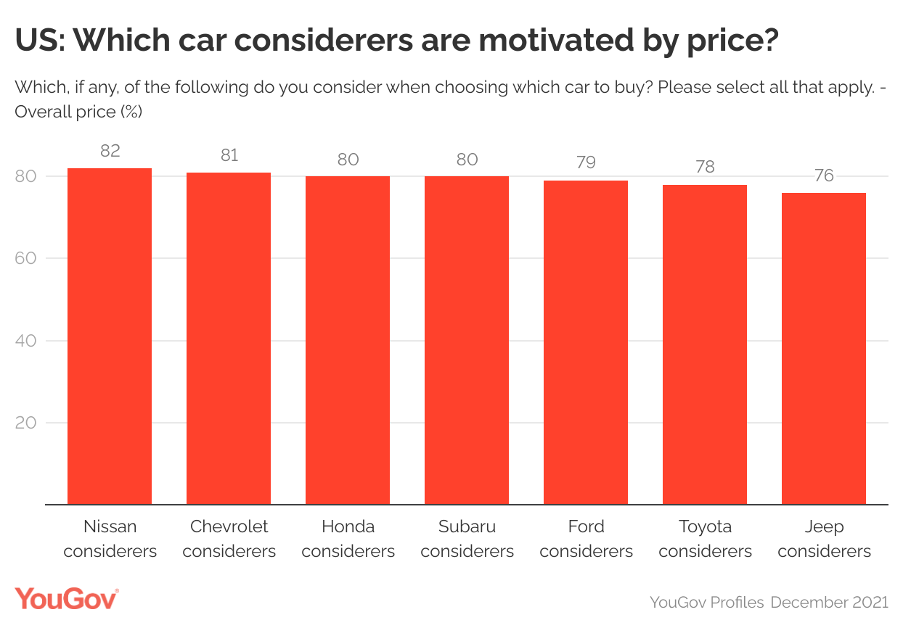

Data from YouGov Profiles indicate that price most frequently factors into car purchase consideration. This may not be altogether surprising, but there is some variation between brands: Americans who are considering Nissan, for example, are far more motivated by the cost of their new ride (82%) than people who consider Toyota (78%) or Jeep (76%). For all of these brands, though, price is influential for a large majority.

As auto manufacturers can only cut costs so much, it’s worth looking at the other factors that might affect car purchase decisions – and the other areas where they can make a difference. If we look at gender splits, for example, Subaru considerers (51% male; 49% female), Jeep considerers (50:50), and Honda considerers (50:50) all have an even or near-even split. But for other brands, a more pronounced gender split exists. Toyota considerers (54% vs. 46%) and Nissan considerers (52% vs. 48%) are more likely to skew male, and Ford considerers are more likely to be male by 20 percentage points (60% vs. 40%). It may therefore be worth asking if there’s anything that can be done to increase these brands’ appeal to female drivers.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

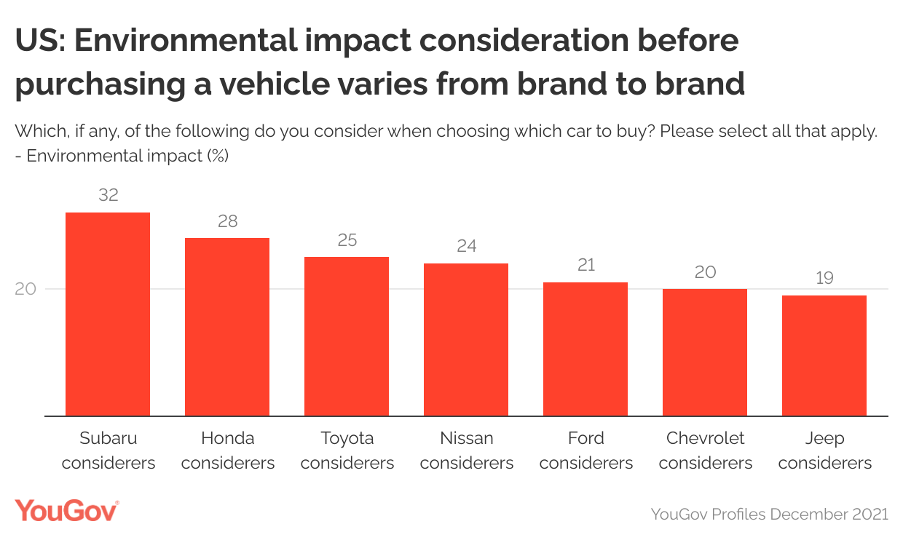

The environment is another factor that can be influential, albeit variably so. About a fifth of Jeep considerers (19%), Chevrolet considerers (20%), and Ford considerers (21%) all say the environment plays a role in their purchase decisions. This rises to three in ten Honda considerers (28%) and a third of Subaru considerers (32%). This suggests that some brands might be playing catchup with eco-conscious consumers.

But there are contradictions at play here: Subaru considerers, for example, might be the most eco-conscious of the brands listed above, but they’re also the most likely to say they’re considering a petrol vehicle for their next purchase (62%) compared to Ford (59%), Chevrolet (57%), Jeep (54%), Toyota (54%), Nissan (48%), and Honda (47%). At just 2%, electric vehicle consideration for prospective Subaru buyers lags behind Nissan (4%) and Toyota (4%). This said, there may be a gap between professed values and eventual consumer action.

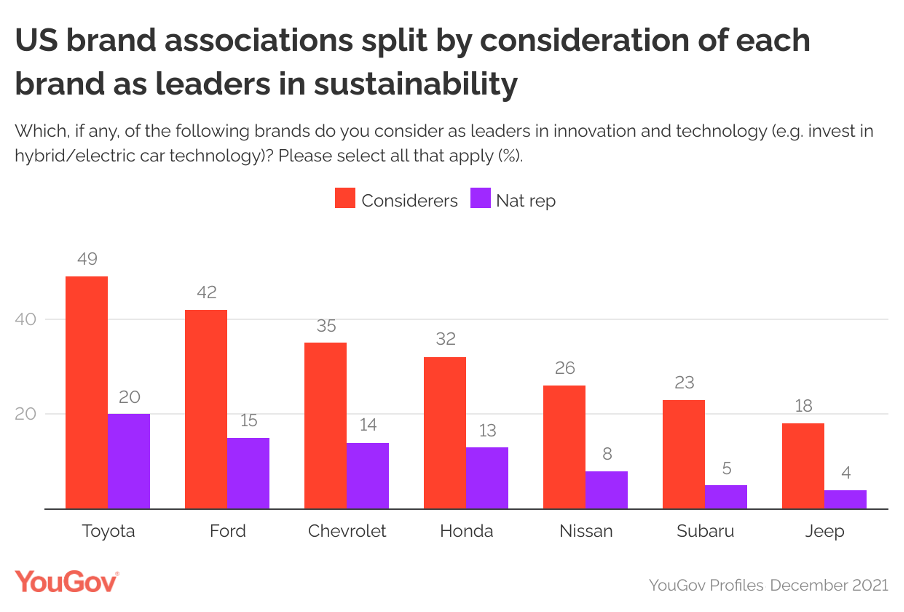

Overall, considerers are more likely to say their preferred brand is a leader in sustainability than non-considerers. But there is a correlation between a greater number of consumers thinking of a brand as a sustainability leader and a greater proportion of the public contemplating buying from that brand.

Half of Toyota considerers (49%), for example, think the brand is a leader in terms of sustainability (e.g. they invest in hybrid/electric car technology) – compared to a fifth (20%) of the general. On the other end of the scale, just 23% of Subaru considerers – for whom the environment is meant to be a particularly significant concern – think of the brand as a leader in sustainability, and just 5% of the public would consider buying from them. Jeep has a lower reputation as leaders in sustainability and lower public consideration, but as a less mass-market product the environmental angle may be less influential.

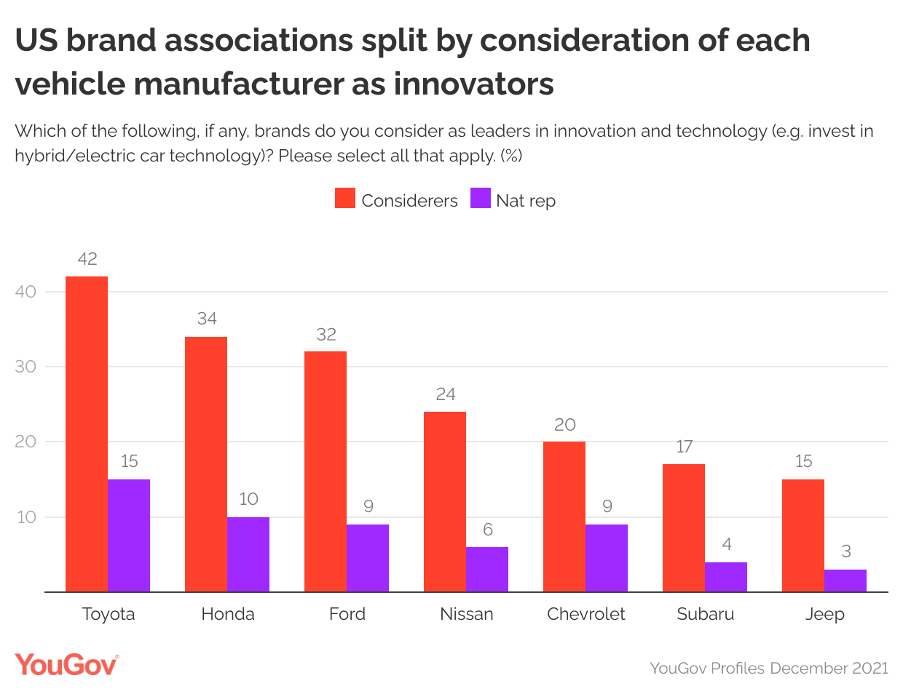

In general, being publicly perceived as an innovator positively affects purchase consideration. Two in five Toyota considerers regard the brand as a technological leader (42%), and 15% of the public feel the same. It’s a similar story with Honda (34% vs. 10%), Ford (32% vs. 9%), and Nissan (24% vs. 6%).

Brands looking to increase customer consideration could focus on a range of factors – from marketing to women, to increasing their environmental bona fides, to putting their bleeding-edge technology and engineering front and center of their campaigns. If YouGov data show anything, it is that automotive brand health varies depending on each brand’s existing consumer perceptions.

Download YouGov’s US Electric Vehicles Report 2022 to examine the current US consumer attitudes towards EVs and understand why American consumers consider different car brands.

Suzanna Mitrovich is an automotive industry expert, with vast experience of driving change in the automotive industry with data insights and analytics. She is passionate about supporting OEMs and emerging companies through the digital transformation taking place in the automotive and mobility sector. She has experience with working with teams across the world to deliver best solutions across the organizations including marketing, sales, aftersales and retail. She has received two bachelor degrees (BA & BSC) and is currently an MBA Candidate.