The global light vehicle market is up again, but a strong China rebound accounts for much of the gain

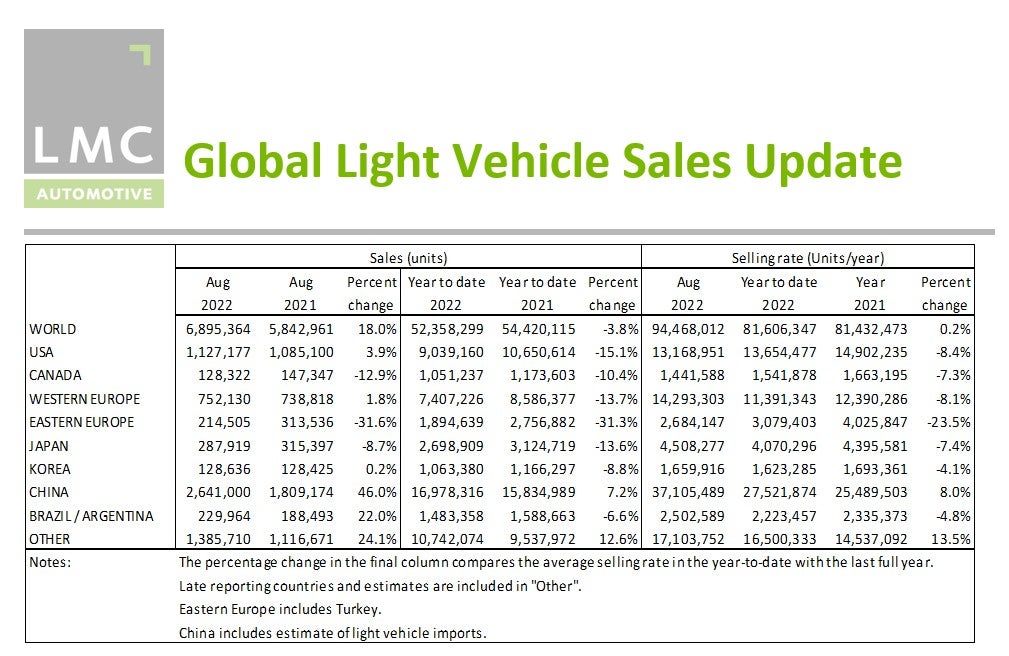

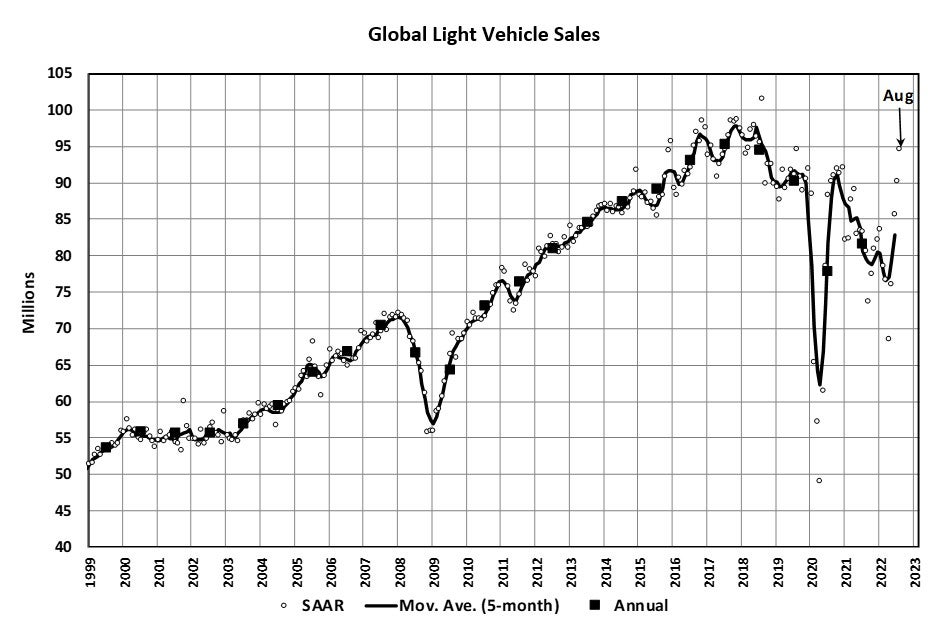

The Global Light Vehicle (LV) selling rate rose for the fourth consecutive month to 94 mn units/year in August 2022, the best performance for the year thus far, according to analysis undertaken by GlobalData unit LMC Automotive.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

However, August results show that the world’s vehicle market continues to show a mixed performance by region and that there is considerable volatility around underlying market volumes. Despite the improvement in overall performance in August, global year-to-date (YTD) light vehicle sales were still down 3.8% from the same period in 2021 – also a weak year for the world’s vehicle market.

China continues to lead the recovery as August saw selling rates shoot to record levels with the support of the temporary purchase tax cut. Indeed, analysts note that the Chinese market continues to surprise on the upside. Advance data indicates that the annual selling rate surged to yet another record high of 37.1 mn units/year, up marginally from a revised 36.8 mn units/year in July.

However, sluggish selling rates in North America and Europe again highlighted ongoing supply disruption.

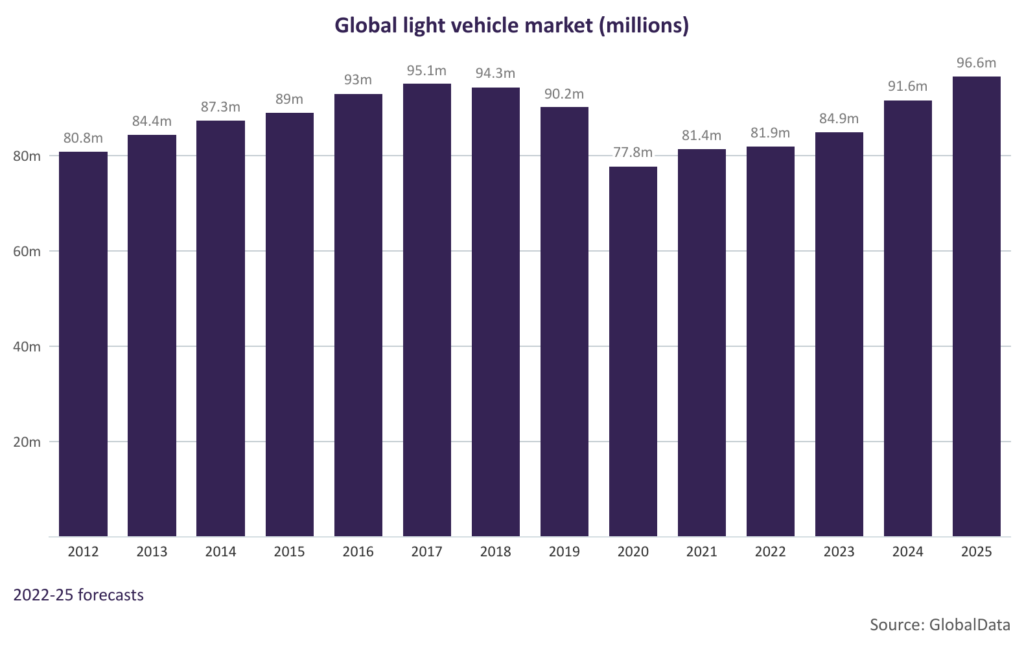

Operational implications for companies

Market geography has never been more important – at first sight – than right now. Companies such as Volkswagen will benefit from stronger sales in China (although Covid-related lockdown reverses are still a major risk there). Others (notably Japanese OEMs) will see volume lifts from higher sales in other Asian markets, especially in southeast Asia. But problems of tight supply remain an issue in mature markets such as North America and Western Europe. Moreover, the dent to the global volume pie remains large, with 2022’s global market at under 82 mn and some 14% below 2017’s peak when it seemed to be heading inexorably towards 100 mn a year.

There are indications, however, that the worst of the semiconductors shortage is now behind us with a gradual easing in prospect through the remainder of the year. One upside of backed up orders is that activity in factories can be ‘smoothed’ just as the emphasis switches to broader demand concerns and slowing economies due to a toxic combination of surging energy prices, lower household incomes, higher interest rates and significant ongoing geopolitical worries (all of which look set to be with us in 2023).

Companies in the auto sector will continue to be challenged by an unfavourable market environment. It means a need for continued focus on supply chain strategies to mitigate risk, market geography to focus on high-margin markets and a need to continue to invest in high-growth technologies and product segments.

After the pandemic and subsequent hesitant recovery – which has exposed severe supply chain problems – and the confidence draining impacts of geopolitical events and tensions, many in the industry will wonder if the sector’s pre-pandemic trajectory and growth assumptions are now gone and whether, in an apparently more uncertain and volatile world, a different (and lower) trajectory takes its place. If it does, there will undoubtedly be capacity considerations to address. The next ten years will see the industry reshaped, but there are still many opportunities ahead in a disrupted transport space subject to changing consumer attitudes. We won’t know about ‘permanent scarring’ for a while yet, but business strategists are sure to be working on very different planning scenarios for all aspects of company operations.

Regional trends

North America

US Light Vehicle sales grew by 3.9% YoY in August, to 1.13 mn units. This was the first YoY gain since July 2021, but the comparison was helped by weak sales in August 2021 and by an extra selling day last month. Volumes have been remarkably steady for the past three months, with sales rounding to 1.13 mn units in each, perhaps hinting at the supply problems that are still restricting the market. That said, inventories grew to 1.27 mn units by the end of August, a 10.2% increase month-on-month, while average transaction prices are finally levelling off at US$46,112, reinforcing the sense that demand may be starting to ease.

Canadian LV sales are estimated to have fallen by 12.9% YoY in August, to 128k units. The selling rate is thought to have declined to 1.44 mn units/year for last month, from 1.58 mn units/year in July, as the market continues to struggle against low inventory, while interest rates are rising and inflation is elevated. In Mexico, sales were up by 16.1% YoY in August, to 91k units, the strongest YoY gain since June 2021. The selling rate increased to 1.08 mn units/year, from 1.04 mn units/year in July.

Europe

The West European selling rate increased to 14.3 mn units/year in August, comfortably up on previous months. With August a seasonally weak month, we assume this selling rate is not going to be repeated in coming months. While there was a 1.8% YoY uptick in raw sales figures when compared with August 2021, this has not had a significant impression on year-to-date (YTD) sales which are down 13.7%.

The East European selling rate remained weak at 2.7 mn units/year. The consequences of the conflict in Ukraine continue to act as a major drag on the region’s overall sales activity, particularly in Russia.

China

The Chinese market continues to surprise on the upside. Advance data indicates that the selling rate surged to yet another record high of 37.1 mn units/year, up marginally from a downwardly revised 36.8 mn units/year in July. The YTD average selling rate reached 27.5 mn units/year, somewhat higher than last year’s total Light Vehicle sales. In YoY terms, sales (i.e., wholesales) expanded by 46% in August and 7% YTD. Sales were boosted by the improving supply, the temporary purchase tax cut on Passenger Vehicles, and a recovery in demand for Light Commercial Vehicles.

In August, NEVs continued to lead the market, with their sales increasing by 104.2% YoY. Yet, their YoY growth has started to slow, due to a high year-ago base. While the temporary purchase tax cut for ICE models is scheduled to expire at the end of this year, the purchase tax exemption for NEVs has been extended until December 2023, indicating that the government is committed to promoting NEV sales.

Other Asia

The Japanese market improved in August, as the shortages of components started to ease with the lifting of the lockdown in Shanghai. The August selling rate reached 4.5 mn units/year, up 18% from a weak July. That, however, brought the YTD average selling rate to barely above 4 mn unit/year, significantly lower than last year’s total LV sales of 4.4 mn units. In YoY terms, sales declined by 8.7% in August (the 14th consecutive month of contraction) and 13.6% YTD.

In Korea, the selling rate remained flat at 1.7 mn units/year for the third consecutive month in August. The YTD selling rate averaged only 1.6 mn units/year, falling below last year’s total LV sales of 1.7 mn units. Yet, in YoY terms, the market is showing some improvements. In August, YoY growth turned to positive (+0.2%) for the first time since February – although that is partially due to a low year-ago base. In the first eight months of this year, sales declined by nearly 9%.

South America

Brazilian LV sales grew by 22.2% YoY in August, to just under 195k units, the highest result since December 2020. As a result, the selling rate was 2.12 mn units/year in August, up from 1.94 mn units/year in July, and the strongest of 2022 to date. However, poor sales in 2021 resulting from global inventory shortages play a strong role in flattering last month’s YoY results. In addition, the spike in sales was partially due to abnormally high fleet sales in August. Despite some improvement in vehicle availability – inventories grew by 9.9% over July’s total – volumes were still around 16% below pre-pandemic levels last month.

In Argentina, LV sales are estimated to have grown by 21.2% YoY in August, to 35k units. However, the selling rate slowed to 379k units/year, from 412k units/year in July. The YoY expansion was in part the consequence of low sales a year ago, but the selling rate is in line with the average for the first eight months of the year. Import restrictions and economic headwinds continue to keep a lid on sales.