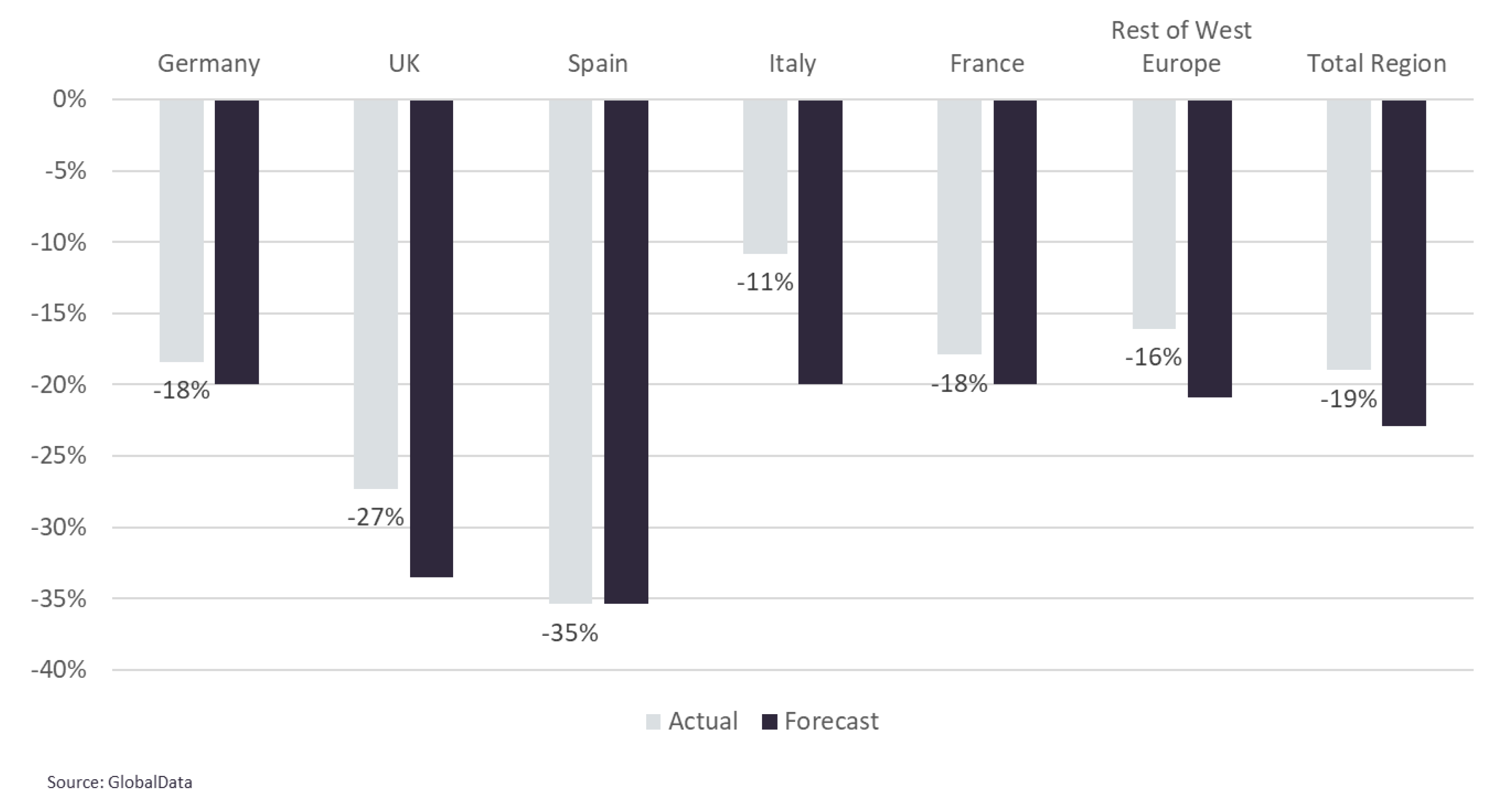

February was a month of few surprises for light vehicle sales in West Europe. That said, a month that saw sales fall by an estimated 19% year-on-year demonstrates how inured we have become to double-digit rises and falls in this see-sawing operating environment. If anything, sales tracked slightly better than GlobalData’s forecasts for the month. Our model called for a 22.9% fall in sales for the month, so the reality is nearly 4% or some 40,000 units better in a market that’s likely to total 890,000 units for the month.

Given this it might be instructive to look at markets that outperformed expectations for the month. Of the big five markets France’s 17.9% fall was a marginal improvement on the 20% fall we had pencilled in. Germany performed similarly, with a 18.4% fall against a 20% forecast. The difference being that Germany’s market narrowed the gap on January’s performance (down 30%), while France’s market moved from a decent result in January (3% down) to a near 20% fall in February. Explanation for the differing performance partially stems from COVID-19 case rates and government responses. From January through to February the two countries’ rate of COVID-19 infection diverged – Germany’s full lockdown seems to have suppressed the virus, while France’s partial lockdown has seen cases increase and more regional lockdowns imposed by the national government.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Of the remaining five markets Italy’s February was stronger than anticipated with a near 11% fall against 14% in January. A recent spike in Italy’s infection rates does not augur well for March however, and the Italian government could move from its current tiered approach to a national lockdown shortly – if reports are correct. Spain’s market in February tracked to expectations with a 35% sales dip, but with Spain seemingly over the worst of the third wave a brighter March could be in prospect. Finally, the UK with a 27.3% fall in light vehicle sales was slightly ahead of the forecast 33.5% fall in sales. Again, the light vehicle fall was slightly masked by the 22% surge in LCV sales in contrast to the car market’s near 36% contraction.

For the year, the current forecast is for a 20.3% increase in the region’s sales. January and February are forecast to be the low-points of the year in SAAR terms (average selling rate of 11.7m). Sequential improvement is expected to begin in March, with SAAR rates of 16m being achieved from July. As ever, the forecasts remain contingent on development of COVID-19 infection rates and the parallel roll out of vaccination programs.