The decision by Ford to close its Genk manufacturing plant underscores the problem faced by volume car players in Western Europe’s declining car market. The problem, in a nutshell, is matching supply with demand in a market that is more than 20% off where it was in 2007.

If the market looks like it is going to recover, the pressure is eased. Plant capacity utilisation will ‘rise with the tide’. The deft use of incentives can help push the metal temporarily; scrappage incentives can also bring a boost (2009) if it’s really serious. Twenty percent industry overcapacity? Yes, but where actually is it? ‘Look at some of the other OEMs, not us.’

And, let’s face it, there has also been political opposition in many parts of Europe to cutting capacity, losing thousands of geographically concentrated jobs in manufacturing. If anything, the still unresolved crisis for Europe’s economy and the recession that is gripping many national economies aggravates such sensitivities.

But Ford’s predicament highlights just how serious things have now become. Finally, it’s looking like there is nowhere to hide. Ford, a relatively strong performer in the European marketplace in recent years, is being hit hard on its bottom line. A projected $1bn loss on its European operations this year is, rightly, hard to take. Patience has run out. The losses are of a scale and projected longevity that have been deemed unacceptable.

The ground shifted in the summer when analysts and executives at Ford started to look at prospects for 2013. The realisation dawned that Western Europe’s economy will not get much better next year and the car market faces a further decline. Some politicians are talking of a difficult long-term economic adjustment, even assuming Europe-wide agreement on economic/political integration to save the euro currency. It’s a new reality for all businesses to deal with. In automotive, product actions and being competitive with attractive product can only take you so far (and some, like Fiat, opt to make cost savings in that area – a risky strategy for the medium-term). If overall market demand is simply not there, the choice is stark: take another hiding on the bottom line or do something serious about your European cost base? And when it comes to that option, manufacturing plants are a huge overhead and obvious target.

The timing of the new Ford Mondeo brought some urgency to the discussion. Putting it into Genk in April 2013 was cancelled. It would now be scheduled for start of production in Europe for the 2014 model year (autumn 2013) and there was breathing space to decide where to put such an important model.

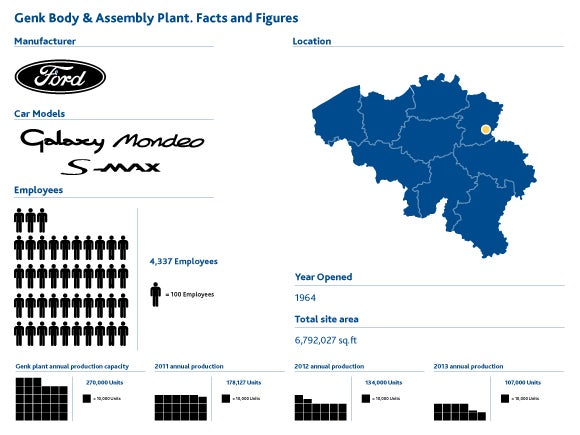

The case for keeping Genk started to fall away when production capacity utilisation rates were looked at. The plant’s main model – the Mondeo – does not sell in the volumes that D-segment saloons in Europe once did and S-Max and Galaxy have not filled the gap. Genk capacity utilisation prospects, even if new Mondeo proves a hit, looked – at under 50% – well below where they should be and pretty unsustainable. Ford got the European plant-model matrix out and reshuffled the pack without Genk, so that overall European capacity utilisation could be raised. Mondeo, S-Max and Galaxy would be moved elsewhere (most likely Valencia), new Mondeo scheduled to be in place at the new plant for the 2014 model year.

There will be some negatives to endure (some suppliers will not be happy), but the fundamental business case for Ford’s actions in Europe appears strong: cut cost and remove excess capacity in a falling market. The big question now is who’s next? The big volume players being squeezed in Europe are Ford, GM (Opel/Vauxhall), PSA, Renault and Fiat. So far in this economic crisis, plant closures announced are Antwerp (GM), Aulnay (PSA), Termini Imerese (Fiat), Genk (Ford). Bochum (GM) is almost certain to go, but that takes the overall tally to just five. PSA Villaverde may be next in line. Fiat must be looking hard at Pomigliano d’Arco. Some analysts say that 10-12 plant closures in Western Europe are going to be required in a structural adjustment reminiscent of the Detroit Big Three’s actions to rebalance capacity in North America in the second half of the 2000s. The pressures in Western Europe are intensified by the existence of relatively low-cost production facilities in Central and Eastern Europe.

On the day that GM and PSA have also announced further steps in their alliance, it’s clear that Europe’s auto industry faces a period of structural change and consolidation. It’s partly the current recession and partly a result of inaction historically which has left OEMs top-heavy with capacity. Plant closures are never easy, to say the least. They will be happening while economies are weak and alternative employment prospects are thin on the ground. What we can hope for is that a healthier and more sustainable European automotive industry is the eventual result of the restructuring that lies ahead. Doing nothing and simply taking higher costs on the chin, or expecting bailouts from governments in the form of scrappage incentives, do not – in the world of 2012 – look like a sensible option for long-term survival.

See also: ANALYSIS: Capacity crunch ahead in Europe