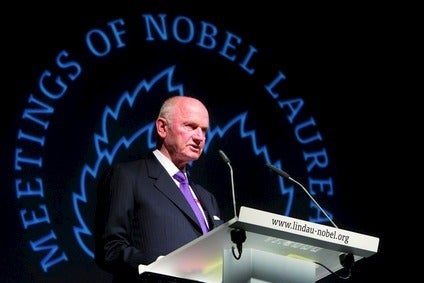

Ferdinand Piech’s forced exit from his role as chairman of Volkswagen Group’s Supervisory Board appears to have resulted from yet another bout of political infighting instigated by himself. This time, he has badly miscalculated. If he wanted to put someone else besides Martin Winterkorn in position as his de facto successor, the ‘plotting’ backfired. CEO Winterkorn had the support to beat off any such challenge. Piech would now have to leave.

It’s a shock ending to Piech’s decades long patriarchal position at the top of Volkswagen’s management. He is seen as a master tactician, the brain behind Audi’s remarkable brand and product renaissance, the man with the vision to cover all segments of the automotive business on the back of a broad portfolio of brands that could share engineering costs. Were there mistakes? It would perhaps be astonishing if such a long spell had not thrown up some mis-steps. The Volkswagen Phaeton perhaps stands out as one obvious one. There may have been some spin-offs with the technologies developed for that car, but it was undeniably costly as well as a sales flop. The Volkswagen Phaeton’s bold brand statement remains controversial and the next generation car is clearly ‘toned down’. Piech overcame internal opposition to develop that car and it has been cited as an example of hubris, a vanity project even.

The questions being asked about Volkswagen now are not new, but the problems are not all of Piech’s making. In part, they reflect his success in relentlessly driving volume up around the world, but in a company that ultimately he could not control completely.

Is the cost base too high? There has long been a view that it is, that Volkswagen Group profits should be higher than they are given the group’s vast scale economies. When, in the mid-2000s, Volkswagen Group CEO Bernd Pischetsrieder looked for deeper cost savings, Piech worked with labour leaders to curtail his efforts and eventually oust him in 2006. The successor back then? Martin Winterkorn, plucked from Audi and widely seen as a Piech man.

Winterkorn, reports suggest, needed labour allies to shore up his position within the supervisory board to counter Piech in the latest infighting. If that is so, could a consequence be that Winterkorn will be hampered politically in the future if he seeks to address cost? This whole question relates to the consensual way of business life for Volkswagen – the State of Lower Saxony retains a 20% stake – and the charge from some that it acts as a drag on returns for shareholders. The union and the State of Lower Saxony are being seen as the winners in the latest power struggle.

A union man will also step into Piech’s shoes for now. Interim chairman of the Supervisory Board is Berthold Huber who was formerly head of the IG Metall engineering union. Representatives of shareholders and employees will, however, eventually propose a new chairman for election. The smart money is on Winterkorn to stand down as CEO and take that role.

Some analysts have also held the view that Piech’s preference for empire-building and adding brands could also go too far, that the scale economies become more elusive if the brand portfolio is too wide or large. Moreover, the company focus can become dissipated and brands can overlap in the market (arguably, Skoda and SEAT, as value-driven brands, for example). Piech wanted VW Group to be the largest OEM in the world and the suspicion has long been that the ambition could come at the expense of profitability. There have been persistent rumours that Piech has been interested in adding even more brands to the Volkswagen Group family (eg Alfa Romeo, more in heavy trucks, too). Those rumours will die down now.

Other thorny questions for VW Group’s management eyeing a global number one spot by 2018 include the need to improve performance with low-cost products in emerging market regions seen as under-performers for the VW Group, most notably southeast Asia and South America. Is Great Wall the strategic partner needed to develop that missing low-cost product? And the Volkswagen brand’s disappointing showing in the US car market is a perennial head scratcher.

It will be interesting to see the extent to which the culture at Volkswagen changes now, with the hands-on engineer and ever-present patriarch gone. Ferdinand Piech said in his autobiography that it is not possible to take a company to the top by focusing on the highest level of harmony. That is perhaps an attitude and style that sounds a little at odds at a company like Volkswagen with its management structure subject to the significant involvement of labour and the local regional authority. Playing politics to get preferred outcomes has finally backfired. But the big things he got right, everyone agreed with.

See also:

GERMANY: Piech ploy over Winterkorn fails, VW chairman quits