The importance of artificial intelligence (AI) to the automotive industry over the coming decade cannot be overstated. Facing the long-term existential threats of sustainability, overcapacity, and the prospect of decreasing volume due to the challenge of shared mobility, automotive players must harness AI’s potential.

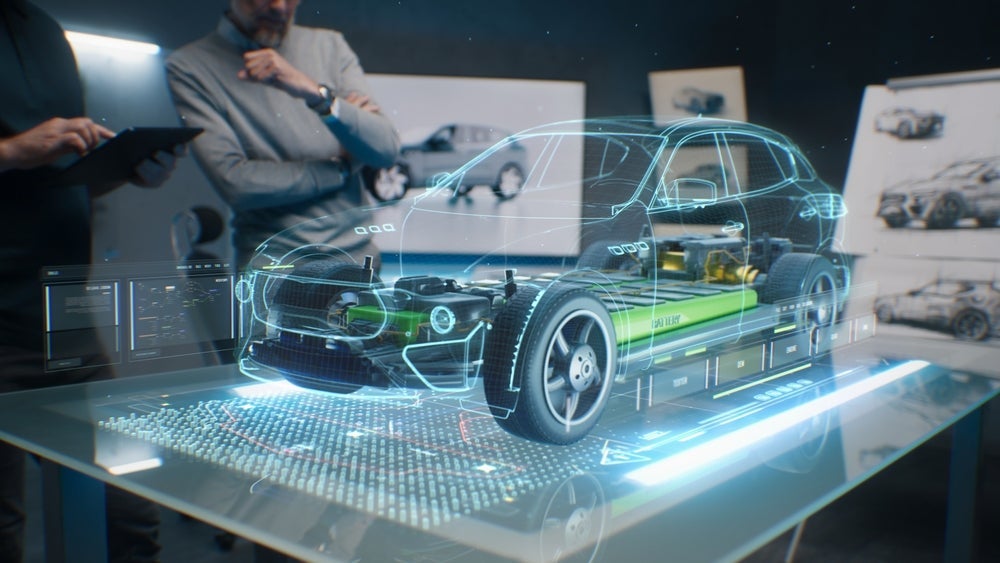

The greatest potential lies in the abundance of data that auto suppliers and automakers amass and do not currently use effectively. Data volume will only continue to grow as autonomous, software-defined, and connected vehicle functions increase in number and scope.

Data science and machine learning (ML) are designed to quickly assimilate large volumes of data, understand what it means, and promptly apply the insights that emerge. Moreover, the cash conservation and cost-cutting of moon-shot projects brought about by the Covid-19 pandemic means that some of the threats (such as autonomy and shared mobility) have temporarily abated. Hence now, more than ever, is the time to embrace AI in the automotive value chain.

Leading automotive companies in AI

Autonomous vehicles (AVs) are the most public-facing application of AI in the automotive sector. GlobalData expects a 35% compound annual growth rate (CAGR) of Level 3 to 5 AV production in the 2025 to 2035 timeframe, reaching nearly 6,500 vehicles in 2035.

AI chips, computer vision, and ML are the key AI technologies associated with self-driving. However, AI is important across the whole value chain. Upstream (tier-1, 2, and 3 suppliers and automakers) benefits from computer vision and smart robots alongside data science and ML to streamline production, while downstream (sales and the increasingly important aftermarket) profits from conversational platforms and context-aware systems alongside data science and ML.

See Also:

More importantly, AI plays a crucial role in closing the feedback loop between upstream and downstream by incorporating sale and post-sale vehicle data into predictive modelling, regulating production more closely to demand. Automakers can subsequently operate in an agile relationship with real-world events, which is necessary to mitigate crises such as the pandemic and the automotive chip shortage, in addition to the threat from mobility challengers. Automakers and suppliers are finally realising that they are far behind the software giants and are rightly wary of handing over value-added opportunities. Developing AI capabilities is now central to automakers’ future profitability and survival.

Leading adopters include BMW, Daimler, Ford, GM, Honda, Hyundai, Tesla, Toyota, and VW.

Discover the leading AI companies in the automotive industry

Using its experience in the sector, Just Auto has listed some of the leading companies providing products and services related to AI.

The information provided in the download document is drafted for automotive executives and technology leaders involved in automotive AI solutions.

The download contains detailed information on suppliers and their product offerings, alongside contact details to aid purchase or hiring decisions.

Amongst the leading automotive AI companies are AEye, Arbe Robotics, Cerence, Cognata, Optibus, Pony.ai, Seeing Machines, UVeye, and Scale AI.

Future of AI in the automotive industry

GlobalData estimates that the market volume of Level 3 to 5 AVs will increase at a compound annual growth rate (CAGR) of 35% between 2025 and 2035, reaching a volume of nearly 6,500.

Impact of AI on the automotive industry

ML and data science are AI technologies with the broadest use cases, and so are recommended investments throughout the automotive value chain. However, other segments of the AI value chain are less universally suited for automotive applications. This is due to the split between manufacturing and assembly components versus the point of sale and aftermarket in the automotive value chain.

For example, as the diagram shows, computer vision, AI chips, and smart robots are largely irrelevant to downstream activities, while conversational platforms are of little use upstream.

For AVs and connected vehicles, computer vision and AI chips are, and will continue to be imperative AI technologies. Automakers that design proprietary forms of this technology, or acquire smart start-ups, or form strong ties with specialist suppliers will be best positioned for the industry to pivot to CASE megatrends.