For much of this century, China’s rapidly expanding market – combined with its trade policy – has been a consistent lure for global OEMs (vehicle makers) to localise their auto production in the country. Moreover, localisation in China has been of key strategic and financial importance for OEMs as their traditional markets have become increasingly saturated. Over the past twenty years, Light Vehicle (LV) production by ‘foreign’ OEMs in China increased by over ten times and, in 2021, accounted for almost 12 mn units – 15% of total world LV output. So, what seems to have gone wrong?

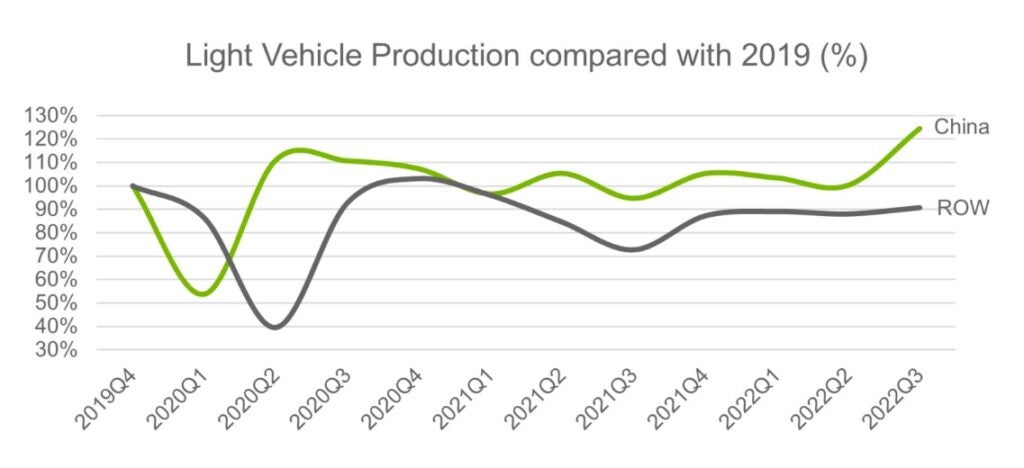

In aggregate, China still retains huge market attractiveness, and, despite the supply-side challenges, the auto industry’s LV output has comfortably moved ahead of pre-pandemic levels, which contrasts favourably with elsewhere in the world (see below chart).

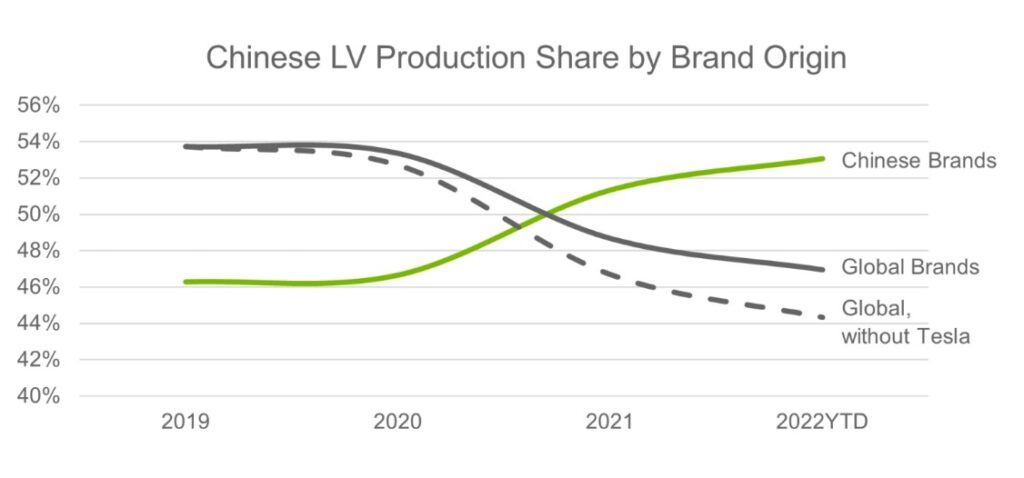

Yet, the relative strength of China’s LV production performance has not been enjoyed by all OEMs, particularly those traditional ‘foreign’ automakers. Indeed, since 2019, the share of ‘foreign’ brand production in China has shrunk from 54% to 47%, and, stripping out firebrand Tesla’s performance, the decline has been even worse.

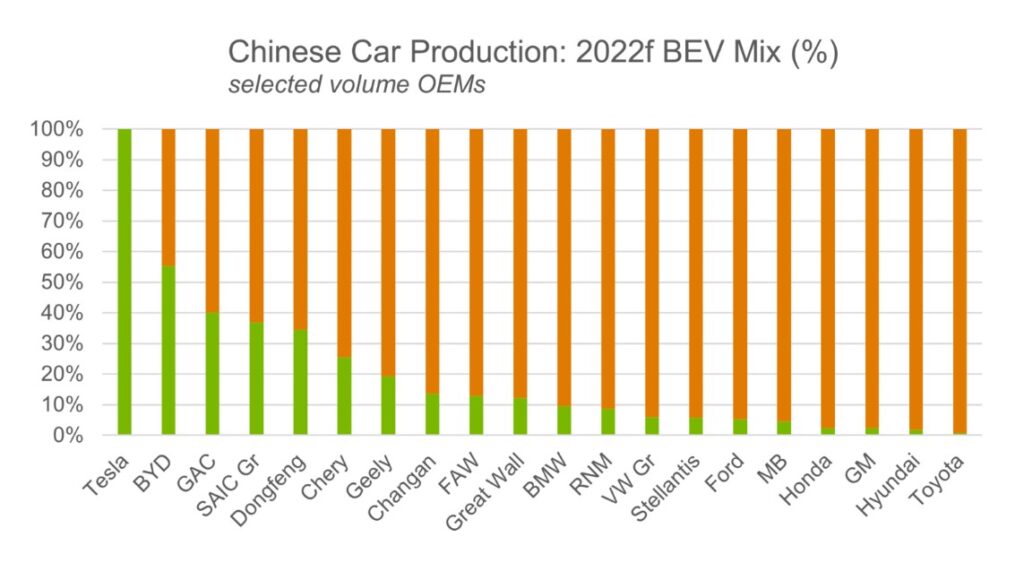

While a more ‘flexible’ approach to material procurement, as well as benefits from deeper supply-chain integration, have contributed to the progress of the Chinese ‘domestics’, it is arguably their success in supplying desirable Battery Electric Vehicles (BEVs) to this buoyant segment in China that has underpinned these gains.

Furthermore, for 2022, the average BEV mix of car production by key Chinese brands is expected to approach 30%. This compares to just 5% for the localised traditional global players (excludes Tesla).

Moving forward, for many of the traditional ‘foreign’ volume auto producers in China, new medium-term investment in plant and BEV products is expected to provide a welcome competitive boost as the local market continues to pivot towards electrification. For some OEMs, however, the required investment scale, the geopolitics, or simply the ongoing operational challenge may prove too overwhelming and a more “asset-light” approach to servicing the world’s biggest LV market will be pursued.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNevertheless, the head-start in BEV competitiveness that the Chinese ‘domestics’ appear to have gained at home, is unlikely to stop there. As demonstrated at the recent Paris auto show, where many Chinese BEV models took centre stage, the breadth of the Chinese BEV product offer is likely to impact LV global markets soon. With tariffs and inventive trade barriers perhaps delaying the advance, this may well prompt the Chinese to more speedily adopt a localisation strategy of their own.

Justin Cox, Director Global production, LMC Automotive (a GlobalData company)