China’s automotive industry has stepped up its efforts to expand into global markets, with many local vehicle manufacturers having doubled their overseas sales this year even as the domestic Chinese market continues to stagnate.

The Chinese vehicle market’s explosive two decade-long growth has come to a halt after peaking at over 28 million in 2018, having expanded from little over two million units before the country became a member of the World Trade Organisation in 2001.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Vehicle sales in the country fell by over 8% in 2019, according to data released by the China Association of Automobile Manufacturers (CAAM) – even before the market was affected by the COVID-19 pandemic, followed by a more moderate decline in 2020. This year, vehicle sales are expected to be slightly higher – mainly reflecting rebounding sales in the first half of the year.

The global shortage of semiconductors has had a significant impact on vehicle output in the country this year, but demand has also softened in recent months due to falling consumer confidence. No doubt, the market will resume its long-term expansion when conditions improve.

Chinese vehicle manufacturers are increasing their presence in a growing number of overseas markets, with the latest CAAM data showing the country exported a total of 1.6 million vehicles in the first ten months of 2021 – including 231,000 units in October alone. This compares with 995,000 exports in the whole of 2020, with volumes set top more than double to over two million units this year.

Chinese automakers are not only expanding into developing regions such as Asia, Africa and South America, where they are already providing increasingly tough competition to established players in traditional internal combustion engine (ICE) segments, including Japanese and South Korean automakers. They have also stepped up their efforts to expand in developed markets, particularly in Europe, targeting also the fast-growing electric vehicle (EV) segment which is becoming a key strength among Chineseautomakers.

Xpeng expects to sell half of its domestic output overseas, with Europe expected to account for a significant proportion of this.

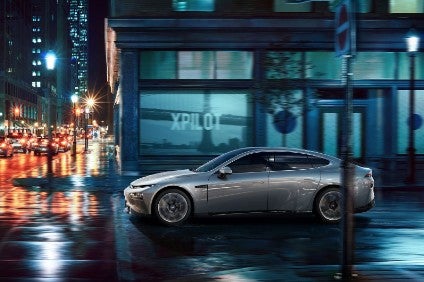

Chinese startups such as Nio and Xpeng are investing heavily to expand their sales networks in Europe’s Nordic countries, including Norway, Sweden, Denmark and the Netherlands, where strong EV demand is being driven by generous government subsidies. Here they are challenging traditional European brands which have been slow at implementing their own EV strategies. Earlier this month Xpeng said it expects to sell half of its domestic output overseas, with Europe expected to account for a significant proportion of this.

The country’s largest vehicle exporter, state-owned SAIC Motor, said its overseas sales more than doubled to 265,000 vehicles in the first half of 2021, including 166,000 units sold under its MG and Maxus brands. SAIC Motor is also China’s largest vehicle manufacturer, with major joint ventures with Volkswagen and General Motors.

The company said it is targeting 550,000 overseas sales this year, targeting all major regions around the world. It recently announced the launch of new international shipping routes to Southeast Asia, Mexico, western South America and Europe to support further growth, while its SAIC-GM-Wuling joint venture is stepping up the global roll-out of its popular mini-EVs.

Chery Group has announced it had sold almost 213,000 vehicles overseas in the first 10 months this year. The company has a presence in over 80 countries and regions worldwide, along with ten overseas factories. Brazil is a key market for Chery, with sales surging by 120% to almost 28,000 in the first nine months of 2021, while the company also plans to establish an EV hub in Thailand to supply South-east Asian markets.

Tesla has become a major vehicle exporter from China, with total exports of 142,000 units in the first ten months of the year. Local sales accounted for a further 218,000 units in the ten-month period. The launch of a new EV plant in Germany at the end of 2021 will no doubt affect exports volumes from China from next year, however.

Geely Group has a controlling stake in Sweden’s Volvo Cars and a significant stake in Malaysia’s Proton, and a stake in Daimler AG. The company exported a total of 96,800 vehicles in the first ten months of the year, just under 10% of its 1,033,395 global sales.

Chinese automotive brands have become more readily accepted in markets around the world in recent years following significant efforts to climb the quality ladder over the last two decades through substantial in-house R&D investment and partnerships with overseas suppliers. The country is now seen as taking the lead in the development and introduction of new automotive technologies, including smart connected EVs and autonomous driving.

CAAM said it expects vehicle exports to continue to grow strongly in the coming years, with Chinese brands challenging established brands in global markets over the next decade. Growing demand for EVs will help Chinese automakers grow their presence in established markets. Improved product quality, competitive pricing and the early roll-out of EVs will help them challenge Japanese, South Korean and other established brands in developing markets.