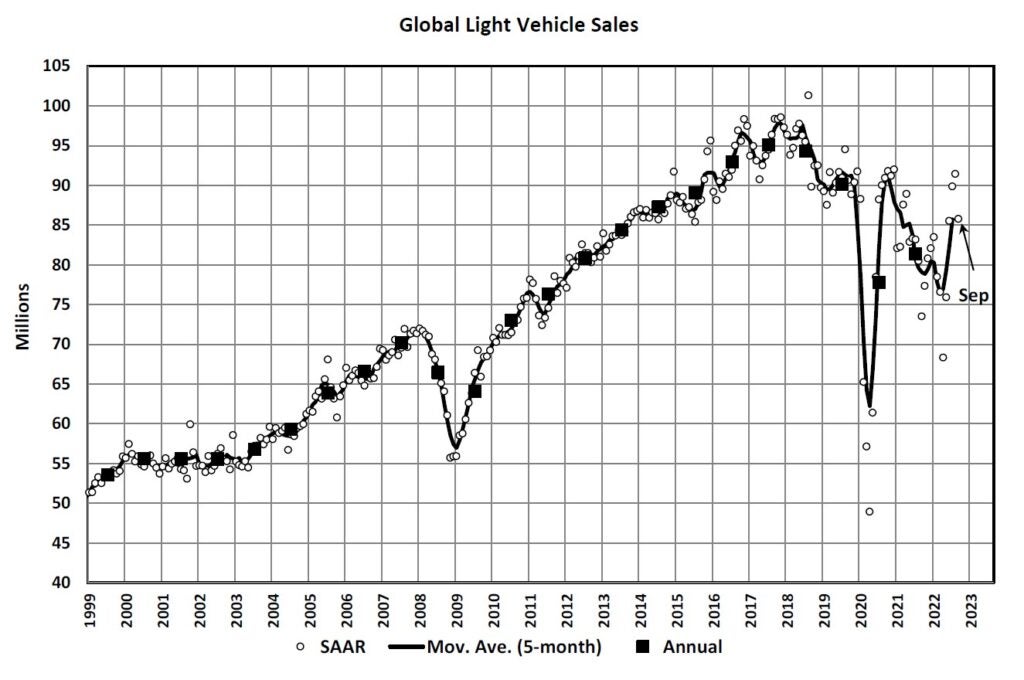

Data released by LMC Automotive (a GlobalData company) for September confirms a weak sales trend for the global vehicle market this year. After a disappointing performance in 2021 notable for sales constraints caused by parts shortages, the market is heading for another historically weak year. A global market forecast at 81.7 mn units in 2022 would be flat on 2021 and some 9% under 2019’s level (just over 90 mn). However, the picture around the world is somewhat mixed, with a strong rebound in China (as parts shortages ease) contrasting with sluggish sales in Europe and North America. The outlook everywhere is subject to rising concerns over prospects for the global economy as well as other risks and uncertainties.

September 2022

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

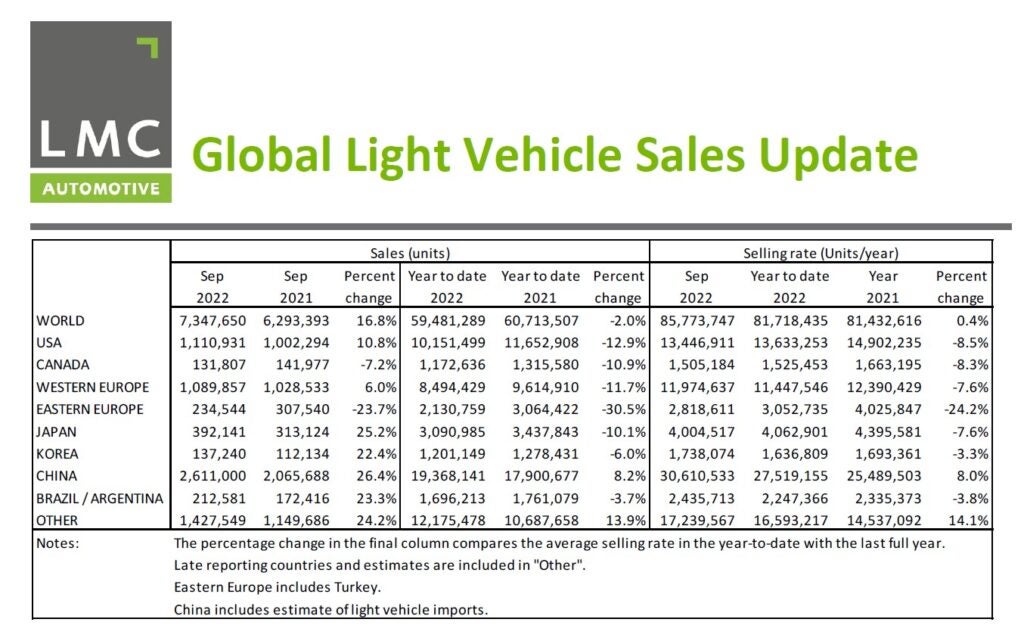

The Global Light Vehicle (LV) selling rate ended a four-month growth trend in September by falling to 86mn units/year from an adjusted high of 91 mn units/year seen in August. The year-to-date (YTD) raw sales figure was down 2% from the weak base of 2021.

Despite a reduced global selling rate in September, China’s market remained robust with YTD growth of 8%. North America and Europe, however, continued to struggle YTD as supply issues held back these markets.

A summary of market developments in the world’s regions follows.

North America

US Light Vehicle raw sales grew by 10.8% YoY in September, to 1.1 mn units. While this was the second consecutive month of YoY increases, it was helped by weak sales in H2 2021. On a brighter note, the selling rate was 13.4 mn units/year, the best since April. However, there are signs of the market slowing. Inventory levels increased 12.6% from last month and are the highest since May 2021.

Canadian LV sales are estimated to have declined by 7.2% YoY in September, to 132k units. While the selling rate would therefore have increased to 1.5 mn units/year, the highest since March, in volume it was the fourth lowest month of the year, an indication that increasing inflation and interest rates are likely having a cooling effect. In Mexico, sales were up by 11.7% YoY in September, to 85k units. In addition, the selling rate was 1.1 mn units/year, only marginally down from last month. Despite the economic headwinds, the market is showing resilience.

Europe

The West European selling rate decreased to 12.0 mn units/year in September, from 14.3 mn units/year in August. Most of the major West European countries experienced slower sales, predominantly driven by supply constraints and seasonal effects. Registration numbers grew 6.0% YoY to 1.1 mn units, with the YTD selling rate 7.6% lower than the 2021 result.

The East European selling rate grew slightly from the previous month to 2.8 mn units/year, though raw sales were down 30% YTD, with the war in Ukraine continuing to restrict supplies, and Russia’s sales crushed by sanctions and other related actions and, as a result, hamper the region’s sales activity.

China

Advance data indicates that the Chinese market remained robust, supported by the temporary purchase tax cut on Passenger Vehicles. The September selling rate reached 30.6 mn units/year, down nearly 10% from the downwardly revised August, but that was still an impressive result. In YoY terms, raw sales expanded by 26.4% in September, the fourth consecutive month of double-digit growth. As component shortages continued to ease, OEMs were able to increase production to meet strong demand.

In September, NEV sales expanded by 94% YoY, accounting for roughly 27% of total LV sales. Among NEV makers, BYD has been performing particularly well, with its sales in Q3 (including both BEVs and hybrids) exceeding those of Tesla (which offers only BEVs). While NEV prices are rising, the purchase tax exemption for NEV’s has been extended until December 2023 which will continue to support NEV sales.

Other Asia

Sales in Japan remain volatile due to supply disruptions. After a strong upswing in August, the September selling rate slowed sharply to 4 mn units/year. In YoY terms, however, sales increased for the first time in 15 months, thanks to easing of component shortages. Sales of Mini Vehicles (which account for about 40% of total LV sales) were particularly strong, increasing by 35% YoY. EV sales are gaining momentum, too, although their share is still small at less than 3% of total Passenger Vehicle sales.

The Korean market accelerated in September, as the supply situation has improved significantly. The September selling rate reached a 15-month high of 1.74 mn units/year, up over 4% from a lackluster August. Almost all Korean OEMs registered double-digit YoY growth in production and both domestic and export sales. (Note, YoY comparisons are not distorted by the lunar Chuseok holiday, as the number of selling days in September 2022 was the same as a year ago.) Yet, demand continues to outstrip supply and sales volumes are being driven by supply-side factors.

South America

Brazilian LV sales grew by 26.1% YoY in September, to 180k units. However, last year’s sales were extremely weak, creating a low base effect. Despite this, the selling rate declined slightly to 2.10 mn units/year, the second consecutive month above 2-mn units/year, for the first time since May 2021. Inventory grew by 7% from last month. This may potentially be an indication of easing in supply issues for manufacturers, but it could also signal waning demand due to rising inflation and interest rates.

In Argentina, LV sales are estimated to have grown by 9.4% YoY in September, to 32k units, and the selling rate slowed again to 336k units/year, the lowest since January. While YoY gains were still achieved thanks to the low baseline effect from a weak 2021, the market does seem to be cooling after several slightly more robust months. Economic and political issues continue to hamper the post-COVID-19 recovery.

Just Auto editor David Leggett adds:

Market geography has never been more important – at first sight – than right now. The mature markets and non-mature markets highlight very divergent trends that will be shaping operational performances for companies in the sector

Companies such as Volkswagen will benefit from stronger sales in China (although Covid-related lockdown reverses are still a major risk there). Others (notably Japanese OEMs) will see volume lifts from higher sales in other Asian markets, especially in southeast Asia. But problems of tight supply remain an issue in mature markets such as North America and Western Europe. Moreover, the dent to the global volume pie remains large, with 2022’s global market at under 82 mn and some 14% below 2017’s peak when it seemed to be heading inexorably towards 100 mn a year.

There are indications, however, that the worst of the semiconductors shortage is now behind us with a gradual easing in prospect through the remainder of the year. One upside of backed up orders is that activity in factories can be ‘smoothed’ just as the emphasis switches to broader demand concerns and slowing economies due to a toxic combination of surging energy prices, lower household incomes, higher interest rates and significant ongoing geopolitical worries (all of which look set to be with us in 2023).

The big question is this: Will companies have to make significant changes to their global manufacturing footprints? It hasn’t really happened yet, but the drop-off in volumes from 2019 is large and tinkering with model-mix has its limits as demand weakens. They will be reluctant to do so, but the pressures will be building next year, especially if risks start to rise on the 2024 outlook. If the divergent trends in the global market continue, the mature markets will be the ones that feel the pressures most.