Semiconductors are used in a variety of automotive applications, including interior, safety, fuel efficiency and connectivity. Continuing just-auto/QUBE’s series of research snapshots, this one turns a spotlight on some of those applications and the key players serving the market.

A semiconductor is a substance, typically a solid chemical element or compound that can conduct electricity, but only partly – as the name suggests – and under certain conditions. Anything that is computerised relies on semiconductors. Further electrification of the drivetrain, increasing fitment of infotainment, active safety tech and the push for autonomous vehicles is fuelling demand for semiconductors.

Connected car systems are key decision drivers for consumers accustomed to the rich user experiences they encounter in their everyday digital lives. The resulting expectations have triggered a transformation in infotainment systems from bulky, purpose-built devices into sleek, connected, upgradeable and integrated platforms. Among those pushing back the technical boundaries are NXP and Harman. The pair recently expanded their technology partnership to accelerate time-to-market for connected car solutions.

Motorists’ insatiable appetite for infotainment is also stoking demand for semiconductors.

Motorists’ insatiable appetite for infotainment is also stoking demand for semiconductors. Tomorrow’s car interiors will also feature a number of refinements, including integrated tablet-style touchscreens with more apps and in-car connectivity; wider, all-digital instrumentation with wraparound LED screens and virtual environments; voice and gesture recognition; augmented reality windscreens; and fold-away steering wheel concepts with more buttons and fewer stalks. Using our eyes, voice and hand gestures, it is also possible to eliminate buttons from an infotainment system.

Meanwhile, cybersecurity has emerged as a growing concern in the automotive industry as connectivity systems proliferate. For its part, Nexteer Automotive is strengthening its steering system offerings with cybersecurity technologies to protect against malicious intrusions and unverified steering commands. Its latest cybersecurity technologies consist of specifically designed hardware modules on the semiconductor level, as well as a multi-layered cryptographic software structure that identifies and authorises information and command flow between the steering system and other in-vehicle or external controllers. As vehicles adopt advanced electronics to enable automated driving, internet connectivity and V2X communication, they become more susceptible to remote hacking, Nexteer explains.

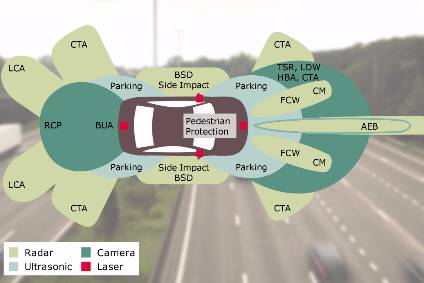

Earlier this week, Philip Hammond, a British Conservative Party politician and Chancellor of the Exchequer, reaffirmed a budget pledge to ensure “genuine driverless vehicles” on Britain’s roads by 2021. In the meantime, there are increasing numbers of cars offering some form of advanced assistance systems (ADAS) to the driver. These include adaptive cruise control, forward collision warning, autonomous emergency braking and lane departure warning.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataYet such technologies are just the tip of the iceberg among production car semiconductor applications. Powertrain applications and electronic systems are further areas of the car where semiconductors are increasingly found.

Key players chip away for market share

A flurry of acquisitions has reshaped the competitive marketplace.

The major manufacturers serving the blossoming semiconductor market include the likes of NXP Semiconductor, Infineon Technologies, Renesas Electronics, and Osram. A recent spate of merger and acquisitions of automotive electronics specialists by some of the key semiconductor giants has reshaped the competitive marketplace.

NXP Semiconductor’s acquisition of Freescale Semiconductor in 2015 made it the world’s largest supplier of automotive semiconductors. In China, the company recently joined others to establish the NXP China Applications Development Centre for Auto Electronics. The centre will help China’s domestic carmakers quickly gain the needed knowledge and expertise to build electronic control units (ECUs) using NXP solutions to drive growth, innovation and industry standards for automotive electronics. Also, NXP and Hella Aglaia recently expanded the ADAS car vision platform with artificial intelligence (AI) capability. The company’s automotive group reported Q3 2017 revenue was $948 million, up 11 percent year on year.

Although US smartphone chipmaker, Qualcomm wants to acquire NXP Semiconductors, the deal has yet to be sealed due to an ongoing investigation by the authorities. Last summer, European Commission (EC) officials began an in-depth investigation to assess the proposed acquisition of NXP by Qualcomm under the EU Merger Regulation. The Commission has concerns the transaction could lead to higher prices, less choice and reduced innovation in the semiconductor industry. The Commission’s initial market investigation raised several issues relating in particular to semiconductors used in mobile devices, such as smartphones and in the automotive industry. Last week, Reuters reported that Qualcomm is set to win “imminent” Japanese antitrust clearance for its bid for NXP Semiconductors and gain approval from the EC by the end of this year.

Infineon Technologies acquisition of International Rectifier in 2015 further strengthened its position in the automotive electronics market, specifically chips for ADAS and radar sensors. Since then, Infineon has acquired Innoluce BV, a semiconductor company headquartered in Nijmegen, The Netherlands, thereby boosting its capabilities in LiDAR systems that will be used in future driverless cars. Infineon said that it will be able to develop chip components for next-generation high-performance LiDAR systems. LiDAR, radar and camera will be the three key sensor technologies for semi-automated and fully automated cars.

Earlier this year, Renesas Electronics, a semiconductor supplier, completed its takeover of Intersil, a power management supplier. A few weeks ago, Renesas divulged that its automotive technologies will drive Toyota Motor’s autonomous vehicles, which are presently under development and scheduled for commercial launch in 2020. Selected by Toyota and Denso, Renesas’ autonomous-driving vehicle solution for Toyota’s autonomous vehicles combines the R-Car system-on-chip, which serves as an electronic brain for in-vehicle infotainment and ADAS, and the RH850 microcontroller for automotive control. This combination delivers a comprehensive semiconductor solution that covers peripheral recognition, driving judgements and body control.

Last summer, Osram acquired a 25.1% share in LeddarTech, a Canadian company that develops a proprietary LiDAR technology integrated into semiconductors and sensor modules for self-driving cars and driver assistance systems. LeddarTech specialises in solid-state LiDAR systems that use infrared light to monitor the area around them. Osram Licht AG’s Q4 2017 revenue increased 13.2 percent to EUR1,029m. In the last fiscal year, Osram benefited from persistently strong demand for its high-tech products, and particularly its opto-semiconductors. The company states that its transition to a high-tech business will continue to feature strongly in the fiscal year 2018. Optical semiconductor-based products already account for two-thirds of the company’s revenue.

Technology partnering

Aside from merger and acquisition activity, there is no shortage of suppliers stepping forward to co-develop technologies in the semiconductor arena. This month alone, we learned that WiTricity is working with Texas Instruments to use automotive-grade semiconductor components in WiTricity’s Drive 11 wireless charging systems and reference designs.

At the most recent CES Audi presented the Audi Q7 deep learning concept, a piloted driving car made possible thanks to collaboration with partner NVIDIA. NVIDIA is a specialist in semiconductor technologies and development and is a long-time supplier to Audi. The relationship illustrates the importance of supplier collaboration in this area. NVIDIA is also working with ZF. ZF’s so-called ProAI is the German supplier’s first system developed using NVIDIA AI technology designed to enable vehicles to better understand their environment by using deep learning to process sensor and camera data.

Meanwhile, VW is partnering with Infineon in order to define future semiconductor solutions involving advanced and emerging auto technologies and to ‘pursue new joint development approaches’. VW points out that a typical car is equipped with as many as 100 networked ECUs and thousands of electronic components. They operate and regulate everything from the air conditioning system to the interior and exterior lighting systems, the adaptive cruise control radar and a whole range of driver assistance systems. So a significant part of all vehicle innovations is based on electronic systems.

On balance, from cockpits to chassis control, the semiconductor market is set to be one of the fastest growing automotive markets over the next few years.