After reaching agreement to purchase TRW, 2015 is shaping up to be the most momentous year in ZF’s long history. Colin Whitbread considers the implications of the latest developments.

The German supplier’s 100th anniversary will be celebrated in August 2015, coinciding with the opening of the company’s new, EUR80m, ZF Forum corporate headquarters in Friedrichshafen. This new building, located adjacent to the picturesque shores of Lake Constance, will not only offer 600 new workplaces for employees but also feature a foyer exhibition area providing “visitors with an insight into ZF’s past, present, and future.” Given ZF’s (now) confirmed acquisition intentions towards TRW, which could boost the German supplier’s annual revenue from around a forecast EUR18bn (US$24.1bn) in 2014 to over EUR30bn (US$41.0bn) in the first full year of the expanded company, it may well be that this insight into the present and future will necessitate more space than originally planned.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

ZF’s somewhat terse, three-sentence confirmation on 10 July that it was considering an offer for TRW dramatically understated the significance and potential of such a deal, both for the two companies themselves and the structure of supply in key growth areas such as powertrain efficiency, active safety (advanced driver assistance systems) and semi-autonomous/autonomous driving.

Recent M&A activity in the automotive supply sector has concentrated on bolt-on acquisitions and selective divestitures, designed to sharpen product portfolios and market presence in core sectors, making the mega-deal between ZF and TRW that much more high profile for its rarity.

Many major suppliers, having seen short-term liquidity fears recede in the rear-view mirror, now view disciplined capital allocation as a key priority, carefully balancing funds for capex (to drive organic growth) and M&A deals (to drive inorganic growth) with the expectations of shareholders, keen to see robust dividend and share repurchase strategies. As Lear discovered in early 2013, failure to adequately fine-tune this balance can lead to pressure from activist investors, fearful that ‘surplus’ liquidity could be ‘squandered’ in risky M&A adventures. Perhaps unsurprisingly, significant share repurchase schemes have become the norm for many (increasingly) profitable major suppliers (including TRW, which doled out US$520m to shareholders through share repurchases in 2013). Significant M&A deals have not.

This makes the now-confirmed US$13.5bn (enterprise value basis) deal between ZF and TRW a headline-grabbing event, especially as ZF, known (and respected) for its conservative financial management, has eschewed a major significant acquisition since taking out four business divisions of Mannesmann Sachs AG, from Siemens in 2001. These activities continue to play a major role in ZF’s current Car Driveline and Car Chassis Technology divisions and have boosted ZF’s competitive position vis-à-vis major domestic rivals such as Bosch and Continental. More recent acquisitions have been relatively minor (Cherry Corp in 2008 and Hansen Transmissions International in 2011) and the most visible recent transaction has actually been the December 2013 sale of the company’s Rubber & Plastics business unit, part of the Car Chassis Technology division (to Zhuzhou Times New Material Technology Co., Ltd). This ejected around EUR700m in revenue and 3,300 employees at nine global locations from the ZF corporate structure.

A number of key elements are clear at this stage.

First, ZF appears, perhaps somewhat surprisingly, deadly serious in its intent to dramatically expand its technological capabilities further into the businesses regarded by TRW as core – Chassis Systems (64.5% of the US supplier’s total H1 2014 revenue); Occupant Safety Systems (19.6%); Automotive Components (10.8%) and Electronics (5.1%). Somewhat surprising, because the company’s ‘ZF 2025’ strategy, launched at the end of 2012 gave few real hints of such a major diversification intent. In addition, ZF CEO Stefan Sommer, has focused on ZF’s desire to extend the company’s product range in the areas of e-mobility, electronics, and, most notably, lightweight design. The EUR3m+ investment in the new ZF Composites Tech Center in Schweinfurt, where it intends to develop manufacturing processes for the volume production of fibre-reinforced plastics (FRP) products, underscored this commitment. If the acquisition of TRW can be finally cemented, the task will be to continue with these ambitions while also advancing developments in significant new areas of technology – a key task for Sommer (who served a stint at Continental Automotive Systems between 1997 and 2007), given his additional responsibility for corporate R&D.

ZF’s approach has undoubtedly been based on a painstaking appraisal of current ‘megatrends’ within the auto industry and growth prospects within specific sectors resulting from this analysis. The company has recently emphasised that market intelligence has taken on greater significance, with management decisions more and more based on identifying and analyzing significant trends in advance and assessing their relevance for ZF industries.

Second, while the timing of ZF’s approach might be questioned (a tilt at TRW 12-18 months ago might have saved US$4bn-5bn versus the US supplier’s current value), the company clearly has the financial firepower to deliver on its vision. The all-cash transaction – lubricated with committed debt financing courtesy of Citigroup and Deutsche Bank – will up ZF’s leverage in the short term but the net cash-generating German supplier “expects to reduce its financial leverage significantly again in the coming years.”

While ZF’s shareholding structure precludes raising significant funds from its owners, it does introduce a degree of simplicity to the deal. ZF has always emphasised the advantages of having an ownership structure comprising: 93.8% Zeppelin Foundation (effective ownership by the City of Friedrichshafen since 1950); and 6.2% Dr. Jurgen and Irmgard Ulderup Foundation. According to the company: “Our independence and financial security form the basis of our long-term business success. Our profitability allows us to make the necessary investments in new products, technologies, and markets, thus securing the future of our company on behalf of our customers, market affiliates, employees, and the owners of ZF.”

Although ZF has not provided a current update of financial performance since the end of April 2014, and has limited its 2014 forecast to revenue growth in the “high single-digit percentage range” and an “improved result”, recent performance has seen significant EBITDA, EBIT and free cash flow growth, which together with a robust balance sheet negates any fears regarding the costs of taking significant new debt on board.

So what will ZF acquire from TRW for paying US$105.6 a share to the latter’s shareholders?

From a purely financial perspective, ZF gains revenue of probably around US$17.1bn-17.2bn (excluding the US$600m of business to be jettisoned with sale of the engine components business to Ferderal-Mogul) of which around US$11.4bn-11.5bn relates to chassis systems and around US$3.5bn to occupant safety systems. Assuming ZF revenue of around US$24.3bn, the combined company could generate total revenue of at least US$41bn in its first full year, with only a small portion of this – probably around US$2.7bn – being non-automotive. It would also gain reported EBITDA of around US$1.8bn, which together with ZF’s probable result of US$2.4bn would result in combined earnings (excluding acquisition-related costs) in its first full year of at least US$4.2bn – a margin not far short of 10.0%.

To put this into some kind of perspective, the deal would close the gap considerably with ZF’s major peer German suppliers, Bosch and Continental. Bosch’s Automotive Technology business generated revenue of US$40.9bn in 2013, a level that looks set to rise to around US$44.1bn in 2014. Continental reported total revenue of US$44.6bn in 2013, a total that is forecast to rise to US$46.2bn in 2014, however, excluding the company’s tyre/rubber businesses (Tires + ContiTech), a more meaningful comparison is with the three divisions in the Automotive Group only (Chassis & Safety; Powertrain; Interior), where 2013 revenue totalled around US$26.9bn, a result that is forecast to increase to US$27.8bn in 2014. Conti’s Auto group reported EBITDA of US$1.67bn on revenue of US$13.8bn in H1 2014 (margin of 12.1%), with the C&S, Powertrain and Interior divisions seeing margins of 13.2%, 8.9% and 13.6%, respectively.

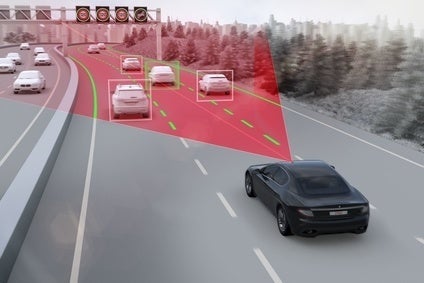

Perhaps more importantly, ZF will acquire a range of technologies to add to its current capabilities, extending its product portfolio to encompass activities such as braking, active and passive safety equipment, advanced driver assistance systems (ADAS) and more software know-how. TRW’s steering expertise would also have added to the existing 50:50 joint-venture (with Bosch) steering activities of ZF Lenksysteme, but ZF’s 50% interest is now to be sold for an undisclosed amount.

TRW has positioned itself solidly in many key growth areas and already converted advanced technology into commercial reality. For example, in December 2013, the company confirmed that its latest Lane Keeping Assist technology, incorporating closed loop control, had entered production for the first time on “two vehicle platforms for the European market”. This integrates data from a video camera sensor with EPS to apply a short counter-steer torque via the steering system to help assist a driver in preventing a vehicle from unintentionally veering from a lane. The technology is seen as a precursor to a full lane centering system where the EPS will aid a vehicle to remain in the centre of a lane at all times. In turn, this is seen as a basis for semi-automated driving functionality.

TRW’s Electronics segment represents a small part of turnover (5.1% in the first six months of 2014), but this disguises the growing importance of electronics across the TRW product portfolio and there are claimed to be significant opportunities for growth associated with crash avoidance technologies becoming mainstream, adoption of radar and camera systems and increased demand for open architecture systems. In July 2013, TRW confirmed the production start of its AC100 24 GHz forward-looking radar on PSA’s EMP2 platform (Citroen C4 Picasso and new Peugeot 308). The AC100 radar on the EMP2 platform enables several safety and driver comfort functions including distance and collision warning and integration with braking systems to provide follow-to-stop adaptive cruise control (ACC). The technology can also enable further features such as activation of reversible restraint systems, pre-crash pre-fill of brakes, adaptive brake assist and automatic emergency braking (AEB).

TRW has also taken a leadership initiative with its Safety Domain ECU (SDE), which can integrate software from OEMs or third parties. Without knowing the code, TRW can integrate the software in an ‘open architecture’ system housed within the controller. These have been reported by TRW to be enjoying high demand as OEMs are increasingly writing their own software and asking suppliers to manage the integration – not just for active safety systems, but also for airbags, steering and braking. TRW views this as a huge opportunity and expects to see exponential growth in the area.

The next generation SDE, which can integrate multiple chassis and driver assist functions, was highlighted alongside TRW’s next generation S-CAM 3 video camera and AC1000 radar; actuators including integrated brake control and electrically powered steering, and adaptive occupant safety technologies at the 2013 IAA Motor Show in Frankfurt in September.

The second generation SDE (SDE 2), which TRW believes will be production ready in 2017, can integrate data from multiple driver assist systems and chassis and suspension functions in one unit. SDE 2 will offer greater performance when compared to the first generation (which started production for a European OEM in September 2013) and is seen as a key technology in supporting semi-automated driving and car2car communication.

The S-CAM 3, which offers six times the processing power of the current generation will be launched early in 2015 and feature on a number of 2016 model year applications. TRW believes that in the coming five to ten years, there will be strong demand for camera systems – driven mainly by governments and NCAP organisations worldwide that are aiming to enhance vehicle safety.

Even this brief snapshot of capabilities vividly underscores ZF’s interest in using the acquisition to catapult it towards the leading edge of some major growth technologies. While ZF might still want to consider the ejection of some TRW businesses in the future, most notably in the US company’s Automotive Components activities (eg, fasteners, interior components), the attraction of much of TRW’s current product portfolio is obvious. In the ADAS area alone, growth prospects are undoubtedly enormous – data from Continental shows year-on-year volume growth of 57% in 2012, 58% in 2013 and 53% and 50% in Q1 2014 and H1 2014, respectively.

Although some 40% of TRW’s revenue continues to originate in Europe, around 20% (a share that is growing), now originates in Asia (China around 16%, equivalent to approaching US$3bn in 2014) – another key attraction for ZF. Confirming the deal with TRW, ZF noted that with the acquisition, the enlarged company will more than double its sales in both China and the US. In China alone, ZF has estimated (probably conservatively) it can achieve revenue of around US$5.5bn, taking total revenue in the Asia-Pacific region overall to approximately US$7.5bn. The US company has recently used joint ventures to enter into new geographic markets, most notably in India and China (50%-owned Shanghai TRW Automotive Safety Systems and 50%-owned CSG TRW Chassis Systems) where joining with a local partner has helped to reduce capital investment by leveraging pre-existing infrastructure. ZF has taken a more direct approach to China, investing heavily in new car axle assembly facilities in particular (with 9HP transmission manufacturing slated for 2017) and lifting revenue in China to probably around US$3bn, or 12% of group revenue, in 2014.

Along with extensive R&D capabilities in the country, the deal will further boost ZF/TRW’s already very strong competitive position in such a key market.

Positive as all this is, hurdles remain, not least of which is a majority vote in favour of the deal by TRW’s shareholders. In the hours following confirmation of the deal, a host of US ‘shareholder rights’ law firms were aggressively touting for business with (potentially) unhappy TRW stock owners, suggesting possible breaches of fiduciary duties (by TRW’s management) and citing a valuation of US$120 a TRW share made by a Wall Street analyst. Regulatory approvals will also be required to secure the deal, even after confirmation of the German supplier’s intended exit from ZF Lenksysteme.

This exit adds a touch of the bizarre to the deal. To help secure the acquisition of TRW, which has a significant steering components business, ZF has agreed to withdraw from a (very successful) steering joint venture which generated revenue of over EUR4bn for the first time in 2013, around three quarters of which – EUR3bn – came from car steering systems.

ZF Lenksysteme has seen rapid growth in the important electronic power steering (EPS) business, extended its product range to more cost-conscious segments and recently invested heavily overseas, most notably in growth markets in Asia. With forecast revenue growth of 5-7% in 2014 and stable profit margins, ZF Lenksysteme’s immediate future appears sound, something that will benefit Bosch alone in the future.

While this transaction was undoubtedly necessary from an antitrust perspective – previous estimates suggest global EPS market shares of around 22.5% for ZF Lenksysteme and 11.5% for TRW, hoisting a combined share to well over JTEKT’s market-leading 29.5% – it leaves ZF with a much smaller presence in the important steering components business while simultaneously providing a significant leg-up for Bosch. With these activities playing a key part in the ADAS and semi-autonomous/autonomous driving areas, ZF has undoubtedly been faced with some difficult choices in order to sidestep potential antitrust authorities in Europe and North America (those with long memories may remember that ZF failed in a bid to acquire the then GM Allison Transmission division in 1993, due to antitrust opposition from US authorities).

Bosch’s CEO, Volkmar Denner noted when confirming the company’s intent to take 100% of ZF Lenksysteme: “The company [Bosch] is a technological leader in the growth area of electric power steering, and precisely this is the core technology for automated driving, for more efficient vehicles, and also for electric cars.”

While ZF will probably gain at least US$1.75bn-2.0bn in payment for this exit (no actual figure is being divulged), it is far from being a satisfactory aspect of the deal for the Friedrichshafen-based company, even if the impact of the acquisition is to boost its overall competitiveness vis-à-vis Bosch and other German and Japanese peers.

In summary, the potential importance of the deal for the individual companies and the wider automotive supply sector cannot be overstressed. ZF CEO Stefan Sommer commented at the end of 2013: “The sales share of North and South America as well as Asia-Pacific will increase from 40% today to more than 50% in 2025. By this time, company sales should have reached around EUR40bn (US$53.5bn).”

ZF might now be poised to meet these targets at a stroke – and ten years earlier than planned.

See also: US: ZF to buy TRW after $13.5bn deal agreed