If you make executive or luxury cars, you’re helped by theoretically naturally higher margins than brands in the volume segments can achieve. This is because there are plenty of fixed costs in the automotive business, regardless of car size and price tag, and they form a smaller proportion of total cost as you move up the premium curve. Yes, I know the premium brands will claim that they specify higher quality for parts and materials all over the car than is the case for the volume brands – and there is obviously truth in that – but it’s about proportions and the shape of cost curves; the margins get larger on cars with a bigger price tag.

The premium makers have also been helped by new sales in emerging markets over the past decade as well as the increasing substitution of volume brand products by premium brand products – partly demand-led, but also supply-led after the ‘invasion of the niche models’.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Even so, making premium cars is no walk in the park. Brand loyalties can be hard to shift. Lexus has found the going much harder in Europe than in North America. Infiniti has its work cut out and is focusing on new markets, such as Russia and China. The German premiums – BMW, Mercedes-Benz and Audi – have been getting stronger for some time. And that has left them enjoying quite a profit bounty and the financial clout to invest even more in new product. The demise of Saab, a respected brand with plenty of heritage (but ultimately mismanaged by GM), shows how difficult the global market is for smaller players. Saab just could not generate the required volume to make breakeven. Volvo? Much hinges on the Chinese dimension and maximising engineering sharing with owner Geely to keep the flow of new product coming as well as finding a place in the global market for the Volvo brand that makes good sense. The smaller guys, you see, have to try even harder because they don’t have the volume. Market strength favours the bigger players.

Which brings me to Jaguar Land Rover, or more especially, Jaguar. Jaguar is a smaller player, undeniably. Under Ford, the big plan was to grow Jaguar inside Ford’s premium brands stable (PAG) and exploit scale economies under the skin and across the premium brands. As a strategy it sounded fine, but the execution in the X-Type and market positioning went awry. Back in 2001, Jaguar hoped that car – sharing underpinnings with the Ford Mondeo of the time – would propel Jaguar into much higher volume territory. The Jaguar X-Type was supposed to be selling at annual volume approaching 150,000 units, which would lift overall Jaguar sales to 200,000 units, maybe more. Alas, the car bombed and Ford’s whole PAG strategy started to unravel, the Jaguar and Land Rover brands eventually finding their way to current owner Tata Motors (under the single business unit of Jaguar Land Rover – JLR).

Tata has been lucky in one respect. It took over JLR just as demand for SUVs was about to soar around the world (especially in China). Land Rover, along with the Range Rover sub-brand, was the right brand at just the right time. The Range Rover Evoque has been ridiculously successful. Land Rover has made the lion’s share of JLR’s overall profit contribution to Tata Motors.

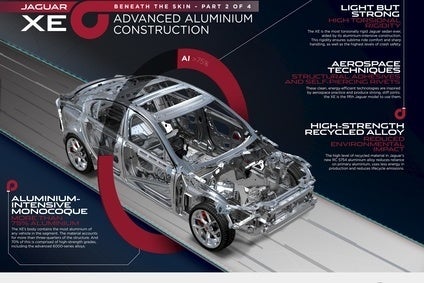

The trick now is to put both brands on a firm footing for future growth and the evolution of the right models with cost-effective and flexible engineering foundations. There’s an industrial strategy unfolding and the XE takes it an important stage further. Engines for XE come from the new factory at Wolverhampton. There’s a new engineering architecture (with lightweight aluminium, the platform is called D7a) that will spawn other – and higher margin – Jaguar and Land Rover models. Jaguar believes that it is the lightest car in its class.

The XE builds on JLR’s growing experience with aluminium, which is a material at the heart of the strategy. It’s more expensive than steel, but JLR is getting very experienced at working with it. It may be costlier than steel, but there are tigher CO2 targets to be met. The current Jaguar XJ, XK and F-Type have all been developed using exceptionally stiff bonded and riveted aluminium structures. The XE uses an aluminium-intensive monocoque, with lightweight aluminium accounting for 75% of the structure. Jaguar claims the weight reduction realised ensures that the XE is the “most fuel-efficient Jaguar yet with fuel consumption and CO2 emissions on the NEDC combined cycle of over 75mpg and less than 100g/km respectively”.

Jaguar also says that the Jaguar XE’s aluminium-intensive body delivers exceptional torsional stiffness and that the architecture incorporates highly advanced suspension systems “delivering unparalleled levels of ride quality, handling and steering”.

The Jaguar XE is also the first car in the world make use of a new grade of high strength aluminium called RC 5754 which has been developed specifically for the XE. This new alloy, Jaguar says, features a high level of recycled material and makes a significant contribution to Jaguar’s goal of using 75% recycled material by 2020.

So, aluminium is a core element in this new architecture which is spanning Jaguar and Land Rover model ranges for greater scale economies. Land Rover does the heavy lifting on profitability, but the new architecture creates a platform for both to build on.

The XE takes Jaguar into a higher volume part of the market, but it’s a strategy that is arguably more subtle than Ford’s attempted land grab with the X-Type. Spread the product development costs, go modular, Land Rover delivers the profits for now, Jaguar further develops its presence in other segments of the market, but it’s not primarily a volume play. Jaguar’s brand is carefully developed with cars that look good and are fundamentally desirable, good design under Ian Callum’s direction is all-important. It’s a strategy led by demand, rather than an ambitious sales target. It might just be a way to profitably grow sales and avoid the unhelpful comparison with the premium segment gorillas, which is no longer the point. Jaguar can thrive on the back of its Land Rover sibling, successive models making more money. That’s the vision. Oh, and the models you roll out to market have to be very good and occupy a distinct and attractive place in the landscape of premium automotive products that is also aligned to the right demographics and customer wants. Otherwise, thousands will just take the default BMW, thanks. The three-box X-Type with its trad-Jag styling couldn’t quite mix it with BMW in the lower level executive car segment. The XE can succeed on slightly different terms as part of a broader JLR new product wave and the absence of overly ambitious sales targets.